Thanks to platforms like Cash App, investing in the stock market has become more inclusive and approachable than ever before. With the ability to buy fractional shares for as little as $1, individuals can now participate in the financial markets with minimal barriers to entry. So exactly, what happens when you buy $1 of stock on Cash App? Let’s explore the process and its implications.

Everyone knows that we can borrow money from Cash App, but do you know that we can also buy stocks from Cash App? Along with this, Cash App gives us such a facility by which we can start our stock journey with $1. Today, we will discuss in detail what happens to those who buy $1 stock from Cash App, what precautions they should take, and what the benefits of buying $1 stock from Cash App.

What Happens When You Buy $1 of Stock on Cash App?

When you buy $1 of stock on Cash App, you’re essentially purchasing a fraction of a share in a company. Cash App allows you to invest in fractional shares, meaning you can buy a portion of a stock rather than a whole share. This enables you to invest in companies whose shares may have high prices, making them unaffordable if you were to buy full shares.

Cash App divides the cost of a share into smaller units, allowing you to invest as little as $1. So, when you make such an investment, you’re acquiring a proportional ownership stake in the chosen company.

Whenever you buy $1 stock from Cash App, you get to know about the market of the company whose stock you are buying. Apart from this, the stock you buy for $1 is not transferable, hence most people buy $1 stock to check how the stock market of this company is and how much it fluctuates.

Understanding Fractional Shares.

Fractional shares represent less than one whole share of a company’s stock. This means you can own a piece of your favorite companies without needing to buy a full share, which may be out of reach for some investors due to high share prices.

With Cash App, the process of buying fractional shares is straightforward. You simply need to search for a company by name or ticker symbol, choose the amount you want to invest, and the Cash App takes care of the rest. Whether you want to invest $1 or more, you have the flexibility to tailor your investment to your budget and preferences.

(( Reference: Information gathered from the official Cash App website. For more details, please visit the website directly. ))

Step-by-Step Guide to Buying $1 of Stock on Cash App.

If you want to buy $1 of stock on Cash App by using a Cash App Card, it can be quite beneficial for you. There are many benefits, such as checking the fluctuation graph of any company, generating your portfolio, and estimating your future profits and losses. To buy $1 of stock from any company on Cash App, you’ll need to follow the steps below:

Step 1: First, open your Cash App account. After opening your Cash App account, you’ll see an “Invest” symbol on the right side. Click on it, as shown in the photo below.

Step 2: As soon as you click on the “Invest symbol” button, a new page will open displaying various stock companies like Apple and Disney. Click on the company you want to buy stock from.

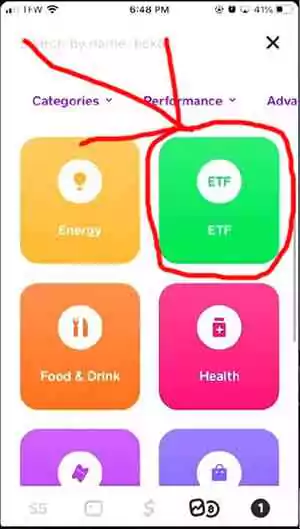

Step 3: Once you select your company, several categories like Energy, Food and Drink, Health, and ETF will appear. Choose the correct category and click “Next.”

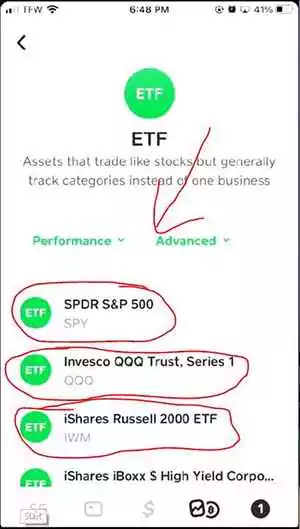

Step 4: After selecting your company and category, a new page will open. Since we selected an ETF, several categories will appear below. Select the right category and click “OK,” as shown in the photo below.

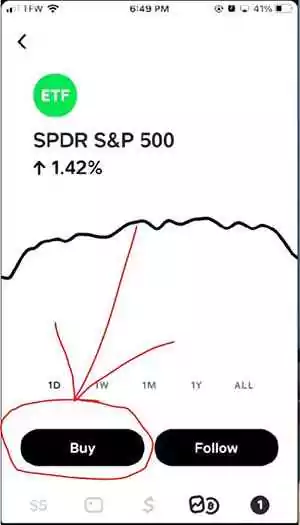

Step 5: After clicking “OK,” the selected stock will open, showing its price fluctuation graph. You can see how much its price has increased or decreased in recent days. Analyze the graph, and if you still want to purchase, click on the “Buy” button.

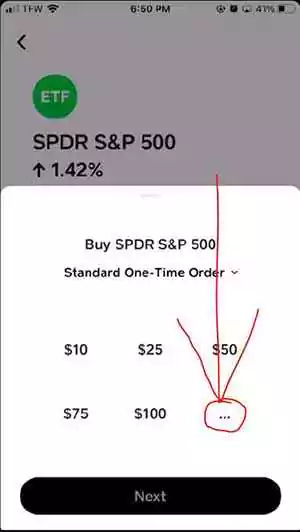

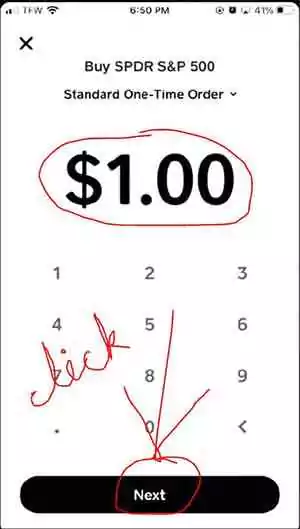

Step 6: Clicking “Buy” will open a new page displaying various purchase amounts. Click on the amount you want to invest. If $1 is not shown, click on the three dots.

