Last updated on June 20th, 2024 at 02:23 pm

At present, digital transactions have increased so much that in the United States, approximately 70% of the transactions take place online. Cash App has a huge contribution to online transactions. Cash App gives us many options for money transfer but when it comes to instant transfer, the question in people’s mind is what are the Cash App charges for instant transfer. Today we will discuss this question of yours in detail.

We have already told you about the Cash App cash-out charges. However, the charge for instant transfer is slightly different because this charge depends on many situations. That is why we have talked about every situation of yours in this guide.

Understanding Cash App Instant Transfers:

Table of Contents

ToggleWhen we settle our amount in Cash App into our bank account, there are two methods available in Cash App. First standard deposit and second instant deposit.

Standard deposit – Standard deposit is a normal deposit in which you can deposit the amount in the account linked to your Cash App. It takes one to three business days for this amount to reach the bank account. There is no charge for this. But if the charge is still deducted from your Cash App account, then you can dispute this charge on Cash App.

Instant deposit- If we talk about an instant deposit, then through instant deposit, if we settle the amount in our Cash App in the bank account linked to our Cash App, that amount gets instantly settled in your debit card or bank account. For this, you have to pay some additional charge. Some charge is taken from you for this facility but your amount is credited to your bank account instantly.

People get a lot of benefits from this, if they want to transfer the amount to their bank account and use it somewhere, then they can easily do it and they do not have to wait for three days. That is why the option of instant transfer in Cash App is very popular.

How Cash App Instant Transfers Work:

Cash App Instant Transfer works just like a standard deposit but is slightly different. However, people also use the Cash App NFC tag to transfer amounts quickly. But it’s not as safe as Cash App’s own “Instant Deposit” option.

When we settle any amount from Cash App into our bank account or debit card, we get two options to transfer the amount, first is standard deposit and second is instant deposit. If we select instant deposit, the amount is transferred instantly to our bank account or debit card, for this we do not have to wait at all.

If you want to settle the amount from your Cash App account to your bank account or debit card, then you will have to follow the steps given below.

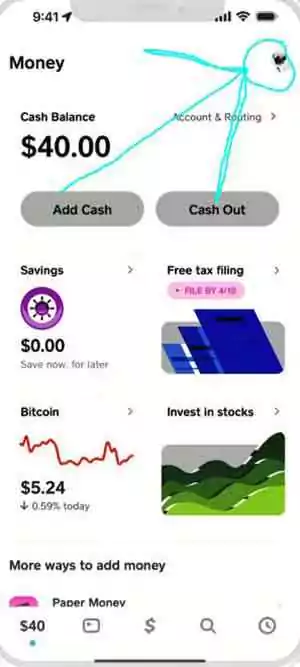

Step 1 – First of all, you have to open the Cash App on your mobile and the profile icon button will appear in the top right corner, click on it and after clicking, you have to select the linked bank account in which you want to transfer the amount.

As shown in the photo below.

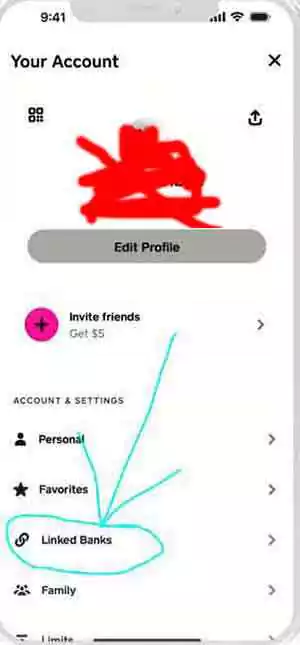

Step 2 – As soon as you click on the profile icon button, you will see the option of “Linked Bank”.

As shown in the photo below.

As soon as you click on it, all the bank accounts and debit cards will be shown in front of you which will be linked to your Cash App account. | You have to select the bank account to which you want to transfer the amount and click on Next.

Step 3 – As soon as you click on Next, two options appear in front of you. First, to select the amount, you have to select the amount in it. After that, as soon as you click on transfer, two options will appear in front of you, first is “Standard Deposit” and second is “Instant Deposit”. So if you want to transfer the amount instantly then you will have to click on the instant option.

As shown in the photo below.

So by following the steps given above, you can instantly transfer the amount in your Cash App to your bank account or debit card.

The Benefits of Cash App Instant Transfers:

Cash App instant transfers offer several advantages that make them a convenient choice for users. Here are some key benefits listed in bullet points:

- Immediate Access to Funds: With instant transfers, the money is deposited into your bank account immediately, allowing you to use it anywhere you need.

- Enhanced Customer Service: Instant transfers enable Cash App to provide excellent service to its clients by ensuring quick and efficient transactions.

- Direct Transfer to Bank Accounts: Through instant transfers, funds from your bank account can be transferred directly to someone else’s account, providing a seamless payment experience.

- Avoid Waiting with Instant Travel: With instant transfers, you don’t have to wait for a day for payments to arrive; the funds are deposited into your bank account promptly.

- Immediate Requirement Fulfillment: In cases where there’s an urgent need for funds, instant transfers come in handy as they provide the necessary amount instantly.

- Avoid Pending Payments: Instant transfers help to avoid pending payments on Cash App, sometimes Cash App pending payments can take time to process, causing delays.

