Blue Mountain Loans offers fast, convenient loans, mostly aimed at people who need cash quickly to cover emergency expenses. This guide explains Blue Mountain Loans reviews, including their loan types, application process, eligibility requirements, and costs. By the end of this article, you will understand if Blue Mountain Loans is the right choice for you and what to expect if you apply.

What Is Blue Mountain Loans?

Blue Mountain Loans is a lending company that offers short-term and installment loans, mainly designed for people facing financial emergencies. They provide a simple online application process and quick access to funds, often within the same day. The company markets itself as a solution for people who may not have the credit score needed to get a traditional bank loan but still need financial help.

Types of Loans Offered by Blue Mountain Loans

Blue Mountain Loans is very famous for short-term loans. Blue Mountain Loans provides two types of loans which we have written below

Installment Loans

Blue Mountain offers installment loans, which allow borrowers to pay back the loan in scheduled payments over time. This can be helpful for those who need a larger amount and prefer a structured repayment plan.1

Personal Loans

The company also provides personal loans, which can be used for various expenses, like medical bills, car repairs, or household emergencies. Personal loans from Blue Mountain are often smaller amounts, with relatively short repayment periods.

Blue Mountain Loans reviews:

If you want to see the correct reviews of any loan website, then there are many review websites available in the United States where people give reviews of different types of websites. We have also searched Blue Mountain Loans on different websites. The data of which is given below

Website: Scam Adviser

- Trust Score: 100/100

- Reviews: No customer reviews available.

- Comments: Scam Adviser rates Blue Mountain Loans highly with a strong trust score, meaning it’s considered safe. However, no customers have left any reviews here.

Website: SuperMoney

- Category: Personal Loans > Blue Mountain Loans Installment Loans

- Reviews: No reviews available.

- Comments: There are no ratings or reviews on SuperMoney for Blue Mountain Loans, so there is no feedback from customers about their experience.

Blue Mountain Loans BBB reviews:

- Customer Reviews: 8 customer reviews, but not used in the BBB rating.

- Rating: F

- Accreditation: Not BBB-accredited

- Comments: The BBB gives Blue Mountain Loans an F rating, and it is not accredited. While there are 8 customer reviews, no details specify whether they are positive or negative.

Website: Trustpilot

- Reviews: No reviews or ratings are available.

- Comments: Trustpilot has no reviews for Blue Mountain Loans, and the company has not claimed its profile. This means there’s no customer feedback on Trustpilot either.

Based on the reviews from these major sites, there is very little customer feedback available for Blue Mountain Loans. Scam Adviser gives it a high trust score, but there are no customer reviews on any of these sites. The BBB rates it with an F, but this rating lacks supporting customer feedback.

Overall, looking at conversations on Reddit and Quora, Blue Mountain Loans seems to be a trusted company that has been operating in the U.S. for a long time. However, due to the lack of user reviews on major review platforms, opinions on its reliability might vary.

How to Apply for a Blue Mountain Loan?

To apply for a Blue Mountain loan, first, you have to visit the website of Blue Mountain Loans. After visiting this website, a form will appear on the home page itself, you have to fill that form.

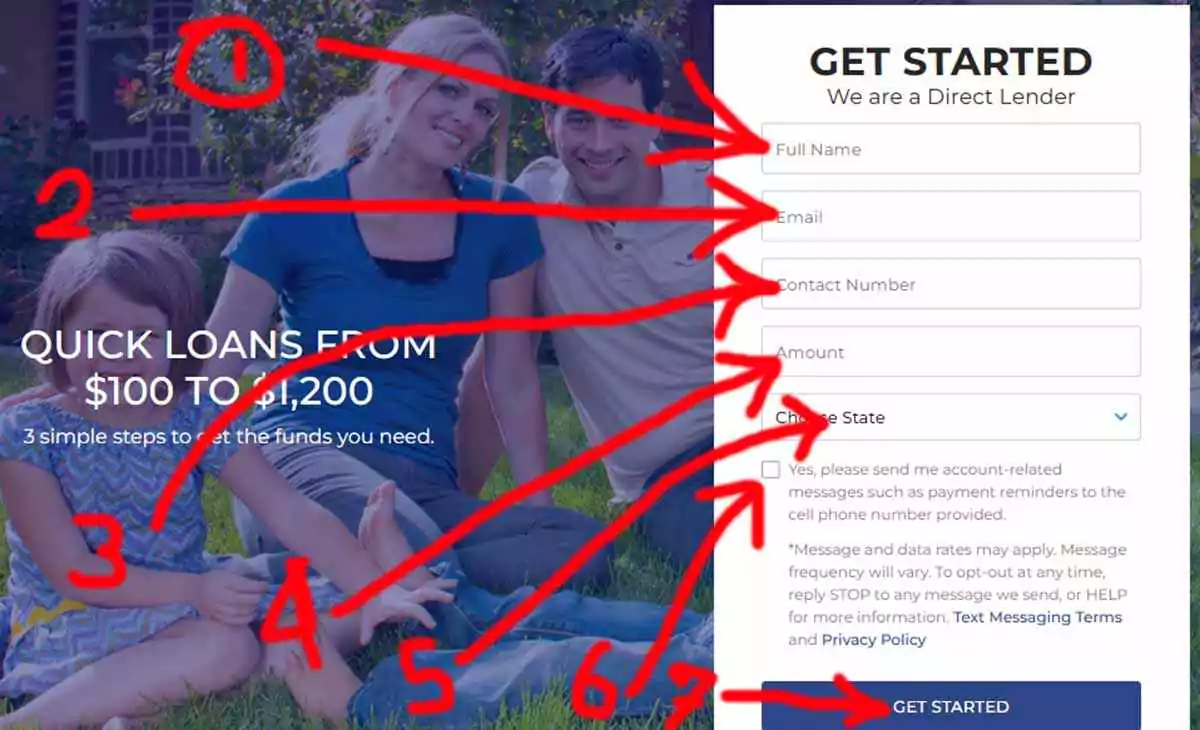

As shown in the photo below.

