Cash App has become a popular choice for online payments, and many users wonder whether it’s possible to add a credit card to the app, especially when they don’t have a linked bank account or Cash App Card. In this comprehensive guide, we will explore how to add credit card to Cash App without bank account, its benefits, the supported credit cards, and much more.

Cash App is an application that you can use even without a bank account and that is why this app is considered a little less secure. If you do not want to add your bank account in Cash App and you want to keep transactions through your Cash App only through credit card, then for this we have brought a direct way for you.

Can We Add a Credit Card to the Cash App?

Yes, you can add a credit card to the Cash App, but certain conditions must be met for a successful link. Your credit card should be in active status, and it should not have a negative balance. Once these conditions are met, you can easily link your credit card to Cash App and use it for your transactions.

(( Reference: Cash App Website ))

Benefits of Adding a Credit Card to Cash App

Adding a credit card to your Cash App account offers several benefits, making your financial transactions more convenient and versatile. Here are some of the advantages of adding a credit card to Cash App.

| Benefit | Description |

|---|---|

| Convenience | An additional funding source for more convenient transactions. |

| Credit Card Rewards | Opportunity to maximize credit card rewards like cashback or rewards points. |

| Payment Flexibility | Ability to make payments even when Cash App balance is low. |

| Split Bills | Ease of splitting bills and sharing expenses, ideal for group expenditures. |

Credit Cards Supported by Cash App

Cash App is versatile in its support for debit and credit cards, making it convenient for users to link their preferred cards. The app supports a wide range of major card networks, including:

- Visa: If you have a Visa debit or credit card, you can confidently link it to your Cash App account. Visa cards are widely accepted and come with various benefits.

- MasterCard: Cash App also supports MasterCard debit and credit cards. MasterCard is known for its global acceptance and secure payment options.

- American Express: If you’re an American Express cardholder, you’ll be pleased to know that Cash App welcomes Amex debit and credit cards. American Express offers various perks and rewards to its cardholders.

- Discover: Discover cards are also supported by Cash App. Discover is renowned for its cashback rewards and unique card offerings.

How to Add Credit Card to Cash App Without Bank Account?

Adding a credit card to Cash App without linking a bank account can be a bit challenging, but it’s not impossible. While Cash App typically requires a bank account, you can follow the steps below to add your credit card directly without linking a bank account.

Step 1: Open the Cash App

First, launch the Cash App on your mobile device. Then, tap on the profile icon located in the top right corner of the screen. This will open your profile settings. As shown in the image below.

Step 2: Navigate to Linked Banks

After tapping the profile icon, several options will appear. Scroll down through the options until you find “Linked Banks.” Tap on this option to proceed. As shown in the image below.

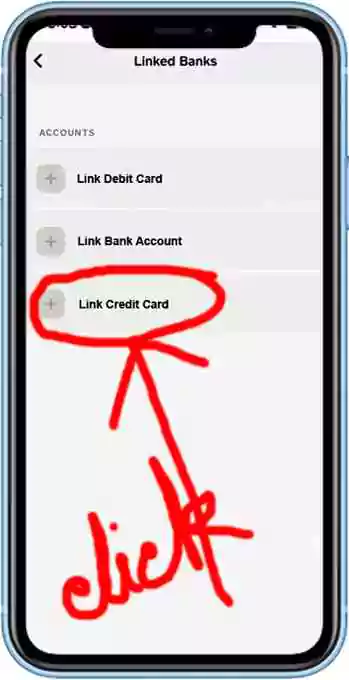

Step 3: Select Link Credit Card

In the “Linked Banks” section, you will see details of any bank accounts, debit cards, or credit cards already linked to your Cash App. Do not select the bank account option. Instead, scroll to the bottom and tap on “Link Credit Card.” As shown in the image below.

