In the USA, the value of payday loans becomes clear during emergencies. Payday loans provide instant help when you need money fast. While there are many types of payday loans available, today we will focus on the Sigma Solutions payday loan. In this article, we will explain what the Sigma Solutions loan is, who is eligible, how to apply, and much more important information about this loan.

What is Sigma Solutions Loan?

Sigma Solutions is a financial services company that specializes in providing payday loans to individuals in need of quick cash. Located in Salt Lake City, Utah, they offer an easy online application process, allowing borrowers to receive funds typically within one business day.

Sigma Solutions offers payday loans for people who need quick cash before their next paycheck. These loans are meant to cover emergency expenses, like medical bills or car repairs. The loan process is easy, and the company promises fast approval. Their loans come with high interest rates, so borrowers must understand the terms and ensure they can repay the loan on time.

How Sigma Solutions Loan Works?

Sigma Solutions Loan works through a straightforward online application process. Borrowers fill out a form with their personal and financial information. Once submitted, the application is reviewed for approval, which can happen quickly. If approved, the funds are typically deposited into the borrower’s bank account within one business day.

How much can I borrow from Sigma Solutions loan?

You can borrow between $100 and $1,000 from Sigma Solutions Loan, depending on your eligibility and financial situation. The specific amount you qualify for may vary based on your income and ability to repay the loan. For more details, you can visit their website.1

What is the interest rate of the Sigma Solutions loan?

The interest rates for Sigma Solutions loans vary significantly, ranging from 65.35% to 1,409.36%, depending on factors like state regulations, loan terms, and the amount borrowed2. Loan amounts and approval criteria also differ by state, and complete details about APR, fees, and payment terms are provided in the Loan Agreement. These loans are intended for short-term financial needs, and borrowers experiencing credit difficulties are encouraged to seek credit counseling.

Who Can Apply?

To qualify, you must:

- Be at least 18 years old.

- Have a steady income.

- Own a bank account.

- Be a U.S. citizen. Military members are not eligible for these loans. They can apply for a VA loan.

How to apply for a Sigma Solutions loan?

To apply for a Sigma Solutions loan, its mobile application is not available right now, for this you have to visit its official website

Here’s a simple step-by-step guide to applying for a Sigma Solutions loan:

- Visit the Application Form: Go to the Sigma Solutions website and find the loan application section.

- Fill Out Personal Information: Enter your details, including your name, address, contact information, Social Security Number, and date of birth. Make sure to choose the amount you want to borrow.

- Provide Employment and Income Details: Include information about your job, income type, and how often you get paid.

- Enter Financial Information: Fill in your bank account details, including your routing number and account number.

- Submit Your Application: After checking your information, click the submit button to send your application.

Understand the Sigma Solutions loan application process through video:

How long does it take to get approved for a Sigma Solutions loan?

Approval for a Sigma loan typically happens quickly, often within minutes after submitting your online application. Once approved, you may receive the funds in your bank account as soon as the next business day. However, exact timing can vary based on factors like state regulations and your financial information.

Can I get a Sigma Solutions loan with bad credit?

While having a good credit score can make it easier to qualify for a loan, Sigma Solutions does consider applicants with bad credit. However, you may be required to pay a higher interest rate or provide additional collateral if you have a low credit score.

Sigma Solutions Inc. loan reviews.

Sigma Solutions Inc. has generally positive reviews online, with many customers praising the company’s fast approval process and competitive interest rates. However, as with any lender, there are also some negative reviews.

