CashNetUSA is the most applied short-term loan in the USA. This is one such loan that is completely online and you can take the help of this loan whenever you need an emergency and hand-to-hand amount. But before taking this loan, many people have this question in their mind, is CashNetUSA legit or not? In this article, we will tell you about the legitimacy of CashNetUSA and also tell you how to apply for it, who is eligible for it, and what documents are required.

What is CashNetUSA?

CashNetUSA is a short-term loan provider. Those who work completely online. Whenever we need an amount in an emergency, we can apply online by visiting the CashNetUSA website and get a loan within 24 hours. This platform is running in more than 30 states. Its public review is also very good. Because it is available in a very short time and very easily.

Its interest rates are a bit high And there is no interest subsidy of any kind in this, but when we have more emergencies, we do not see the interest rates, we only see who can provide us the loan. CashNetUSA is a platform in which we fill our details online and within 24 hours this loan is approved and the amount is transferred directly to our account. That’s why people like CashNetUSA more.

Is CashNetUSA Legit and Real?

Suppose we take a loan from any lender. So in that, we have to fill in our bank details and many more sensitive information. This is the reason why before applying for a loan on any online platform, we must consider whether the lender is legit or not.

That’s why we are asking whether CashNetUSA is legitimate or not. Friends, if you want to know about the legitimacy of a lender, then first of all you should read about its public review. If its review is positive, then understand that the lander is legit and real. We read the reviews of CashNetUSA in which more than 70% of reviews were positive and some were negative. And this is the reason why we consider CashNetUSA Legit and Real.

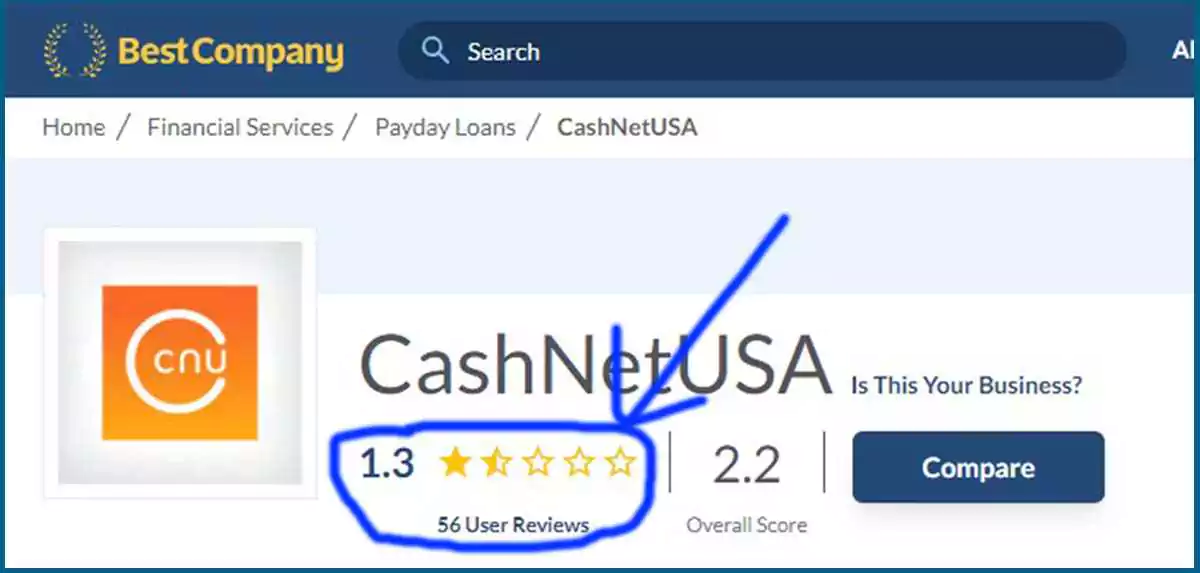

Public Reviews on Best Company.

CashNetUSA is a payday loan service, but its legitimacy is questioned by many due to its low ratings. For example, on the “Best Company” platform, CashNetUSA has a rating of just 1.3 out of 5 stars based on 56 user reviews, with an overall score of 2.2. This suggests that a significant number of customers have had negative experiences with the service.