Step 4: Enter Credit Card Information

Once you tap on “Link Credit Card,” a new page will open where you will see information about any charges associated with using a credit card for payments. Below this information, you will be prompted to enter your credit card details, including the credit card number, expiration date, CVV, and billing ZIP code. Fill in all the required details. As shown in the image below.

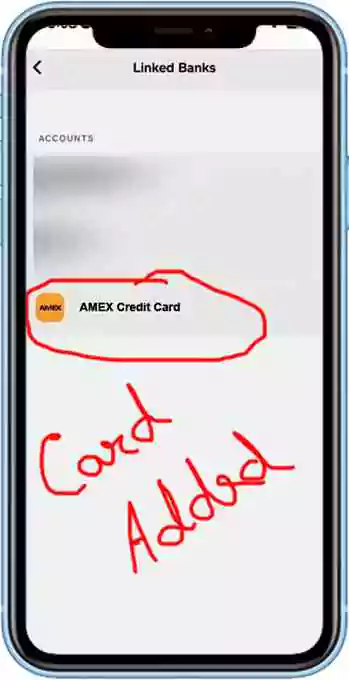

Step 5: Verify and Add Credit Card

After entering all the details, tap on “Add” to complete the process. Your credit card will be linked to your Cash App account without requiring a bank account. You can confirm this by checking the “Linked Banks” section where your credit card should now be listed. As shown in the image below.

Following these simple steps, you can easily add your credit card to Cash App without linking a bank account.

How to Add Credit Card to Cash App on iPhone?

If you want to add a credit card to the Cash App on your iPhone, the process is straightforward and follows the same general steps as adding it on an Android device. But, the interface and options on the iPhone might be slightly different.

How Much Can You Send on Cash App with a Credit Card?

Cash App imposes sending limits on transactions, including those made with a credit card. By default, you can send and receive up to $1,000 within any 30 days using Cash App. This means that your total transactions—whether they involve sending or receiving money—should not exceed $1,000 during a rolling 30-day period.

If you find that this limit is insufficient for your needs, Cash App provides an option to increase these limits. To do so, you’ll need to verify your identity by providing specific personal information. This information typically includes your full name, date of birth, and your Social Security Number (SSN).

The process of identity verification on the Cash App is straightforward. Once you’ve provided the necessary details and they have been verified by the app, you may receive higher transaction limits, allowing you to send and receive more money.

How Much Does Cash App Charge for Credit Card?

Cash App charges a standard fee of 3% for credit card payments. This fee is applied when you use your credit card to make transactions or send money through the app. It’s important to be aware of this fee when using a credit card on Cash App, as it will be added to the total amount of your transaction.

While Cash App itself doesn’t charge additional fees for adding or linking a credit card to your account, the 3% credit card fee is something to consider, especially if you’re making larger payments or cashing out to your credit card. Always review the transaction details and fees associated with your specific payment to have a clear understanding of the total cost.

Cash App Credit Card Sending Limit

The sending limit for Cash App depends on your account’s verification level. For unverified accounts, the weekly sending limit is $250. This means that you can send up to $250 per week using your Cash App account if it’s not verified.

If you have a verified Cash App account, the weekly sending limit increases significantly. Verified accounts can send up to $7,500 per week. This higher limit allows for more substantial transactions and greater flexibility when using Cash App to send money to friends and family.

Cash App Credit Card Cash Advance Limit

The cash advance limit for Cash App credit cards is determined by a set of transaction and usage limits. These limits are in place to ensure responsible usage and to maintain the security and integrity of the platform.

Here are the specific cash advance limits for Cash App credit cards:

- $7,000 per transaction

- $7,000 per day

- $10,000 per week

- $15,000 per month

These limits mean that you can initiate a cash advance transaction of up to $7,000 at one time, but you are also restricted by daily, weekly, and monthly limits. For example, if you max out your daily limit of $7,000, you won’t be able to initiate another cash advance transaction until the next day, when your daily limit resets.

How to Change the Credit Card on Cash App

If you need to change the credit card linked to your Cash App account, follow these steps:

- Open Cash App.

