If you work in a government job or a non-profit organization, you might be eligible for a program called the PSLF (Public Service Loan Forgiveness). This program helps forgive some or all of your student loans after you make 120 qualifying payments. In this article, we will explain what PSLF Student Loans Forgiveness is, who can apply, the steps you need to take, and other important details to help you understand how to benefit from this program.

PSLF Student Loan Forgiveness is a federal program in which some loan amounts are forgiven. It is quite famous in the USA. Those who work in public service. Public service means working in government agencies and non-profit organizations but the work should be of public service only.

People who do this work have the PSLF Student Loan Forgiveness Program for their children’s education. We have given more information about this in our article below.

There is no deadline for PSLF student loan forgiveness. This process has been going on for a long time and is still going on. But its applications stop for some time and it is not possible to tell you about the article.

Because the date that is now is different after some time the date will change. Therefore, for more information, you will have to talk to its office or visit its official website.

How to check PSLF student loan forgiveness status.

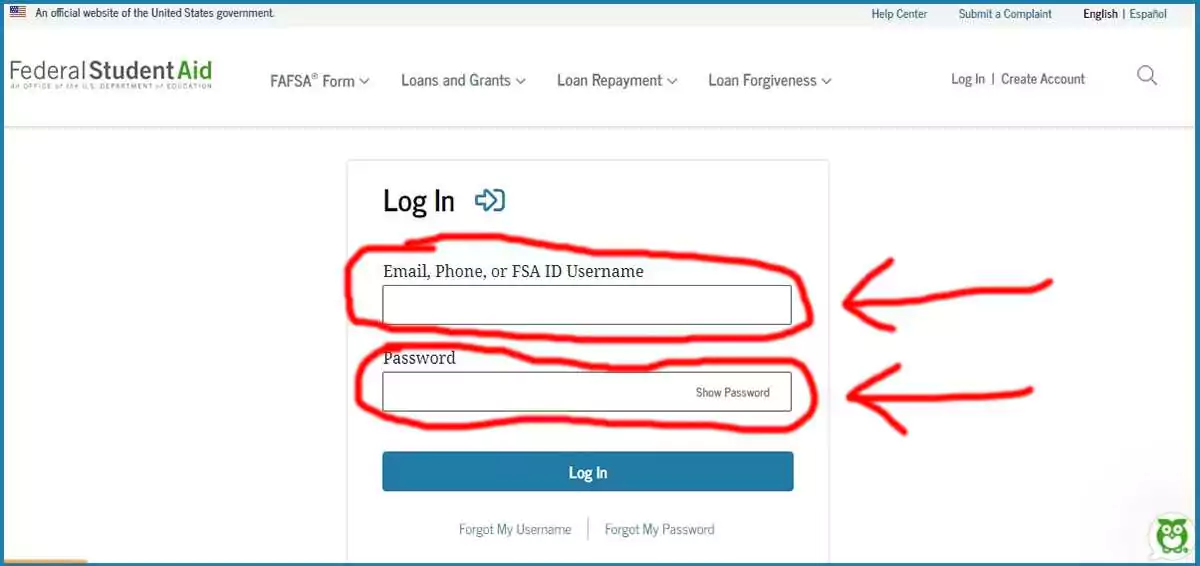

To check the status of your PSLF application, you first need to visit StudentAid and log in using your email, phone, or FSA User ID and password.

Once logged in, you’ll be able to see all the details related to your PSLF application. This includes any actions that have been completed and what steps are still pending.

The system will show whether your forms have been submitted and processed. If there are any missing forms or if something needs your attention, you’ll get an email notification from them. By logging in, you can track your application’s progress, see what has been done, and understand what remains before your loan forgiveness can be approved. It’s a great way to stay updated without calling or waiting for other communication.

How many student loans have been forgiven under PSLF?

In 2023, over 720,000 public servants have had their federal student loans forgiven through the PSLF program, thanks to significant changes made under the Biden-Harris Administration. The data for 2024 will be available after a few months, which we will update in the coming time.2

Initially, only 7,000 borrowers had received forgiveness since the program began 16 years ago, but recent improvements have made it much easier for public servants to qualify. On average, borrowers have received nearly $70,000 in relief, transforming their financial futures and allowing many to pursue major life goals like buying homes or starting families.

PSLF student loan forgiveness mohela.

PSLF program is a federal program that forgives the remaining balance on Direct Loans for borrowers who have made 120 qualifying payments while working full-time for certain public service employers.