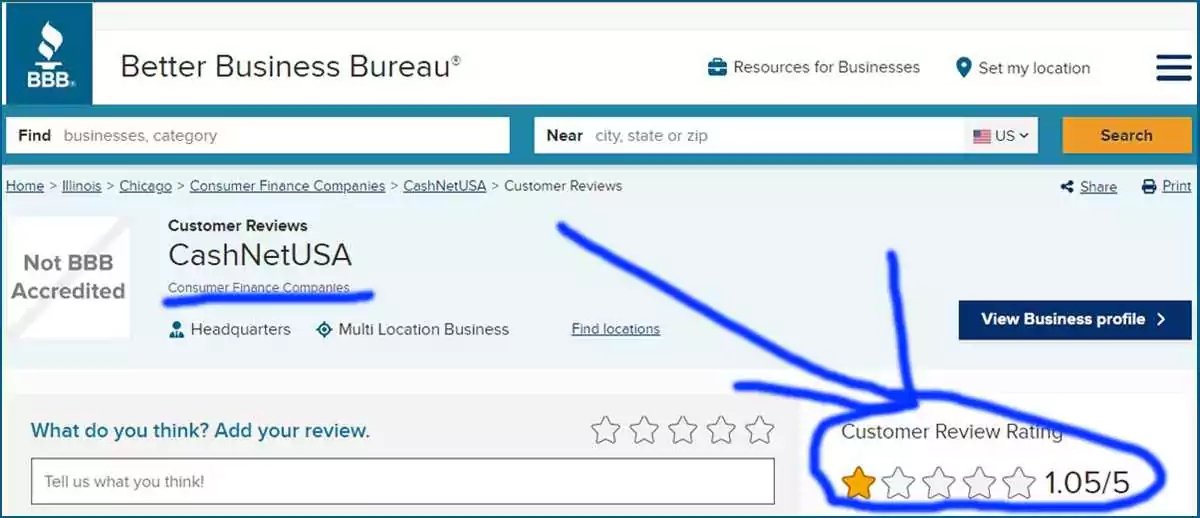

Public Reviews on Better Business Bureau.

The Better Business Bureau (BBB) shows an even lower customer review rating of 1.05 out of 5 stars, indicating widespread dissatisfaction. Moreover, CashNetUSA is not BBB accredited, which raises further concerns about its trustworthiness. While the company is real and operates legally, these low ratings highlight potential issues that consumers should be aware of before using their services.

Public Reviews on Trustpilot.

CashNetUSA is also rated on Trustpilot, where it has a much more positive reputation compared to other platforms. With a rating of 4.7 out of 5 stars based on 33,996 reviews, Trustpilot categorizes CashNetUSA as an “Excellent” service. This high rating suggests that a large number of customers are satisfied with their experiences.

The company is marked as “Verified” on Trustpilot, which means it has been confirmed as a legitimate business. This positive feedback contrasts with the ratings on other platforms, indicating that customer experiences may vary widely. It’s important to consider reviews from multiple sources when evaluating CashNetUSA’s services.

How Does CashNetUSA Work?

CashNetUSA is an online lender that offers payday loans, installment loans, and lines of credit to borrowers in certain states in the United States.

- Online Application: To apply for a loan with CashNetUSA, borrowers need to complete an online application on their website. The application process is straightforward and typically requires basic personal and financial information.

- Eligibility Check: Once the application is submitted, CashNetUSA will review the information provided to determine the borrower’s eligibility for a loan. They consider factors such as the borrower’s credit score, income, and other relevant criteria.

- Loan Approval and Amount: If the borrower meets the eligibility requirements, CashNetUSA will notify them of the loan approval and the approved loan amount. The loan amount can vary based on the borrower’s state of residence, income, and creditworthiness.

- Loan Terms and Repayment: CashNetUSA provides the borrower with the loan terms, including the interest rate, repayment schedule, and any additional fees associated with the loan. Borrowers must review the terms carefully before accepting the loan.

- Funds Disbursement: Once the borrower agrees to the loan terms, CashNetUSA will disburse the funds directly to the borrower’s bank account. The speed of funding can vary depending on the borrower’s bank and the time of application approval.

- Repayment: Borrowers are required to repay the loan according to the agreed-upon schedule. CashNetUSA offers different repayment options, such as electronic funds transfer or a check, depending on the borrower’s preference.

- Customer Service and Support: CashNetUSA provides customer service and support to assist borrowers with any questions or concerns they may have during the loan process or repayment period.

Borrowers need to remember that payday loans, installment loans, and lines of credit from CashNetUSA come with high interest rates and fees.

How Do I Get a Loan from CashNetUSA?