Step 7: Clicking on the three dots will give you the option to manually enter the amount. Enter $1 and click “Next.” But before that, check the balance in your Cash App. If there is no balance in Cash App, then first deposit money into Cash App.

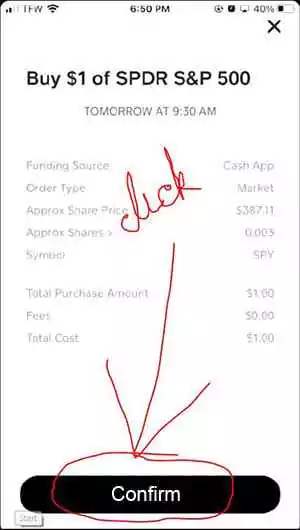

Step 8: After clicking “Next,” all the details regarding the $1 purchase will be displayed. Review the information and click “Confirm.” Once confirmed, your $1 stock purchase will be complete.

By following these simple steps, you can buy stocks worth $1 using Cash App.

Building Your Investment Portfolio.

One of the advantages of fractional share investing on Cash App is the ability to build a diversified investment portfolio with ease. Instead of needing a large sum of money to buy whole shares of multiple companies, you can spread your investment across different stocks with as little as $1 each.

This democratization of investing means that even those with limited funds can participate in the stock market and potentially benefit from the long-term growth of the companies they believe in. Whether you’re passionate about technology, healthcare, or consumer goods, you can allocate your investments accordingly.

Top 10 stocks on Cash App under $1

Here are some top stocks under $1 available on Cash App:

Ginkgo Bioworks Holdings, Inc. (NYSE: DNA)

- Current Price: $0.33

- A biotechnology company focusing on custom organisms for various industries.

FuelCell Energy, Inc. (NASDAQ: FCEL)

- Current Price: $0.63

- Provides clean energy solutions through fuel cell technology.

Faraday Future Intelligent Electric Inc. (NASDAQ: FFIE)

- Current Price: $0.39

- An electric vehicle manufacturer.

GEE Group Inc. (NASDAQ: JOB)

- Current Price: $0.4756

- Staffing and recruiting company.

Cybin Inc. (NYSE: CYBN)

- Current Price: $0.3660

- Develops psychedelic-based therapeutics.

OPKO Health Inc. (NASDAQ: OPK)

- Current Price: $0.9970

- Involved in diagnostics and pharmaceuticals.

Pedevco Corp. (NYSE: PED)

- Current Price: $0.6670

- Oil and gas exploration and production company.

Netcapital Inc. (NASDAQ: NCPL)

- Current Price: $0.50 (approx)

- A financial technology company operating a funding portal.

Societal CDMO Inc. (NASDAQ: SCTL)

- Current Price: $0.75 (approx)

- Contract development and manufacturing organization.

S&W Seed Co. (NASDAQ: SANW)

- Current Price: $0.60 (approx)

- Agricultural company focusing on alfalfa seed and other crops.

IMPORTANT NOTE: For the most accurate and updated prices, please refer to the linked sources. Prices fluctuate up and down accordingly.

Benefits of Investing $1 in Stock on Cash App.

Fractional share investing is utilized by seasoned stock market investors for several reasons, primarily to diversify their portfolios and maximize investment opportunities. Here are some benefits of fractional share investing in simple English:

- Diversification: Big stock market players use fractional shares to diversify their investment portfolios. Instead of putting all their money into a single stock, they can spread their investments across multiple companies, reducing their overall risk.

- Affordability: Fractional share investing allows investors to buy a portion of high-priced stocks without needing to purchase a full share. This makes investing in expensive companies more affordable for individuals with limited funds.

- Accessibility: Fractional shares make it easier for everyone to invest in the stock market, regardless of their financial situation. Even with just a few dollars, anyone can start investing in their favourite companies.

- Flexibility: With fractional shares, investors have the flexibility to allocate their investment dollars exactly as they wish. They can choose to invest in specific companies or sectors without being constrained by the price of a single share.

- Dollar-Cost Averaging: Fractional share investing allows investors to practice dollar-cost averaging, which involves regularly investing a fixed amount of money over time. This strategy can help smooth out market volatility and potentially lower the average cost per share over the long term.

Understanding the Risks.

While fractional share investing offers accessibility and flexibility, it’s essential to understand the risks involved. Fractional shares are not transferable, which means you cannot move them to another brokerage account. If you decide to close your Cash App Investing account or transfer it to another platform, your fractional shares will need to be liquidated, potentially resulting in charges.

If your Cash App account is sponsored, then avoid buying stocks because if he/she unsponsor your Cash App account, then you will face a lot of trouble in selling your stocks.

Conclusion:

Investing in Bitcoins or stocks through platforms like Cash App has made the stock market more accessible to individuals with any budget. So, what happens if you invest $1 in a stock? Buying $1 of stock allows fractional share ownership, enabling investors to participate in the market’s potential growth. However, it’s essential to understand the risks involved and make informed decisions when investing.

FAQs:

What happens if I close my Cash App Investing account?

If you close your Cash App investing account, your fractional shares will need to be liquidated, potentially resulting in charges and fees.

Can you make money investing $1 in stocks?

No, you cannot make money by investing $1 in any stock. Because investing $1 in any stock is not for profit, it is only for checking and analyzing the market.

Can I transfer fractional shares to another brokerage account?

No, fractional shares are not transferable between brokerage accounts. They can only be bought, sold, or held within the same brokerage where they were purchased.

Thanks for your visit.

(What happens when you buy $1 of stock on Cash App?)

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Investing involves risk, including the potential loss of principal. Readers are encouraged to conduct their research and consult with a qualified financial advisor before making any investment decisions.