Klarna is a popular Pay Later Financing service that allows users to make purchases and pay for them over time through automatic payments, known as autopay. While this feature is convenient for many, some users may prefer to turn off autopay on Klarna. However, Klarna doesn’t offer a direct option to disable autopay until the full payment for the purchased item is made.

Despite this limitation, there are several methods you can use to turn off autopay on Klarna. Remember, even after turning off autopay, you still need to pay the remaining balance, either through another bank account or manual payments.

Why Some Users Might Want to Turn Off Autopay

Autopay is a kind of auto debit in which the amount is automatically deducted from your bank account or debit card at the time of the next EMI. Some people feel tension that when the time comes, they will have to put the amount in their bank account or debit card. That is the only reason most people want to turn off autopay on Klarna and want to make the payment manually.

However, apart from this, there are many other reasons due to which people want to turn off Klarna Autopay, which we have explained in detail below.

- Avoiding Overdraft Fees: If you don’t maintain enough balance in your bank account, autopay might cause overdraft fees.

- Financial Control: Some users prefer to manage payments manually to ensure they only pay when they are ready.

- Switching Payment Methods: You might want to change the payment method linked to your Klarna account.

- Change Payment Method: Some people no longer want to use the bank account or debit card they used to purchase Klarna and want to add a different payment method. In such a case too, they will need to turn off AutoPay from their old bank account or debit card.

- Item purchased for another person: Some people turn off Klarna Auto Pay because the item they purchased using Klarna was purchased for someone else. That person will make the manual payment every month.

Can You Turn Off Autopay on Klarna?

Officially, Klarna does not allow you to turn off autopay until the full price of the purchased item is paid. The amount will continue to be deducted from your bank account until the balance is cleared. However, there are a few workarounds you can use to effectively disable autopay while ensuring you stay on top of your payments.

How to Turn Off Autopay on Klarna?

If you’ve purchased using Klarna and set up the remaining installments on autopay, you can’t directly turn it off until the full amount is paid. However, there are several indirect methods you can use to disable autopay while managing your payments effectively:

Method 1: Make Manual Payment in Advance

One way to turn off Klarna’s autopay is to make manual payments in advance. By paying off your installments ahead of time, you ensure that there is no automatic deduction from your bank account. This method allows you to maintain control over your payments.

Steps to Follow:

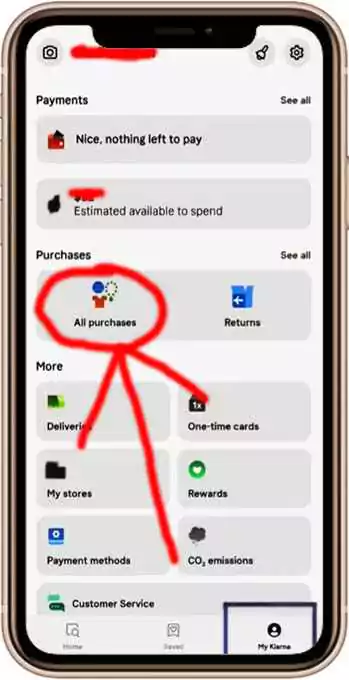

Step 1 – Open the Klarna App:

First of all, you have to open the Klarna app on your mobile and click on the “My Klarna” button so that you can see all the options of the Klarna app. In all these options, you will see an option “All Purchases“. In this option, you will see all the items that you have purchased and all the items whose EMI is pending will also be visible. So, you have to click on this option. As shown in the photo below.

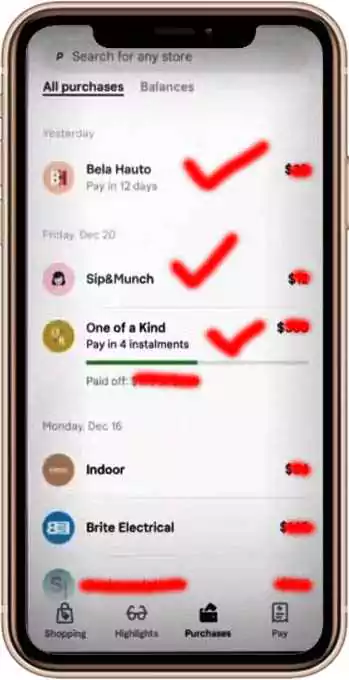

Step 2 – Navigate to Payments:

As soon as you click on “All Purchases”, you will see all the items that you have purchased and whose EMI is pending. You have to select the item for which you want to pay in advance EMI manually and click on it. As shown in the photo below

Step 3 – Select the Order:

As soon as you click on the item for which you have to make payment in advance, its complete details will be displayed in front of you. How much is the amount, how many days it was going to be auto-debited, how many installments remain, and along with this, you will see a “Pay” button at the bottom left side. You have to click on it. As shown in the photo below.