To get a loan from CashNetUSA, you’ll need to visit their website and fill out the online application form. This form asks for your personal, financial, and employment details to determine your eligibility. After applying, CashNetUSA will review your information. If approved, you can receive funds as soon as the next business day. Remember, it’s essential to carefully review the loan terms and conditions before applying.

What are the Requirements for a Loan from CashNetUSA?

Requirements for a loan from CashNetUSA are given below.

- Be at least 18 years old.

- Good credit history.

- Be a U.S. citizen.

- Show regular source of income.

- Valid checking account.

- Phone number

- Email address.

(( Reference: This information was obtained from CashNetUSA’s official website. For more details, you can visit their site directly ))

How Long Does it Take to Get Approved for a Loan from CashNetUSA?

CashNetUSA is famous for quick loan approval and amount transfer to your account. People like it because there is very little documentation inside it and the loan gets approved very quickly. If all your documents are fine, your credit history is good and you feel proper about the application, then it takes only 24 hours for your application to be approved, and in the meantime, if your application is approved, then the amount will be credited to your account is transferred directly.

But if there is any mistake in your application form. So by marking it your application is defunct and you correct it then you get approval. That’s why for the first time you have to fill out your application correctly. So that the amount is transferred to your account in 24 hours.

Does CashNetUSA Report to Credit Bureaus?

CashNetUSA does not typically report to credit bureaus(Experian, Equifax, and TransUnion). This means that taking out a loan from CashNetUSA will not impact your credit score.

However, if you default on your loan, the lender may pursue collection efforts, which could hurt your credit.

What is the Repayment Process for a Loan from CashNetUSA?

The repayment process for a loan from CashNetUSA is straightforward. When CashNetUSA gives you a loan, it fixes auto debit on your account. Due to this, the amount is automatically debited from your account on the due date.

If you want, you can also pay it manually a day or two before. That’s why CashNetUSA has kept a very good facility for repayment. You can choose the repayment plan at your convenience.

CashNetUSA Customer Service Number.

If you have any questions about your loan from CashNetUSA, you can reach the company’s customer service team by calling 888-801-9075 or emailing support@cashnetusa.com

The customer service team is available 24/7 to assist with any questions or concerns.

Conclusion

CashNetUSA offers a quick and convenient solution for short-term financial needs, especially in emergencies. While the platform is legitimate and widely used, it’s important to be cautious due to its high interest rates and mixed customer reviews.

Some users have had positive experiences, while others have raised concerns about the service. As with any loan, carefully consider your options and read the terms before proceeding.

Faq’s

What credit score is needed for CashNetUSA?

640 and above score is needed for CashNetUSA for a loan.But in some special conditions it can be more or less.

How does CashNetUSA verify income?

Cashnetusa implements two methods to verify your income. Firstly, he checks your bank statement in which your regular income is coming. The second one verifies income from your employment letter.

Can you pay off CashNetUSA early?

Yes, You can pay off CashNetUSA early. it is totally depends on you.

Can I get a loan from CashNetUSA with bad credit?

Yes, you can get a loan from CashNetUSA with bad credit. But this happens only in a few cases. Because apart from credit score, there are many things that affect your loan approval. That's why only in a few cases you can get a loan on bad credit score.

How can I contact CashNetUSA?

If you have any questions about your loan from CashNetUSA, you can contact their customer service team by calling 888-801-9075.

Is CashNetUSA a payday loan?

CashNetUSA is not payday loan. But it is similar to a payday loan because there are many things that are common between short term loans and payday loans from CashNetUSA. That's why we can consider both almost the same.

Is it hard to get approved for CashNetUSA?

No, it is not hard to get approved for Cashnetusa for a loan if you are eligible for that.

Does CashNetUSA do instant funding?

Yes, Cashnetusa does instant funding within 24 hours.

What is the maximum loan amount for CashNetUSA?

The maximum loan amount for Cashnetusa is $1000.

What happens when you don’t pay CashNetUSA?

If you don't pay Cashnetusa emi on time then your credit history will be damaged. and maybe Cashnetusa take legal action against you.

Thanks for your visit.

(Is CashNetUSA legit and Real?)

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The content is based on publicly available information and personal opinions. Before applying for a loan with CashNetUSA or any other lender, consult with a financial advisor to ensure it suits your needs. The company’s services and interest rates may vary by state, and user experiences can differ. Always read the terms and conditions carefully before committing to any financial agreement.