- Full Name – In the first box, enter your full legal name.

- Email – Type your email address in the second box. Make sure this email is active, as it may be used for communication about your loan.

- Contact Number – Enter your phone number in the third field. This number should be one you can be easily reached at.

- Amount – In this box, fill in the loan amount you’re interested in. It can range between $100 and $1,200.

- Choose State – Use the dropdown menu in the fifth box to select your state of residence. This information helps them verify if their services are available in your location.

- Message Consent – If you would like to receive account-related messages, check the small box here. This allows Blue Mountain Loans to send reminders or updates directly to your phone.

- Get Started Button – Once you’ve filled in all the information, click on the “Get Started” button at the bottom. This will submit your details and start the loan application process.

As soon as you click on the “Get Started” button, your loan application starts. You have to fill in all the necessary information asked in it and after the application is completed, you get a message of approval or disapproval within a short time. Your amount is transferred to your account on the same day or the next day. In this way, you can easily apply for a Blue Mountain loan.

Eligibility Requirements for Blue Mountain Loans

To qualify for a loan with Blue Mountain, you’ll need to meet several basic requirements:

- Age: Must be 18 years or older.

- Income: A regular source of income is usually required.

- Bank Account: An active checking account where funds can be deposited.

- Identification: You may need to provide proof of identity, like a driver’s license or other government-issued ID.

Pros and Cons of Blue Mountain Loans

Pros:

- Quick and Easy Process: Blue Mountain Loans’ online application is simple and can be completed quickly.

- Flexible Loan Options: The company offers both installment and personal loans, providing flexibility based on the borrower’s needs.

- Fast Fund Disbursement: Funds are often transferred within one business day.

Cons:

- High-Interest Rates: Like most payday and short-term lenders, Blue Mountain Loans has relatively high interest rates, especially for people with lower credit scores.

- Limited Availability: The loans are not available in all states.

How Much Does a Blue Mountain Loan Cost?

The cost of a loan from Blue Mountain Loans can be very high due to its high annual percentage rate (APR). The maximum APR for a Blue Mountain Loan can go up to 660%. However, the exact rate you receive may vary depending on factors like your credit history or how you’ve handled loans in the past.

For example:

- If you have a good credit score or a solid history of repaying loans, you might qualify for a lower APR.

- But if your credit score is low, you may end up paying closer to the maximum APR, which can make the loan very expensive.

Repayment Terms and Loan Duration

Blue Mountain Loans usually offer flexible repayment options, which can vary based on the loan type:

- Installment Loans: Typically repaid over several months, often 6 to 12 months, depending on the amount and terms.

- Personal Loans: These loans might have shorter repayment periods, designed for people who need cash for a short time.

You can repay the loan through automatic bank drafts, monthly billing, or direct payments.

Loans like Blue Mountain Loans:

Here are some loan options similar to Blue Mountain Loans, designed for people needing quick cash or help during financial emergencies:

OppLoans

OppLoans provides personal loans with a fast approval process, even for people with lower credit scores. They offer installment loans that allow you to repay over time.

Rise Credit

Rise Credit offers installment loans with flexible repayment terms. They cater to people with poor credit and also provide financial tools to help improve credit over time.

CashNetUSA

CashNetUSA offers short-term payday and installment loans for people in need of quick funds. They’re known for fast approval and same-day funding but have high interest rates.

MoneyKey

MoneyKey provides installment and payday loans with an easy online application. They focus on small, short-term loans, which can be repaid in regular installments.

Speedy Cash

Speedy Cash offers payday and installment loans, with options for same-day funding. They are known for being quick and convenient, though interest rates can be high.

Conclusion

Finally, Blue Mountain Loans can be a quick solution for those facing financial emergencies, offering fast funding and flexible options. However, the high interest rates and limited availability in some states mean this loan might not be suitable for everyone. Be sure to consider the potential costs and evaluate if this type of loan is truly beneficial based on your financial situation and ability to repay.

FAQs

What Are the Loan Limits at Blue Mountain Loans?

Loan amounts usually range from $100 to $1200, depending on the applicant's qualifications.

Blue Mountain Loans phone number.

Blue Mountain Loans phone number is - 833-289-6600

Blue Mountain Loans official website.

Blue Mountain Loans official website is bluemountainloans.com

Blue Mountain Loans customer service:

For customer support, reply with "Help," call us at 833-289-6600, or email service@bluemountainloans.com.

Thanks for your visit.

(Blue Mountain Payday Loans Reviews:)

Disclaimer: Blue Mountain Loans may have high APRs, and eligibility varies by state. Please consult a financial advisor before making borrowing decisions. Loan terms and availability can change, and the information here may not reflect recent updates. Always verify loan details with the lender directly.