- Access your profile.

- Scroll down to “Payment Methods.”

- Remove the old card.

- Select “Add a Credit Card” and enter the new card details.

- After adding a new credit card, your credit card is changed

Cash App Doesn’t Have a Credit Card Option.

If you can’t see the credit card option in your Cash App, there’s no need to worry. This issue is likely related to a server problem or a temporary glitch in the app. To resolve this, you can try the following steps:

- Uninstall and Reinstall Cash App: Sometimes, reinstalling the Cash App can help resolve app-related issues. Uninstall the app from your device and then reinstall it from your device’s app store.

- Clear Cookies and Cache: As mentioned earlier, clearing cookies and cache can help refresh the app and may resolve issues related to missing options. You can do this by accessing your device’s settings, finding the Cash App, and clearing its data.

- Refresh the App: After reinstalling the app or clearing cookies and cache, open Cash App again. The credit card option should become visible.

If the issue persists even after trying these steps, you can contact Cash App support for further assistance. They can provide guidance and help resolve any technical issues you may be experiencing with the app.

Can We Add a Credit Karma Card to the Cash App?

There is no direct integration between Credit Karma and Cash App. Therefore, you cannot directly link your Credit Karma card to your Cash App account for transactions or transfers. Credit Karma primarily provides credit monitoring services and tools to help you manage your credit score and financial health, while Cash App is a peer-to-peer payment platform.

To add your Credit Karma card to Cash App, follow these steps:

- Open the Cash App on your device.

- Access your profile and navigate to “Payment Methods.”

- Select “Add a Credit Card” and enter the required card information, including the card number, expiration date, CVV (security code), and billing ZIP code.

- Verify the card by confirming a small charge, if prompted.

- Once the card is successfully added, you can use it for transactions and transfers on Cash App.

Can We Add an Apple Credit Card to the Cash App?

No, you cannot add an Apple Credit Card, specifically the Apple Card Mastercard, to Cash App for cash advances. This is because it goes against the terms and conditions set by Apple Card. The Apple Card is designed to be used for transactions and purchases, and cash advances or cash withdrawals are generally not allowed. Attempting to use your Apple Card for cash advances may result in errors, fees and penalties imposed by the card issuer. But you can transfer money from Cash App to Apple Pay by using some indirect methods.

Cash App Credit Card Customer Service Number

If you encounter issues with your Cash App credit card and need to reach out for customer support, you can do so by calling the Cash App customer service number at 1 (800) 969-1940. This contact number is a direct way to get in touch with Cash App’s customer service team, who can assist you with various concerns, including account-related questions, transaction issues, or any other inquiries you may have.

Conclusion.

Adding a credit card to Cash App without a bank account is possible and can offer several benefits, including convenience and the opportunity to maximize credit card rewards. By following the outlined steps, users can easily link their credit cards to the Cash App, making financial transactions more flexible. However, it’s important to be aware of the associated fees and limitations. For specific issues or further assistance, contacting Cash App customer support is recommended.

FAQs.

Is Cash App secure for credit card transactions?

Cash App employs security measures to protect your data, and credit card transactions are generally secure.

Can I use a prepaid credit card on Cash App?

Cash App may accept some prepaid credit cards, but it's essential to verify with the app whether your specific card is compatible.

Can I remove a credit card from Cash App?

Yes, you can remove a credit card from Cash App by accessing your payment methods in the app settings.

Are there any additional fees for using a credit card on Cash App?

Cash App does not charge fees for adding a credit card, but you may be subject to standard credit card fees, such as interest charges, according to your credit card provider's terms.

Thanks for your visit.

(Add Credit Card to Cash App without Bank Account?)

Disclaimer: The information provided in this article is for educational and informational purposes only. We do not endorse or recommend using specific financial products or services. Please visit the official Cash App website for the most accurate and personalized advice. Use Cash App and related services at your own risk.