These benefits highlight the convenience and efficiency of Cash App instant transfers, making them a valuable tool for managing financial transactions swiftly and securely.

What are the Cash App Charges for Instant Transfers?

Cash App charges for instant transfers depend on the amount you are transferring. The fee ranges from 0.5% to 1.75% of the transfer amount, minimum fee is $0.25. This means that the fee changes depending on how much money you are sending.

Understanding these fees can be a bit tricky because they vary based on different situations. However, knowing that this fee is taken out of the money before it goes into your bank account is important.

In addition to your bank account and debit card, you can also add your credit card to Cash App. There is a different fee for transferring money to a credit card, which we will explain in a future article.1

Cash App Instant Transfer Fee Calculator:

Cash App does not have any instant transfer fee calculator. This is because when we transfer funds from our Cash App account to our bank account or debit card, the fee depends on various factors such as the type of Cash App account you have, the type of bank account linked, and the amount being transferred. These factors determine whether your instant transfer fee will be lower or higher.

Therefore, if you want to calculate the fee for your Cash App instant transfer, you simply need to initiate the transfer, and the app will display the charge at that moment. This functionality essentially serves as the Cash App instant transfer fee calculator.

Apart from this, there is another method, if you want to calculate the fee of Cash App Instant Transfer, then check your Cash App balance before transferring the amount and then after transferring the amount, check your Cash App balance. You should know that you can check your Cash App balance without logging in.

Factors Influencing Cash App Instant Transfer Costs:

As you may know, Cash App’s instant transfer fee ranges from 0.5% to 1.75%. Now, which instant transfer fee remains at 0.5% and which at 1.75% depends on several factors.

Some of these factors are given below.

- Verification status of the Cash App account.

- Age of the Cash App account.

- Type of Cash App account (individual or family account).

- Receiving bank account type.

- State tax rules affect the fee.

- How much amount is being transferred?

Comparing Cash App Instant Transfer Charges with Other Platforms:

In the United States, several money transfer apps are popular among people. Some of the most popular apps include Apple Pay, Google Pay, PayPal, and others. Below, we have compared the Cash App with these platforms and indicated how much each app charges for instant transfers.

| Payment Platform | Fee Structure for Standard Deposit | Fee Structure for Instant Deposit |

|---|---|---|

| Cash App | – Free (arrives within 1-3 business days) | 0.5% – 1.75% fee (minimum fee of $0.25, arrives instantly on a linked debit card or bank account) |

| Apple Pay | Not applicable | 1.5% fee (minimum fee of $0.25, maximum fee of $15, arrives instantly) |

| PayPal | Not applicable | 1.50% fee (minimum fee of $0.25, maximum fee of $15, arrives instantly) |

| Google Pay | Not applicable | Instant Deposit Not applicable – Debit Card Transfer: 1.5% fee (minimum fee of $0.31) |

Tips to Minimize Cash App Instant Transfer Charges:

Minimizing Cash App instant transfer charges can be achieved through various methods. When transferring funds from your Cash App to your bank account, opt for the standard deposit instead of instant transfer whenever possible. Standard deposits typically take around three days to process, but sometimes the amount may appear in your bank account within one day.

Additionally, transferring the maximum allowable amount at once can help reduce charges. Considering these considerations, you can effectively lower Cash App instant transfer charges.

Conclusion:

In conclusion, Cash App instant transfers offer convenience, but it’s essential to understand the associated fees and factors influencing them. You can minimize charges and manage your finances more effectively by assessing your needs and considering alternative transfer methods.

FAQs:

Cash App Instant Transfer Fee for $100:

The fee for an instant transfer of $100 on Cash App ranges from $0.50 to $1.75, with a minimum fee of $0.25.

Cash App Instant Transfer Fee for $200:

The fee for an instant transfer of $200 on Cash App ranges from $1.00 to $3.50, with a minimum fee of $0.25.

Cash App Instant Transfer Fee for $300:

The fee for an instant transfer of $300 on Cash App ranges from $1.50 to $5.25, with a minimum fee of $0.25.

Cash App Instant Transfer Fee for $400:

The fee for an instant transfer of $400 on Cash App ranges from $2.00 to $7.00, with a minimum fee of $0.25.

Cash App Instant Transfer Fee for $500:

The fee for an instant transfer of $500 on Cash App ranges from $2.50 to $8.75, with a minimum fee of $0.25.

Cash App Instant Transfer Fee for $1000:

The fee for an instant transfer of $1000 on Cash App ranges from $5.00 to $17.50, with a minimum fee of $0.25.

Cash App Instant Transfer Fee for $10000:

The fee for an instant transfer of $10,000 on Cash App ranges from $50.00 to $175.00, with a minimum fee of $0.25.

Cash App Instant Transfer Fee for $20000:

The fee for an instant transfer of $20,000 on Cash App ranges from $100.00 to $350.00, with a minimum fee of $0.25.

Thanks for your visit.

(Cash app charges for instant transfer:)

Disclaimer: The information provided in this article is for educational and informational purposes only. We do not endorse or promote any specific financial products or services. Readers are advised to research and consult with financial experts before making any financial decisions.

- Reference: We gathered data from the official Cash App website. You can visit the official website for further details. [↩]