Last updated on February 25th, 2025 at 04:48 pm

In the complex landscape of business administration in the United States, the Employer Identification Number stands as a vital identifier for businesses. But what if you need to locate your EIN without access to the W2 form? This comprehensive guide will tell you the best methods to find employer identification number without W2.

If an employee has a W2 form available, then he can easily get his Employer Identification Number because there are many details of the employee on the W2 form. You can even find your tax liability on your W2. But sometimes w2 form is not available to the employee. So in such a situation, he has to face a big problem.

Understanding the Employer Identification Number in the USA

Table of Contents

ToggleAn Employer Identification Number is a unique nine-digit number issued by the IRS in the United States. It serves as a means of identification for tax purposes, specifically for businesses and entities that are required to file tax returns. While primarily associated with employers, the EIN is also utilized by certain other entities that do not have employees but are subject to tax obligations.

Essentially, the EIN helps the IRS track and manage tax accounts related to business entities, facilitating the filing of various business tax returns.1

What is an Employer Identification Number Used For?

The main use of an Employer Identification Number is to do tax-related work like filing tax refunds or depositing tax etc. Apart from this, there are some other uses of EIN which we have written below.

- Opening business bank accounts

- Applying for business licenses and permits

- If there is an EIN, the tax refund amount shows in the bank account quickly.

- Hiring employees and reporting payroll taxes

- Conducting business transactions with vendors and clients

- To take a personal loan against income tax return.

How Do I Get an Employer Identification Number?

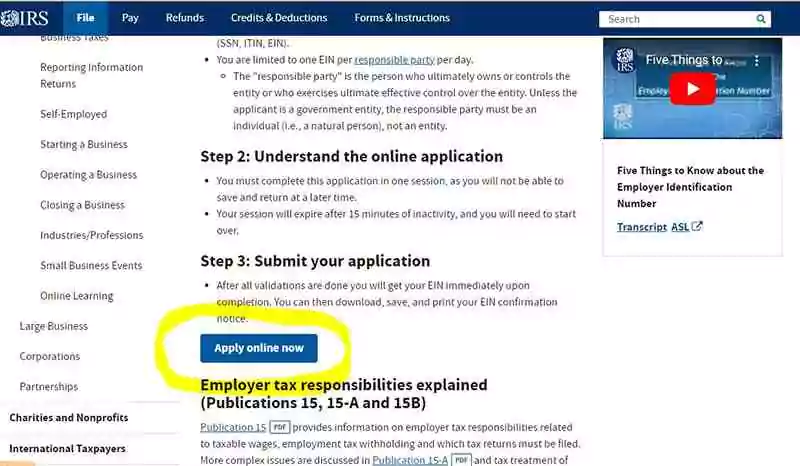

To get an Employer Identification Number, you have to apply online through the official website of the IRS. Before applying, you have to check your eligibility criteria carefully on the official website of the IRS and then apply online.

We have explained the complete process of applying online step by step below.

