If you are looking to buy a home in rural Louisiana, a rural development loan may be the perfect solution for you. These loans are designed to help individuals and families in rural areas purchase homes and improve their communities. In this article, we will cover everything you need to know about rural development loan requirements in Louisiana, including eligibility criteria, documentation needed, property requirements, and more.

What is a rural development loan in Louisiana?

A rural development loan is a type of loan offered by USDA, to help individuals and families living in rural areas purchase homes and improve their communities.

These loans are often referred to as USDA loans and are designed to promote rural development and economic growth in rural areas. Rural development loans can be used to purchase a home, refinance an existing mortgage, or make home repairs and renovations.

Eligibility Criteria for Rural Development Loans in Louisiana.

To be eligible for a rural development loan in Louisiana, you must meet certain eligibility criteria. These criteria include:

- Income: You must have a low income.

- Citizenship: You must be a United States citizen or permanent resident.

- Property: The home you wish to purchase must be located in a designated rural area. To find out if the home you are interested in is located in a designated rural area, visit the USDA’s Eligibility website.

- Credit: You must have a credit score of at least 640. However, some lenders may require a higher credit score.

- Credit history: You must have a good credit history.

How do I qualify for a rural development loan in Louisiana?

The Rural Development Loan, insured by the United States Department of Agriculture (USDA), offers 100% financing for homebuyers in suburban and rural areas. To be eligible for this loan program in Louisiana, you must meet the following requirements:

- Location: The property you intend to purchase must be located in an eligible suburban or rural area. Typically, these areas are outside major city limits. You can check the USDA’s eligibility map or consult with a lender to determine if a specific property qualifies.

- Credit Score: While the USDA does not have a published minimum credit score requirement, most lenders set a score requirement for borrowers. Generally, a credit score of at least 640 is needed to obtain automated approval for USDA loans. However, some lenders may consider manual underwriting for borrowers with scores as low as 580.

- Income Limits: USDA loans have income limits based on the size of the household. The income limit considers the combined income of all working adults in the home. In Louisiana, the income limits are as follows:

- 1-4 Person Household: $103,500

- 5+ Person Household: $136,600

- Occupancy: The USDA loan program requires the property to be used as the borrower’s primary residence. It cannot be used for investment or vacation properties.

- Debt-to-Income Ratio: Lenders will evaluate your debt-to-income ratio, which is the percentage of your monthly income that goes toward debt payments. Generally, a ratio below 41% is preferred, but exceptions can be made based on other compensating factors.

- Property Eligibility: The USDA is flexible regarding the types of homes that qualify for the Rural Development program. Eligible properties include new construction homes, preexisting homes, townhomes, condos, manufactured homes, and modular homes.

Rural development loan requirements in Louisiana?

In addition to meeting the eligibility criteria outlined above, there are other requirements you must meet to qualify for a rural development loan in Louisiana. These requirements include:

- Debt-to-income ratio: Your debt-to-income ratio (DTI) must be no higher than 41%. This means that your total monthly debt payments, including your mortgage payment, cannot exceed 41% of your monthly income.

- Property requirements: The home you wish to purchase must meet certain property requirements, including being in good condition and being structurally sound. The property must also have access to safe drinking water and adequate sewage disposal.

Documentation Needed for Rural Development Loans in Louisiana

To apply for a rural development loan in Louisiana, you will need to provide documentation of your income, credit history, and employment, as well as information about the property you wish to purchase.

Some of the documents you may be asked to provide include:

- Pay stubs or other proof of income

- W-2 forms or tax returns

- Bank statements

- Credit reports

- Employment verification

- Appraisal of the property you wish to purchase

Property Requirements for Rural Development Loans in Louisiana.

The property you wish to purchase with a rural development loan must meet certain requirements. These requirements include:

- Location: The property must be located in a designated rural area.

- Size: The property must be modest in size, as determined by the USDA. Generally, properties with a maximum of 2,000 square feet are considered modest in size.

- Condition: The property must be in good condition and be structurally sound.

- Utilities: The property must have access to safe drinking water and adequate sewage disposal.

How to Apply for Rural Development Loans in Louisiana?

If you want to apply for a USDA Single Family Housing Direct Home Loan in Louisiana, here is a simple, step-by-step guide to help you through the process:

Check Your Income Eligibility:

Start by checking if your income qualifies as low or very low for the area where you want to buy a home. This loan is specifically for those who meet income limits set by USDA.

