In recent years, digital payment platforms have revolutionized the way we handle our finances. Along with this, some platforms also provide the option to borrow money. Cash App, a popular mobile payment service, offers a range of features beyond simple peer-to-peer transactions, And Cash App also gives the option to borrow money. Now the question comes, do these platforms report to credit bureaus or not? In this article, we will explore the question: “Does Cash App report to Credit Bureaus?”

Cash App Borrowing Feature:

Table of Contents

ToggleCash App is a safe platform to receive and transfer amounts and along with this, the feature of borrowing amounts is also available on Cash App and that is why it is more popular.

The Cash App Borrowing feature offers users the convenience of accessing quick funds for various financial needs. Whether it’s covering unexpected expenses, managing bills, or making essential purchases, Cash App provides a seamless borrowing experience.

With this feature, users can apply for a loan directly within the app and can get a $20 to $200 loan instantly. There are different repayment plans to repay this. Whatever plan you select, you have to pay this amount according to that plan. Most of the people repay this amount in four weeks.

What is Credit Reporting?

Before diving into the specifics of Cash App’s reporting practices, it’s essential to understand the concept of credit reporting. Credit reporting involves the collection and maintenance of financial data by credit bureaus, also known as credit reporting agencies.

These agencies compile information from various sources, such as lenders, creditors, and public records, to create individual credit reports for consumers. These reports contain detailed information about an individual’s credit history, including their payment history, credit utilization, and outstanding debts.

If you take a loan from any lender and your EMI bounces, then that lender reports it to the Credit Bureaus and the Credit Bureaus save this report in your records and this is how credit reporting happens.

Whenever you go to take a loan from any other lender, your secured credit history is shown by the credit bureaus. This lets the new lender know how your transaction is, and whether you will be able to repay the EMI on time or not.

Understanding Credit Bureaus:

Credit bureaus play a crucial role in the financial ecosystem by providing lenders and creditors with insights into consumers’ creditworthiness. The three major credit bureaus in the United States are Equifax, Experian, and TransUnion.

Credit bureaus are agencies that store a huge amount of customer data, which includes the customer’s credit report, credit history, financial behavior, etc. Customer data also has to be modified from time to time. If he currently does positive credit activities, his credit report keeps improving. That is why credit bureaus play a huge role in the world of finance. Almost all types of loan-providing agencies report to credit bureaus.

Importance of Credit Reports:

Credit reports serve as a reflection of an individual’s financial health and responsibility. They are instrumental in determining eligibility for various financial products, including credit cards, loans, mortgages, and even rental agreements.

The importance of credit reports is so much that any lender will definitely check your credit reports before giving a loan or giving a credit card. If your credit reports are bad then it becomes very difficult for you to get a loan. To keep their credit reports good, people make repayments of their loans on time so that their credit reports remain good in future and they continue to get loans whenever they need to.

Does Cash App Report to Credit Bureaus?

The amount borrowed on Cash App is issued by First Electronic Bank c/o Square Capital, LLC. This loan ranges between $20 to $200. Due to the small amount, Cash App does not report it to credit bureaus even if its EMI bounces. If EMI bounces in one week, Cash App deducts its amount in the next week.

If there is no balance in Cash App, then it deducts the amount from the debit card or bank account linked to it. But remember that Cash App has full right to report to credit bureaus. We have explained this in detail below

