Last updated on October 31st, 2024 at 02:08 pm

The Kabbage PPP loan forgiveness program helped small businesses during the COVID-19 pandemic by offering financial relief for payroll, rent, and utilities. Through this program, businesses that used the loan for approved expenses could apply to have it forgiven. While this program is no longer active now.1 In this article, we will explore how Kabbage managed PPP loan forgiveness, what happened after the program ended, and the steps borrowers should take now.

What Was PPP Loan Forgiveness?

PPP Loan Forgiveness was a part of the Paycheck Protection Program, designed to help businesses maintain their workforce during the COVID-19 pandemic. If businesses used the loan primarily for payroll, rent, and utilities, they could apply for forgiveness, meaning they wouldn’t need to repay the loan.

The key requirement was spending at least 60% on payroll expenses. After applying, borrowers awaited approval from the Small Business Administration. The program is now closed, but previously offered crucial financial relief. You can talk to Kabbage PPP loan customer support for more information

How did Kabbage PPP Loan Forgiveness work?

Kabbage PPP Loan Forgiveness worked by allowing businesses to apply for forgiveness of their Paycheck Protection Program (PPP) loans if they used the funds for eligible expenses, such as payroll, rent, and utilities, during a specified covered period.

- Loan Disbursement: After the loan was disbursed, businesses entered the Covered Period.

- End of Covered Period: Following this, they had up to 10 months before repayment deferment ended.

- Forgiveness Application: Businesses then submit their forgiveness applications to the SBA through their lender.

- SBA Decision: After the lender’s submission, the SBA had up to 90 days to decide on loan forgiveness.

This process ensured businesses could apply for loan forgiveness if they met the required conditions.

How Kabbage Processed PPP Loan Forgiveness

Kabbage, now KServicing, played an important role in processing PPP loans and their forgiveness. After distributing the loans, Kabbage provided a platform for businesses to apply for forgiveness. This process involved submitting forms to the SBA and showing proof of how the funds were used. Borrowers could access forms like SBA Form 3508 or 3508EZ through SBA’s website.

The End of PPP Loan Forgiveness Applications

PPP loans and forgiveness applications are no longer active since the program ended. If businesses did not apply for forgiveness by the deadline, they now have to repay their loans. KServicing no longer processes new applications for forgiveness. However, businesses that received loans should still check if their application status has been updated by contacting their loan servicer or the SBA.

Legal Issues with Kabbage and PPP Loans

Kabbage faced legal action after allegations arose that the company mishandled PPP loans. It was accused of approving loans for ineligible businesses. In 2023, Kabbage agreed to settle these allegations with the Department of Justice, resolving claims that it defrauded the PPP program.2 This impacted borrowers’ experience and caused delays in processing some forgiveness applications.

What Borrowers Should Do Now

If you took a PPP loan from Kabbage and haven’t resolved your forgiveness or repayment issues, you should contact your current loan servicer. For loans transferred to other servicers in April 2023, borrowers can reach out to the SBA at lrsc.servicing@sba.gov to confirm their new servicer.3 Make sure to resolve any remaining payments or forgiveness issues by contacting your loan servicer.

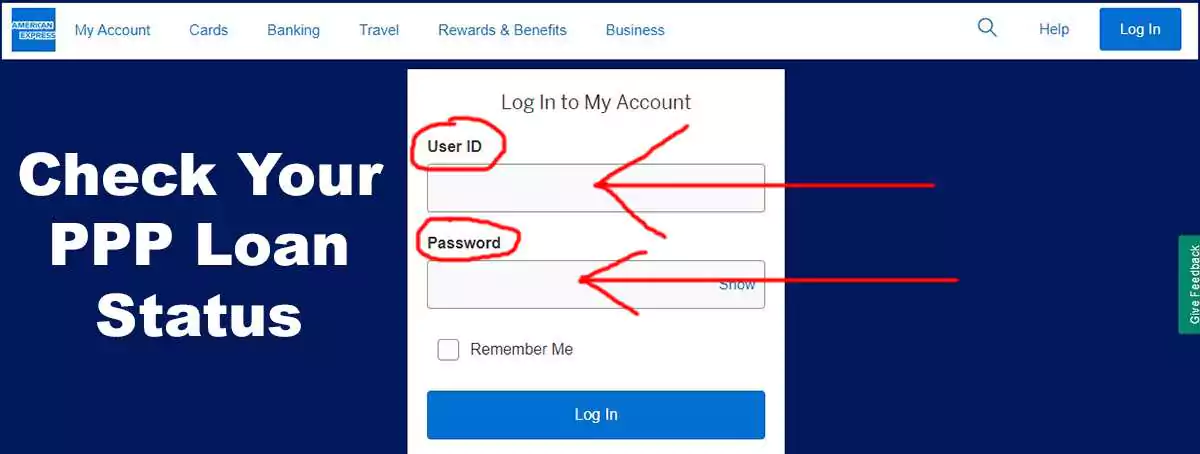

Check Your PPP Loan Status

The SBA is no longer accepting new PPP loan applications. However, if you received a PPP loan through Kabbage, you can still check your loan status or track forgiveness progress by signing into your American Express dashboard. This platform will provide updates on your loan and any remaining steps for forgiveness or repayment.

Kabbage was acquired by American Express,4 and most of the loans previously provided by Kabbage are now managed through the American Express dashboard. To access your loan account, simply open the dashboard and log in with your user ID and password. From there, you can view all the necessary information about your loan. If you face any issues or have questions, you can contact American Express customer support for assistance through their helpline.

Conclusion

The Kabbage PPP loan forgiveness program provided critical financial relief to small businesses during the COVID-19 pandemic. Though the program has ended, borrowers must stay proactive by checking their loan status and ensuring any remaining forgiveness or repayment steps are addressed. The transition of loans to American Express and ongoing legal concerns highlight the importance of keeping up-to-date with loan servicing updates.

FAQs

What if my PPP loan wasn’t forgiven?

You need to contact your loan servicer to discuss repayment options.

What happened with Kabbage and the PPP program?

Kabbage faced legal challenges due to allegations of mishandling PPP loans, resulting in a settlement with the Department of Justice.

Who should I contact for Kabbage loan issues now?

You should contact your new loan servicer, which was assigned by the SBA.

Is Kabbage still servicing PPP loans?

No, Kabbage transferred its PPP loan servicing duties to other providers in 2023.

Thanks for your visit.

(Kabbage PPP Loan Forgiveness:)

Disclaimer: This article is for informational purposes only and does not constitute legal advice. We are not affiliated with Kabbage Inc., KServicing, American Express, or any companies mentioned in this article. Readers are advised to consult with their financial institutions or loan servicers for specific guidance. The information provided here is based on publicly available sources and may change over time.

- Reference [↩]

- Office of Public Affairs [↩]

- Kservicing [↩]

- CNBC [↩]