In today’s digital age, mobile payment platforms have revolutionized the way we handle transactions. Cash App is a leading player in this domain. One of the standout features of Cash App is its integration with ATMs, providing users with easy access to their funds when needed. In this article, we delve into the realm of Cash App in network ATMs, exploring what they are, their benefits, how to identify them, and tips to maximize your convenience while minimizing fees.

We can withdraw cash and deposit bills from ATMs, but they all have different charges. If you want to withdraw free from Cash App, you will have to look for Cash App in-network ATMs which are quite difficult to find. After all, these ATMs are in-network of Cash App, so let’s know about this in detail.

What is a Cash App In Network ATM?

In the United States, there are thousands of ATMs operated by various networks, such as Allpoint, MoneyPass, PNC Networks, Wells Fargo, and Bank of America, among others. Bank of America has the largest number of ATMs in the USA. Cash App, while not a bank, is a financial service that offers various services like depositing money and receiving money. One of its key offerings is the Cash App Card, which allows users to withdraw cash from ATMs.

Cash App has partnered with different networks across various states in the USA. When you use a Cash App Card at ATMs that are part of these partnered networks, known as Cash App in-network ATMs. You may receive certain benefits such as discounts on withdrawal fees or, in some cases, free withdrawals. These ATMs are referred to as Cash App In-Network ATMs.

What ATM network does Cash App use?

Cash App has stated on its official website that the prepaid cards it issues, known as Cash App cards, are provided by Sutton Bank. According to Sutton Bank’s CARDHOLDER AGREEMENT, their ATMs operate on the AllPoint ATM Network. Therefore, Cash App primarily uses the AllPoint ATM Network, and ATMs within this network are referred to as its in-network ATMs.

Additionally, due to the presence of various ATM networks across different locations in the USA, Cash App collaborates with multiple ATM networks in different areas. Experts believe that Cash App has partnerships with MoneyPass, US Bank, Bank of America, and Wells Fargo, among others, and uses their ATM networks in several locations. However, there is no official statement confirming these collaborations.

Benefits of Using In-Network ATMs with Cash App:

The benefits of using in-network ATMs with Cash App are as follows:

- Fee-Free or Discounted Transactions: Unlike out-of-network ATMs that often levy hefty fees, Cash App in-network ATMs allow users to withdraw cash without worrying about additional charges.

- Convenience: With a vast network of in-network ATMs, Cash App ensures that users can access their funds conveniently, whether they are in their hometown or traveling to a different city.

- Security: Cash App employs robust security measures to safeguard users’ financial information, providing peace of mind when conducting transactions at in-network ATMs.

What ATMs are in-network with Cash App?

It can be quite challenging to confirm which ATMs are in-network for Cash App. However, the easiest way to find out is by opening the Cash App and using the “Find ATM” option to locate in-network ATMs near you. Nonetheless, we have provided a list below of ATMs that are typically considered in-network for Cash App:

AllPoint ATM Network:

- Cash App cards, issued by Sutton Bank, operate primarily on the AllPoint ATM Network.

- AllPoint ATMs are available at various retail locations across the USA, including Target, CVS, Walgreens, and more.

Additional Collaborations:

- Due to the diverse ATM networks across the USA, Cash App collaborates with multiple ATM networks in different regions.

- Believed partnerships include:

- US Bank

- Bank of America

- Wells Fargo

- These collaborations enable Cash App users to access these banks’ ATM networks in certain locations, though there is no official statement confirming these partnerships.

How to Find Cash App in network ATMs?

If you want to find Cash App in-network ATMs, the best way is to use the “Find an ATM” feature in the Cash App. Different states have different ATM network collaborations, so using the Cash App is the most reliable method.

Here’s the step-by-step process to find In-Network ATMs for Cash App:

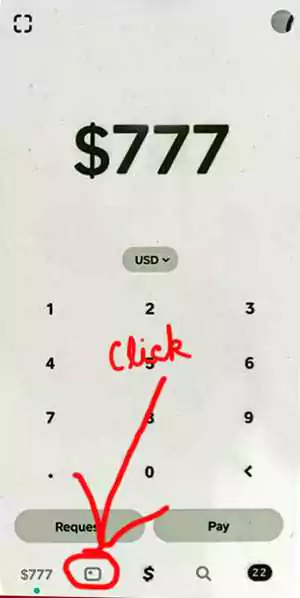

Step 1 – Open the Cash App: Click on the green Cash App icon on your mobile device. (See image below)

Step 2 – Navigate to the Debit Card Icon: Once the app opens, you’ll see your available Cash App balance and icons at the bottom. Click on the debit card icon. (See image below)