Mohela is one of the loan servicers that service Direct Loans and borrowers who have Direct loans serviced by Mohela are eligible for the PSLF program. To qualify for loan forgiveness, the borrower must make 120 on-time, full, scheduled payments on their Direct Loans while working in a public service job and submit an Employment Certification Form (ECF) to Mohela to confirm their employment in a public service job and their loan payments.

Once the borrower has made 120 qualifying payments and submitted the necessary forms, they can apply for loan forgiveness and Mohela will process the application. It’s important to stay in contact with Mohela and keep them informed of any changes in employment or other relevant information.

PSLF student loan forgiveness is taxable.

According to the Internal Revenue Service, the forgiven amount under the PSLF program is not considered taxable income.3This means that borrowers will not have to pay taxes on the amount that is forgiven under the program. This is in contrast to other loan forgiveness programs, such as Income-Driven Repayment plans, where the forgiven amount may be considered taxable income.

It’s important to note that the laws and regulations related to taxes are subject to change and that the information provided here is based on current tax laws at the time of my knowledge cutoff (2024).

Does PSLF forgive all loans?

No PSLF does not forgive all loans. It is only available for Direct Loans, not for other types of federal student loans such as Stafford loans or Parent PLUS loans. Additionally, the borrower must be working in a qualifying public service job, such as a government agency, non-profit organization, or certain types of military service.

Therefore, PSLF forgives only Direct loans and only if the borrower meets the above criteria. It’s important to note that the program has been revised over time and the criteria for loan forgiveness may change in the future.

Why do people get rejected for PSLF?

People can be rejected for the PSLF program for many reasons. Some are as follows.

- Not having Direct Loans: The PSLF program is only available for Direct Loans, so borrowers with other types of federal student loans, such as Stafford loans or Parent PLUS loans, will not be eligible.

- Not working in a qualifying public service job: If the borrower is not working in any public service jobs, they will not be eligible for loan forgiveness under the program.

- Not making qualifying payments: To qualify for loan forgiveness, the borrower must make 120 on-time, full, scheduled payments on their Direct Loans while working in a public service job and under certain repayment plans such as Standard Repayment Plan, Graduated Repayment Plan or the Extended Repayment Plan.

- Not submitting the Employment Certification Form (ECF): The borrower must submit an ECF annually or when they change employers to confirm their employment in a public service job.

- Not meeting updated criteria: The program has been revised over time, and criteria for loan forgiveness may have changed, therefore some borrowers who initially applied for loan forgiveness may no longer meet the updated criteria for the program.

- Insufficient funds: The program is dependent on the budget allocated by the government for the program each year, if the budget is low, the number of loans that can be forgiven will also be low.

Do you need to consolidate my student loans for PSLF?

Yes, you might need to consolidate your student loans for PSLF, but it depends on the type of loans you have. Only Direct Loans qualify for PSLF. If you’ve taken out loans like FFEL or Perkins Loans, you’ll need to consolidate them into a Direct Consolidation Loan to be eligible.

But don’t worry—if you already have Direct Loans, you don’t need to do anything extra! Just make sure to check what type of loans you have, and if consolidation is needed, it’s a simple step that brings you closer to loan forgiveness.

Conclusion:

The PSLF Student Loan Forgiveness program offers significant relief to individuals working in public service roles by forgiving the remaining balance of their student loans after 120 qualifying payments. Although the process can be complex and the criteria strict, it provides a much-needed opportunity for public servants to achieve financial freedom. Always stay updated on changes in the program and seek expert advice to ensure you meet the eligibility requirements for loan forgiveness.

Faq’s

Do private student loans qualify for PSLF?

No, private student loans do not qualify for Public Service Loan Forgiveness (PSLF). Only federal Direct Loans are eligible.

Does PSLF forgive graduate student loans?

Yes, PSLF forgives graduate student loans, as long as they are federal Direct Loans and you meet the program’s other requirements, such as making 120 qualifying payments while working for a qualifying employer.

How much is forgiven with PSLF?

With PSLF, the entire remaining balance of your federal Direct Loans is forgiven after you make 120 qualifying payments. There is no cap on the amount that can be forgiven, so it could be thousands or even tens of thousands of dollars, depending on your loan balance.

Are parent plus loans eligible for PSLF?

Yes, Parent PLUS Loans are eligible for PSLF, but only if they are consolidated into a Direct Consolidation Loan and repaid under an income-driven repayment plan.

Thanks for your visit.

(PSLF Student Loans Forgiveness Program)

Disclaimer: The information provided in this article about the PSLF program is for informational purposes only and should not be considered legal advice. The PSLF program is subject to change by federal regulations, and eligibility requirements may vary. We strongly recommend checking the official U.S. Department of Education website for the most up-to-date information before making any decisions.