Last updated on May 10th, 2024 at 06:02 am

Are you curious about Cash App fees to receive money? Cash App, a popular peer-to-peer payment platform, offers users a convenient way to send and receive funds. However, it’s essential to understand the fees associated with obtaining money on Cash App. In this article, we’ll tell you about Cash App fees to receive money, helping you understand the actual cost and make informed decisions about your transactions.

You may already know about Cash App instant transfer charges, but there is also a charge for receiving money on Cash App, most people are confused about this. You are right in thinking that there is no charge for receiving the amount on Cash App, but if your Cash App account is a business then there may be a charge for receiving the amount also. So let’s discuss it in detail.

Introduction to Cash App Fees:

Table of Contents

ToggleCash App, a popular peer-to-peer payment app, provides users with a convenient way to send and receive money. Similarly, many other financial services provide money transfer services like Cash App. Most of these services do not charge any fee for transferring the amount or receiving the amount.

But there are some special types of transactions in these services, in which these platforms charge fixed fees. Cash App also charges fees for some of its services like instant money transfer, Cash app cash out, Cash App business account and use of credit cards on Cash App etc.

To further improve their services and to pay salaries to their employees, they also need funds, due to which they fix fixed fees on some of their services. These fees are charged to the customer who avails of these services. Similarly, Cash App also charges fees for some of its services.

Base Fees vs. Additional Charges:

The charge for normal use of any financial service is called a base fee. Apart from normal use, there are special types of transactions like transferring amounts to another platform etc. On such transactions, these financial services charge some extra. It imposes charges which are called additional charges.

If we talk about Cash App, then the basic fee of Cash App is nothing, its basic use is free. But additional charges are levied on some special transactions like Transferring money from Cash App to Apple Pay and Transferring money from a Vanilla gift card to Cash App etc. These charges may vary depending on the circumstances.

Does Cash app charge a fee to receive money?

No, Cash App does not charge a fee to receive money. However, if you are using Cash App for business purposes, there may be a processing fee of 2.75% when receiving payments from clients. This fee can vary depending on the specific situation.

Do you have to pay a fee to receive $3000 on Cash App?

Yes, Cash App may charge fees for certain transactions, including receiving money. And how much will be charged depends on how you received $3000 on your Cash App. If someone has transferred $3000 to you from Cash App to Cash App, then there will be no charge for it, but if you use a business account on Cash App, then you will be charged 2.75%.

If you make a direct deposit of $3000 on your Cash App, there will be a fee for this which will depend on several conditions. Therefore, if you want to receive $3000 on Cash App, then you should use to a standard deposit which will not charge you any fee.

Why is Cash app taking a fee when receiving money?

If you receive money on Cash App and Cash App charges you a fee, then it is possible that you are using the business account of Cash App. Whenever any client sends any amount to the Cash App business account, a fixed fee is deducted from this amount.

But if you are using Cash App’s personal account and still the fee is deducted from the amount received by you, then you can dispute the charge on Cash App.

How much does Cash app charge to receive money?

On a personal Cash App account, there is no charge to receive money—it’s entirely free. However, if we register our business on Cash App and use a business account, then in such a scenario, when any client sends us money on Cash App in exchange for our services, a processing fee of approximately 2.75% is deducted from the received amount.

Cash app fees to receive money from a bank account:

If someone transfers money from their bank account to our Cash App account, and the money is received in our Cash App, no fees will be deducted from the amount received. Receiving money on the Cash App is completely free.

However, the fees charged depend on the sender’s bank account. The charges will be deducted from their bank account, not from our Cash App account.

Cash app fees to receive money on a business account:

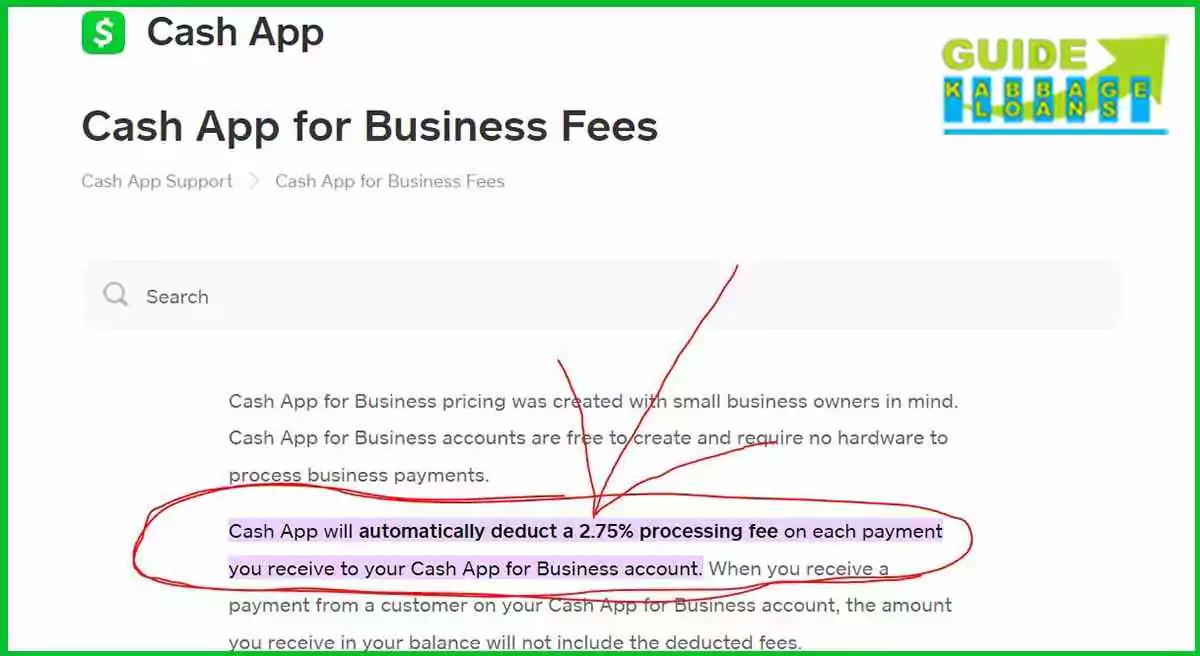

When conducting transactions through a business account on Cash App, it’s essential to consider the associated fees. Particularly, when clients send payments for services rendered via Cash App, a processing fee is incurred. This fee, amounting to around 2.75% of the received sum, is subtracted from the total amount transferred.

This deduction is a standard practice implemented by Cash App to cover processing and administrative costs associated with facilitating financial transactions on its platform. Therefore, it’s important for businesses utilizing Cash App to receive payments to account for these fees when calculating their overall revenue and expenses.

(( Reference: For more information, visit the official Cash App website, where this data was sourced. ))

Comparing Cash App Fees with Competitors:

There is no fee for receiving money on Cash App and all the financial service platforms like it. All these platforms are absolutely free to receive money. But there are some special transactions on all these platforms through which if you receive the amount then some charge is deducted from it, like if we transfer the amount from Bankmobile to Cash App then some fixed charge is levied.

Similarly, if we send or receive an amount from one platform to another, there may be some additional charges that are different for all the platforms. But almost all platforms to receive money are free.

Important Note: If you receive an amount on Cash App from a stranger then you should be careful while doing so.

Summary:

The article delves into Cash App fees for receiving money, clarifying misconceptions and outlining charges for personal and business accounts. It emphasizes that while receiving money on Cash App is generally free, there are exceptions, especially for business transactions. Furthermore, it compares Cash App fees with competitors, highlighting its competitive advantage in certain aspects.

Faq’s:

How much does Cash app charge to receive $100?

There will be no charge for receiving $100 on Cash App Personal Account. However, Cash App charges a processing fee of 2.75% on each payment received in Cash App Business accounts. Therefore, to receive $100, the fee would be $2.75.

How much does Cash app charge to receive $200?

There will be no charge for receiving $200 on Cash App Personal Account. However, Cash App charges a processing fee of 2.75% on each payment received in Cash App Business accounts. Therefore, to receive $200, the fee would be $5.50.

How much does Cash app charge to receive $300?

There will be no charge for receiving $300 on Cash App Personal Account. However, Cash App charges a processing fee of 2.75% on each payment received in Cash App Business accounts. Therefore, to receive $300, the fee would be $8.25.

How much does Cash app charge to receive $400?

There will be no charge for receiving $400 on Cash App Personal Account. However, Cash App charges a processing fee of 2.75% on each payment received in Cash App Business accounts. Therefore, to receive $400, the fee would be $11.00.

How much does Cash app charge to receive $500?

There will be no charge for receiving $500 on Cash App Personal Account. However, Cash App charges a processing fee of 2.75% on each payment received in Cash App Business accounts. Therefore, to receive $500, the fee would be $13.75.

How much does Cash app charge to receive $1000?

There will be no charge for receiving $1000 on Cash App Personal Account. However, Cash App charges a processing fee of 2.75% on each payment received in Cash App Business accounts. Therefore, to receive $1000, the fee would be $27.50.

How much does Cash app charge to receive $3000?

There will be no charge for receiving $3000 on Cash App Personal Account. However, Cash App charges a processing fee of 2.75% on each payment received in Cash App Business accounts. Therefore, to receive $3000, the fee would be $82.50.

How much does Cash app charge to receive $5000?

There will be no charge for receiving $5000 on Cash App Personal Account. However, Cash App charges a processing fee of 2.75% on each payment received in Cash App Business accounts. Therefore, to receive $5000, the fee would be $137.50.

How much does Cash app charge to receive $10000?

There will be no charge for receiving $10000 on Cash App Personal Account. However, Cash App charges a processing fee of 2.75% on each payment received in Cash App Business accounts. Therefore, to receive $10000, the fee would be $275.00.

Thanks for your visit.

(Cash App fees to receive money:)

Disclaimer: The information provided in this article (Cash App fees to receive money.) is for educational and informational purposes only. It does not constitute financial or legal advice. Readers are advised to consult with a qualified professional or Cash app website for guidance tailored to their specific circumstances.