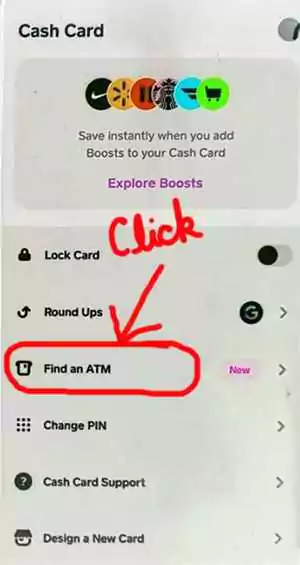

Step 3 – Scroll to “Find an ATM”: After clicking the debit card icon, a new window will open displaying your Cash App card. Scroll down until you see the “Find an ATM” button and click on it. (See image below)

Step 4 – Check Direct Deposit Options: A new window will appear with two options: “Withdraw Anywhere” and “Free Reimbursed Because You Direct Deposit.” Ensure both options are checked. If you receive $300 or more via direct deposit each month, these will have green checkmarks. (See image below)

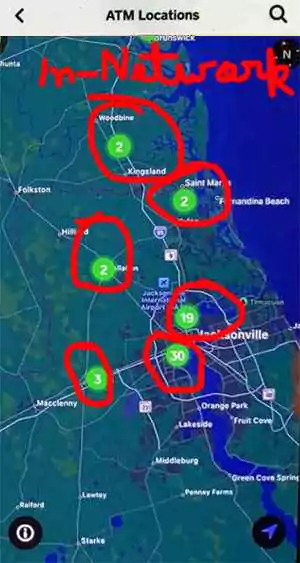

Step 5 – Find ATMs on the Map: Click “Next” and a map will open showing all nearby ATMs. The ATMs highlighted in green are in-network. (See image below)

You can withdraw cash from any ATM highlighted in green. If you receive $300 or more in direct deposits each month, you can withdraw cash for free from these in-network ATMs. This is a simple and effective way to locate Cash App in-network ATMs.

List of Cash App In-Network ATMs:

Finding Cash App’s in-network ATMs can be tricky, but you can easily locate them by opening the Cash App and using the “Find ATM” option. Here is a list of ATMs that are typically in-network for Cash App:

- ATMs at Target,

- ATMs at CVS,

- ATMs at Walgreens,

- Ally Bank,

- Capital One 360,

- Discover Bank,

- Bank of America

- MoneyPass,

- PNC Networks,

- Wells Fargo

Out of the ATMs listed above, there may be different Cash App in-network ATMs in different states. So, in some states, these may be in-network ATMs and in some states, these may be out-of-network ATMs. Always use the “Find an ATM” feature within the Cash App for the most accurate and up-to-date information.

Cash App Out-Network ATMs: What You Need to Know

Users may encounter out-of-network ATMs in certain situations despite the convenience of in-network ATMs. It’s important to be aware of the following when using out-of-network ATMs:

- Additional Fees: Out-of-network ATMs often impose hefty fees, including surcharges from both the ATM operator and Cash App.

- Transaction Limits: Cash App may impose transaction limits or fees for using out-of-network ATMs, so users should exercise caution to avoid exceeding these limits.

Conclusion:

Navigating the world of Cash App in-network ATMs can significantly enhance your user experience by reducing or eliminating withdrawal fees. With partnerships across various ATM networks like AllPoint, MoneyPass, and major banks, Cash App provides its users with convenient access to their funds. Utilizing the “Find an ATM” feature within the app ensures that you can locate the nearest in-network ATM with ease, whether you’re at home or travelling.

FAQ’s:

What happens if I use an out-of-network ATM?

Using an out-of-network ATM may result in additional fees imposed by both the ATM operator and Cash App, potentially leading to higher transaction costs.

What when you search “Cash App in-network ATM near me”?

Whenever someone searches "Cash App in-network ATM near me" on Google or any other platform, all the ATMs that appear in the results are not correct. Because there are different ATMs at different places that are in-network of Cash App. Therefore, you should not search for this on Google. If you want to find in-network ATMs of Cash App, that too around you, then you have to open Cash App and click on the "Find ATM" option in Cash App.

Then you will see many ATMs around you which will be shown on Google Maps, out of them all the ATMs in green colour will be "Cash App in-network ATMs near you".

How do I identify in-network ATMs for Cash App?

To identify in-network ATMs for Cash App, use the in-app locator, you will see many ATMs on App, and out of them all the ATMs in green colour will be in-network ATMs for Cash App

Thanks for your visit.

(What are Cash App in network ATMs)

Disclaimer: This article is intended for informational purposes only and does not provide legal advice. We strive to ensure the accuracy of the information presented, but Cash App’s policies and partnerships with ATM networks may change. Always verify the latest details directly from the Cash App platform or official website.