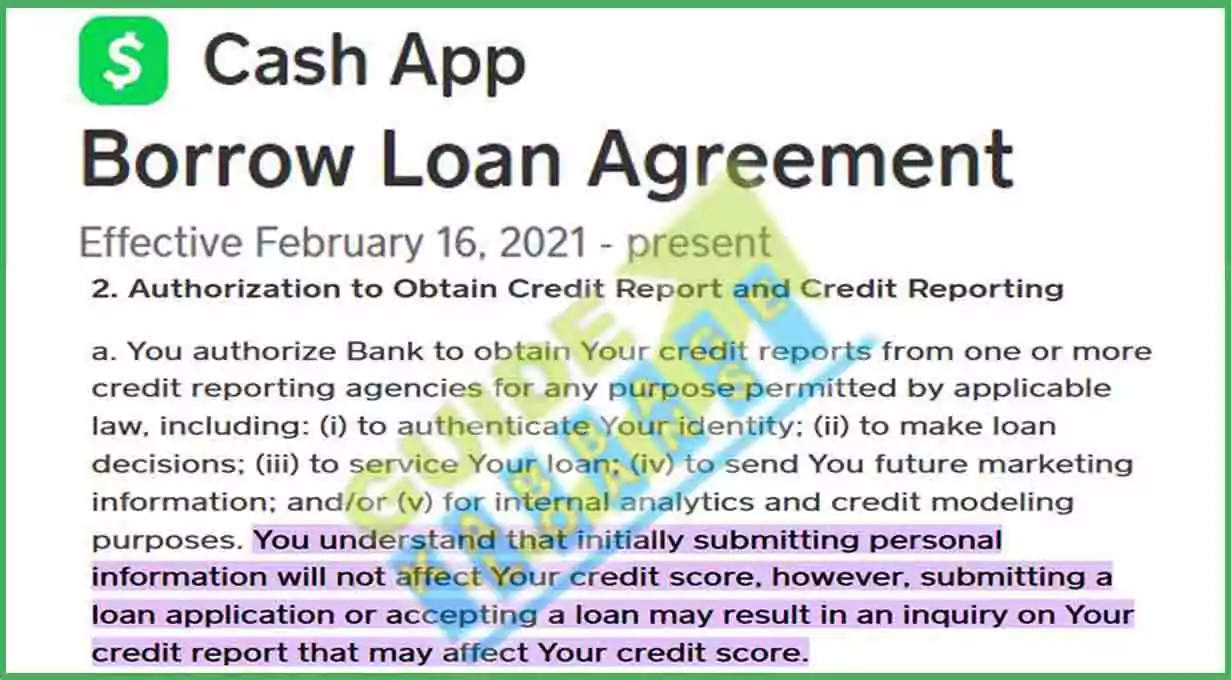

The Borrow Loan Agreement issued by Cash App on February 16, 2021, and updated on February 1, 2024, outlines the terms and conditions between the borrower (referred to as “You”) and First Electronic Bank c/o Square Capital, LLC, the issuer of the closed-end loan. Here’s a simplified explanation of whether Cash App reports to credit bureaus:

Yes, Cash App may report information about your account to credit bureaus. This includes details such as late payments, missed payments, or defaults on your account, which could potentially impact your credit report.

(First Electronic Bank c/o Square Capital, LLC \ Attn: Cash App Lending Program Operations \ 1955 Broadway, Suite 815 \ Oakland, CA 95612)

This agreement also covers various aspects such as authorization to obtain credit reports, payment obligations, disbursement of funds, loan purpose and structure, changes in terms, fees for late payments, interest charges, payment methods, default conditions, and personal financial information requirements.

Additionally, it clarifies that Cash App may use arbitration for dispute resolution, with certain exceptions, and outlines the importance of communicating with each other before initiating formal dispute resolution procedures.

(( Reference: For more detailed information, you can refer to the Borrow Loan Agreement available on the official Cash App website. ))

Does Cash App affect your Credit Score?

According to the Cash App Borrow Loan Agreement, providing personal information initially does not impact your credit score. However, submitting a loan application or accepting a loan may lead to an inquiry on your credit report, potentially affecting your credit score.

This process authorizes the bank to access your credit reports from one or more credit reporting agencies. The purposes for accessing your credit reports include verifying your identity, making loan decisions, servicing your loan, sending you marketing information, and conducting internal analytics and credit modelling.

Along with credit score, there are many other disadvantages of not making cash app loan repayment. If you do not deposit EMI on time, you will never be able to take loan from Cash App. If you deposit EMI on time, your Cash App Baro limit increases.

Conclusion:

Understanding the relationship between Cash App and credit bureaus is essential for managing one’s financial well-being. While Cash App may report certain account information to credit bureaus, the impact on an individual’s credit score depends on various factors. It’s crucial to stay informed about the terms and conditions of borrowing through Cash App and to make timely repayments to maintain a healthy financial profile.

FAQs:

Does Cash App Borrow report to credit bureaus?

No, Cash App does not report borrowing activities to traditional credit bureaus. Your borrowing behavior on Cash App does not impact your credit score or appear on your credit report.

Does Cash App Borrowing affect my credit score?

No, Cash App borrowing activities are not reported to credit bureaus, so they do not impact your credit score.

Can I borrow money on Cash App if I have bad credit?

Yes, Cash App's borrowing feature evaluates various factors beyond traditional credit scores, so users with less-than-perfect credit may still be eligible to borrow.

How soon can I borrow again on Cash App after repaying a loan?

The availability of borrowing funds on Cash App typically depends on factors such as repayment history and account standing. Users may be able to access additional funds shortly after repaying a previous loan, but specific timelines may vary.

Is there a limit to how many times I can borrow from Cash App?

While Cash App does not specify a maximum number of borrowing transactions, users are subject to borrowing limits based on factors like account activity and repayment behavior.

Can I increase my borrowing limit on Cash App?

Yes, users may have the option to increase their borrowing limit over time by demonstrating responsible borrowing behavior, maintaining a positive account standing, and fulfilling repayment obligations promptly.

how many credit bureaus are there in the united states?

There are three main credit bureaus Experian, Equifax and TransUnion in the United States.

Thanks for your visit.

(Does Cash App report to Credit Bureaus?)

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Readers are encouraged to consult with a qualified financial advisor or conduct further research before making any financial decisions based on the content of this article.