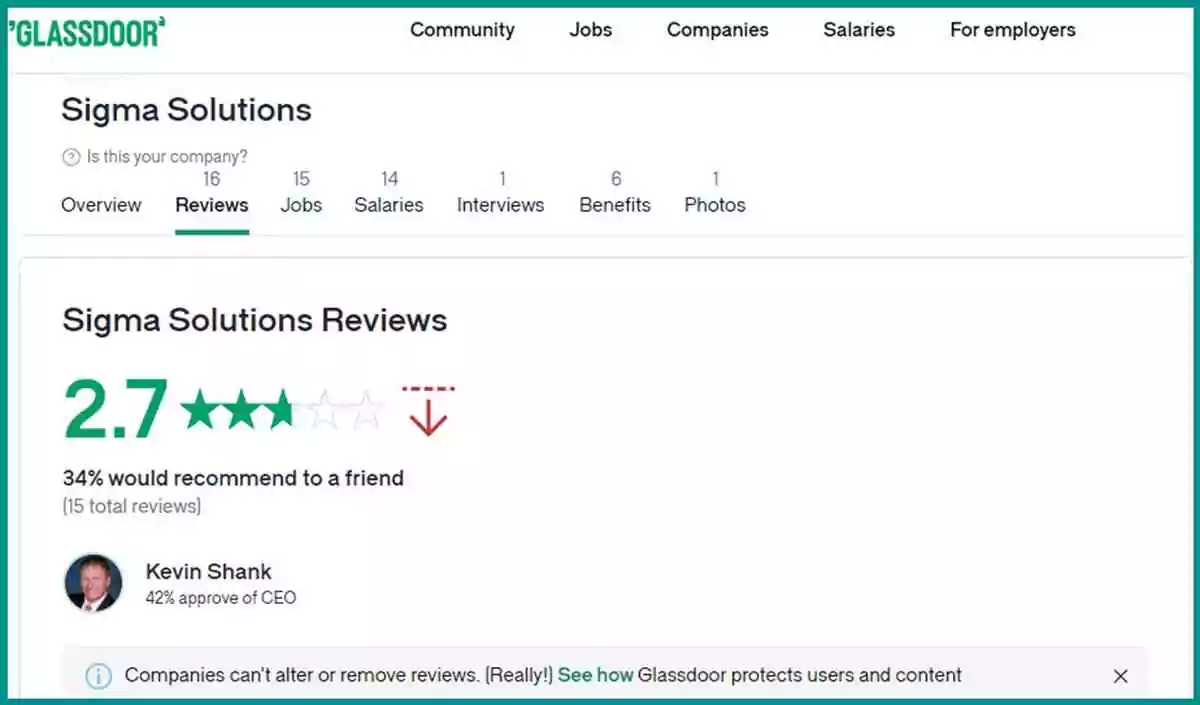

Glassdoor Reviews:

On Glassdoor, Sigma Solutions has received mixed reviews from employees. Many appreciate the work environment, highlighting positive interactions among colleagues and a supportive management team. However, some employees have expressed concerns regarding work-life balance and job security, noting that there can be high pressure in certain roles.3

Better Business Bureau (BBB) Reviews:

According to the Better Business Bureau, Sigma Solutions holds a rating of ‘F.’ This indicates that the company has not met the BBB’s standards for resolving customer complaints, which can be a significant red flag for potential clients. Customer feedback on the BBB platform indicates issues related to service delivery and responsiveness.4

Pros and Cons of Sigma Solutions loan:

| Pros | Cons |

|---|---|

| Quick approval and funding | High interest rates |

| Easy online application process | Short repayment period |

| Can help cover emergency expenses | Risk of falling into debt |

| No credit check required | Possible hidden fees |

Customer Experiences and Complaints

Discuss customer reviews and common complaints about the company, such as:

- Hidden fees: Many customers report being charged significantly more than they expected5

- Lack of transparency: Customers have expressed frustration over the lack of communication and difficulty contacting support for loan inquiries6

- Overcharging: Some customers claimed they were overcharged for months beyond the agreed repayment period.

Conclusion

In summary, Sigma Solutions Loan offers a fast and convenient option for those facing urgent financial needs. While it provides quick access to cash, potential borrowers must be mindful of the high interest rates and the risk of accumulating debt. It’s crucial to assess your ability to repay the loan and explore other financial options if necessary.

Faq’s

Is Sigma Solutions legit?

Sigma Solutions is a legitimate lending company that offers loans to individuals and businesses. However, it's important to review the lender's reputation and customer reviews before applying for a loan.

Is Sigma Solutions loan scam?

No Sigma Solutions Loan is not a scam. Sigma Solutions is a legitimate lending company that offers loans to individuals and businesses. But check before applying.

Sigma Solutions loan phone numbers.

This is the phone number of Sigma Solution Loan - 800-373-5527

Loans like Sigma Solutions.

There are many other lending options available, including personal loans from traditional banks, credit card advances, and peer-to-peer lending platforms.

Can military members apply for Sigma Solutions loans?

No, military personnel are not eligible for these loans.

Thanks for your visit.

(Sigma Solutions Loan)

Disclaimer: The information provided in this article is for informational purposes only and does not constitute legal advice. Sigma Solutions loans come with high interest rates and can lead to debt if not managed responsibly. Borrowers should ensure they fully understand the loan terms and conditions.