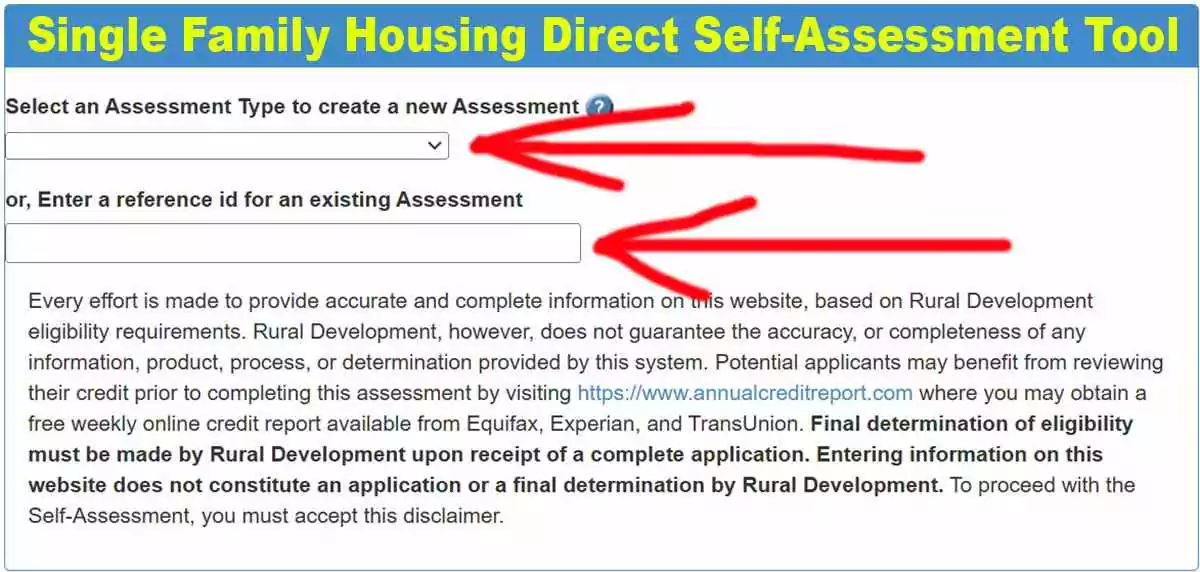

Use the Self-Assessment Tool:

Go to the USDA website and use the Single Family Housing Direct Self-Assessment Tool. This tool will ask for basic info about your income, monthly expenses, and where you plan to buy. It will give you a quick idea of whether this loan might be a good fit for you.

Gather Your Application Documents:

If the self-assessment looks positive, the next step is to gather documents, like proof of income, monthly expenses, and other financial details. You can get the full application form online or from your local USDA Rural Development office.

Submit the Application:

Once your application package is ready, submit it to your nearest USDA Rural Development (RD) office. You can apply anytime during the year.

Wait for Processing:

USDA will review your application, verify all details, and check if you meet the requirements. Processing time can vary based on available funding and the demand in your area, so there may be a bit of waiting.

Approval and Loan Offer:

If you’re approved, USDA will inform you of your eligibility, the maximum loan amount, and the loan terms.

By following these steps, you’ll be well on your way to applying for a loan that could help make your dream of owning a home in Louisiana a reality!

What is the interest rate on a rural development loan in Louisiana?

As of now, the interest rate for a Single Family Housing Direct Home Loan through USDA Rural Development in Louisiana is set at 4.375% for both low-income and very low-income borrowers. This rate can be reduced to as low as 1% with payment assistance, depending on the applicant’s income level and eligibility.1

How much can I borrow with a rural development loan in Louisiana?

The amount you can borrow with a rural development loan in Louisiana depends on your income, the property you wish to purchase, and other factors. In general, rural development loans have a maximum loan amount of $548,250 in most areas. However, in some high-cost areas, the loan limit may be higher.

What is the debt-to-income ratio for rural development loans?

The debt-to-income ratio for rural development loans is 41%. This means that your total monthly debt payments, including your mortgage payment, cannot exceed 41% of your monthly income.

What is the income limit for rural development loans in Louisiana?

The income limit for rural development loans in Louisiana varies depending on the county you live in and the size of your household. To find out if you meet the income requirements for a rural development loan in Louisiana, visit the USDA’s Income and Property Eligibility website.

What is the minimum credit score for a rural development loan?

The minimum credit score for a rural development loan is 640. However, some lenders may require a higher credit score. To find out what credit score you need to qualify for a rural development loan, contact an approved lender in Louisiana.2

Single Family Housing Direct Home Loan Program in Louisiana:

The Single Family Housing Direct Home Loan Program, or Section 502 Direct Loan Program, is designed by USDA Rural Development to make homeownership achievable for low- and very-low-income families in rural Louisiana. This program provides payment assistance, a temporary subsidy that reduces monthly mortgage payments, helping families secure safe, decent, and affordable housing.

To qualify, applicants need to meet several criteria, including income eligibility, legal residency status, and lack of decent housing options. They must be unable to obtain financing from other sources and be willing to occupy the property as their primary residence. The program covers various uses for the funds, such as buying, building, renovating, or relocating a home, and even setting up essential water and sewage facilities. Properties financed must not exceed the area loan limit or be income-generating.

Conclusion.

A Rural Development Loan can make homeownership more accessible for families in rural Louisiana. By meeting specific eligibility criteria—such as income limits, credit score requirements, and property guidelines—you can take advantage of 100% financing options provided by the USDA. This loan program offers an excellent path for those unable to secure traditional financing, aiming to promote community growth and provide stable housing opportunities in rural areas.

Faq’s

What are the requirements for a rural development loan in Louisiana?

To qualify for a rural development loan in Louisiana, you must meet certain eligibility criteria, including having a low or moderate income, being a United States citizen or permanent resident, and purchasing a home in a designated rural area.

What documentation is needed to apply for a rural development loan in Louisiana?

To apply for a rural development loan in Louisiana, you will need to provide documentation of your income, credit history, and employment, as well as information about the property you wish to purchase.

Can I use a rural development loan to buy land in Louisiana?

Yes, you can use a rural development loan to purchase land in Louisiana, as long as the land is located in a designated rural area and is used for residential purposes.

What is the repayment period for a rural development loan in Louisiana?

The repayment period for a rural development loan in Louisiana may vary depending on the loan amount and other factors, but it can be up to 30 years.

Can I get a rural development loan in Louisiana with bad credit?

While having good credit is important when applying for a rural development loan in Louisiana, it is still possible to qualify for a loan with a lower credit score if you meet other eligibility requirements and have a solid financial history.

Thanks for your visit.

(Rural Development Loan Requirements Louisiana:)

Disclaimer: This article provides general information on USDA Rural Development Loans. Eligibility and requirements may vary based on individual circumstances, so please consult with a USDA representative before making any decisions.

- USDA [↩]

- Rural Development [↩]