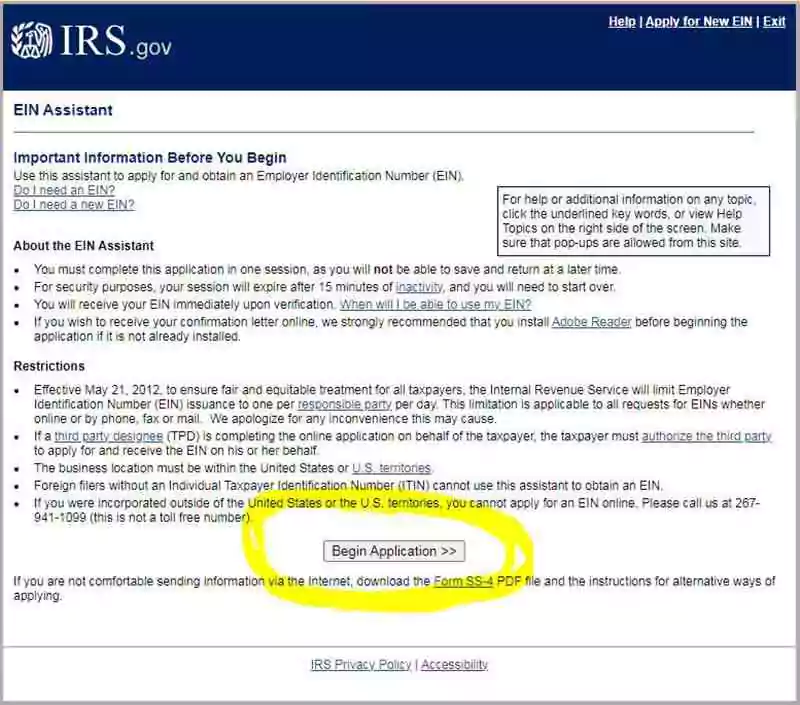

Step-1 First of all you have to open the official website of the IRS. As soon as you open the official IRS website, you will get the option of “Apply for Employer Identification Number”, you have to click on it. As soon as you click on it, a new page will open in which the button “Apply Online Now” will appear, you have to click on it. As shown in the photo below.

Step-2 In the next step, as soon as you click on “Apply Online Now“, another new page will open in front of you in which you will be given a lot of information about the EIN. There will also be detailed information given about which people will not get EIN, which you have to read and understand carefully.

After that below you will see the button “Begin Application”, you have to click on it. As shown in the photo below.

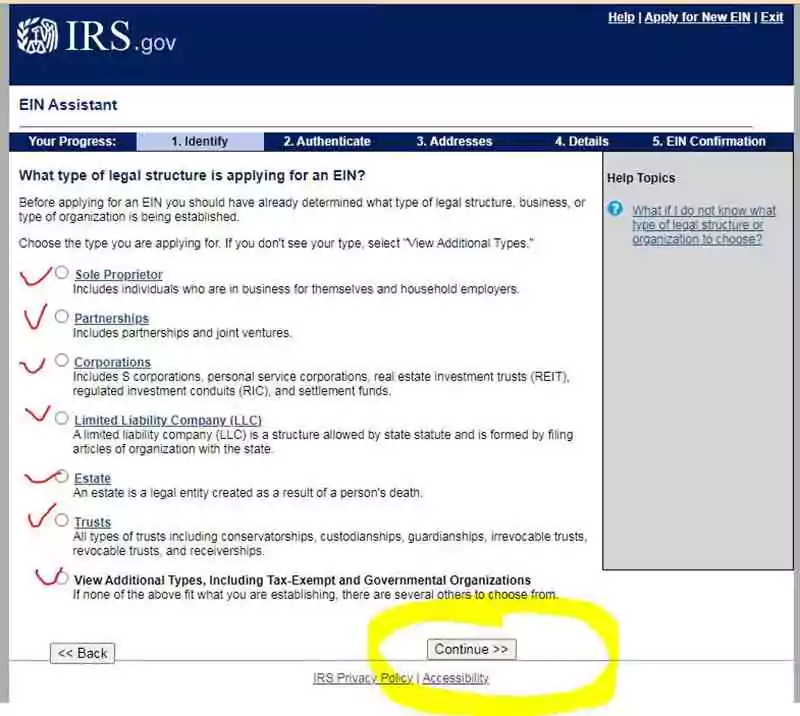

Step-3 After that in the next step, as soon as you click on “Begin Application“, another new page will open in front of you in which you will have to choose the type of your business. You will get many options in it, after seeing the right option you have to click on Continue.

As shown in the photo below.

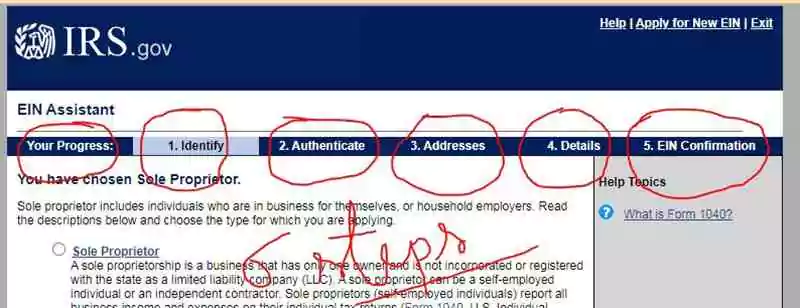

Step-4 In the next step, as soon as you click on “Continue“, another new page will open in front of you in which you will be asked about your identity. You will have to fill in the details about your identity and click on “Next” again. After that, the next option of Authenticate will open, in which after you do the authentication, the next step will open again.

In this way, you have to complete 6 steps one after the other in which the first step is “Your Progress“, the second step is “Identity“, the third step is “Authenticate“, the fourth step is “Address“, the fifth step is “Details” and sixth step is “EIN Confirmation“. In this way, you will see 6 steps.

As shown in the photo below.

After completing all these 6 steps, your EIN application will be confirmed and you will receive the EIN in the next day or two. In this way, you can get EIN very easily. If you apply offline, it takes about a week to receive it.

Ways to Find Employer Identification Number

If you’ve misplaced your EIN or need to find it without a W2 form, there are several alternative methods you can try:

- Check on the W2 form.

- Check previous tax returns or correspondence from the IRS.

- Look at business licenses, permits, or loan applications.

- Contact your bank or financial institution, as they may have your EIN on file.

- Call the IRS Business and Specialty Tax Line at 800-829-4933 for assistance.

How to find employer identification number without W2?

If you need to locate your Employer Identification Number without access to your W2 form, there are several methods you can try:

- Review Business Documentation: Check any business licenses, permits, or loan applications associated with your employer. Often, the EIN is included in such documentation.

- Contact Financial Institutions: Reach out to your bank or financial institution where your employer conducts business. They may have records containing the EIN.

- IRS Business and Specialty Tax Line: You can call the IRS Business and Specialty Tax Line at 800-829-4933 for assistance. Be prepared to provide relevant information to verify your identity and relationship with the employer.

- Directly Contact Employer: Consider reaching out directly to your employer, particularly the accounting department or HR, to inquire about the EIN. They should be able to provide this information upon request.

- State’s Corporation Database: Some states publish EIN information in their corporation databases. You can search these databases online to find the EIN associated with your employer.

By utilizing these methods, you should be able to locate your employer’s EIN even without access to your W2 form.

How Do I Verify My EIN in the USA?

To verify your Employer Identification Number in the USA, you have a few options. The IRS issues your EIN when you register your business, and it’s important to know how to confirm it if needed. You can check your EIN through documents, online services, or by directly contacting the IRS.

Here are some simple ways to verify it:

- Look at IRS Documents: Check the confirmation letter (CP 575) the IRS sent when your EIN was issued.

- Contact the IRS: Call the IRS Business Line at 1-800-829-4933 to verify your EIN after confirming your identity.

- Check Tax Filings: Look at your past tax returns, payroll forms, or any other tax-related documents where your EIN might be listed.

- Review Business Bank Records: Your business bank account or payroll records may have your EIN listed.

Is the Employer Identification Number the Same as the Tax ID?

Yes, in some countries, the Employer Identification Number is referred to as the Tax Identification Number or Tax ID. However, in the United States, it is commonly known as the EIN (Employer Identification Number). Although these terms may vary from country to country, their meaning remains the same, and they serve the same purpose.

Conclusion:

Finding your Employer Identification Number (EIN) without a W2 form can be crucial, especially during tax season. By exploring various methods outlined in this article, you can locate your EIN efficiently. Remember to verify the accuracy of your EIN and seek professional assistance if needed.

FAQs:

Can I apply for an EIN online?

Yes, you can apply for an EIN online through the IRS website for free.

What if I can’t find my EIN?

If you've misplaced your EIN, you can try contacting the IRS for assistance or check any official documents like W2 or correspondence you may have received from them.

Is an EIN necessary for all businesses?

While not all businesses are required to have an EIN, it's generally recommended for most business entities, as it simplifies tax and financial transactions.

How long does it take to receive an EIN after applying?

If you apply for an EIN online, you will receive it immediately upon completion of the application. Other methods, such as applying by mail or phone, may take longer.

Can I apply for an EIN if I am not a U.S. citizen?

Yes, non-U.S. citizens can apply for an EIN if they are starting a business in the United States. However, additional documentation may be required.

Thanks for your visit.

(How to find employer identification number without W2?)

Disclaimer: The information provided in the article is for general informational purposes only and should not be considered legal advice. Readers are advised to consult with a qualified professional for any specific concerns or questions regarding their Employer Identification Number (EIN) or tax-related matters.