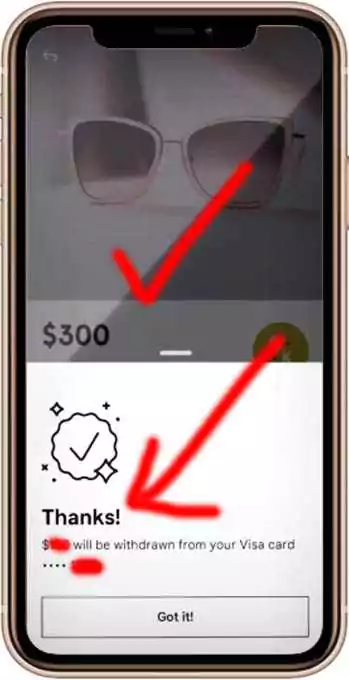

Step 4 – Make the Payment:

As soon as you click on “Pay”, the EMI amount from the payment method you have currently added on Klarna will be debited in a single click. Your upcoming EMI will be credited in advance and a text ‘Thank You’ will appear on it. Now this EMI will not be auto-debited from any of your payment methods. As shown in the photo below.

Important Note: This method of turning off autopay in the Klarna app is quite popular. But remember that the terms and conditions of Klarna are different for each country. So, check whether this method will work in your country or not by calling the Klarna helpline number and then following the steps.

Method 2: Contact Your Bank

Another effective method is to contact your bank and request them to revoke the authorization for Klarna to automatically deduct payments from your account. This method can stop Klarna from pulling funds directly from your bank account. But for this, you may have to complete some legal formalities, only then the bank will take these steps for you

Steps to Follow:

If you want to stop Klarna from automatically taking payments from your bank account, here’s a simple way to do it by contacting your bank:

- Reach Out to Your Bank: Start by calling or writing to your bank or credit union. Let them know you want to cancel Klarna’s permission to take payments automatically from your account. Use the phrase “revoked authorization” when you talk to them so they understand exactly what you need.

- Follow Up with a Written Request: Your bank might ask for a written request to make this official. Some banks offer an online form for this, while others might need a letter. Make sure to complete this step as per your bank’s guidelines.

- Use a Stop Payment Order if Needed: If you haven’t canceled the authorization with Klarna directly, you can still block future payments by asking your bank to issue a “stop payment order.” This will stop Klarna from withdrawing money from your account. Just be aware that most banks charge a small fee for this service.

By following these steps, you can successfully turn off autopay for Klarna and take control of your payments.

(( Reference: The information provided is based on guidelines from the Consumer Financial Protection Bureau’s website. ))

Method 3: Pause Billing by Reporting a Problem in the Klarna App

If you’ve returned an item after making the first installment payment, you can pause the billing process by reporting a problem with the order in the Klarna app. This method is particularly useful if you are concerned about further payments being deducted for an item you no longer possess.

Steps to Follow:

- Open the Klarna App: Log in and go to the “Payments” section.

- Select the Problematic Order: Find the order for the returned item.

- Click “Report a Problem”: Choose the option to report a problem with the order.

- Pause Billing: Follow the prompts to pause billing for this specific order.

Important Note: This method works only for those people who have purchased any item and enabled auto pay but are returning that item. In such a case, their auto-pay will also have to be turned off or else their payment may be auto-debited next month.

Method 4: Call and Write to Klarna

You can also contact Klarna directly to request that they stop the automatic payments. This method involves both a phone call and a written communication to ensure your request is recorded.

Steps to Follow:

- Call Klarna Customer Service: Use the contact number provided on Klarna’s website to speak with a representative.

- Request to Stop Autopay: Clearly explain that you want to stop autopay for your current orders.

- Follow Up with Written Communication: Send an email or letter confirming your request to ensure there’s a record of your communication.

In this way, you can talk to them and tell them about your problem and turn off autopay on Klarna. Instead, they will tell you about other payment methods and you have to tell them how you want to make the payment.

Conclusion

Managing your Klarna payments can be essential for maintaining financial control and avoiding unnecessary fees. While Klarna does not offer a straightforward way to disable autopay, the methods outlined in this article provide practical solutions for users looking to turn off autopay.

Whether you choose to make manual payments in advance, contact your bank, pause billing for returned items, or communicate directly with Klarna, these strategies can help you manage your payments more effectively. Always remember to stay informed about the specific terms and conditions that apply in your region to ensure a smooth payment experience.

Faq’s

Can I Turn Autopay Back On After Disabling It?

Yes, you can easily re-enable autopay at any time through the Klarna app or website. But it also depends on your method, if you turn off autopay by depositing the payment of the upcoming EMI in advance, then autopay will be turned on automatically on the next EMI.

What Happens If I Forget to Make a Payment After Disabling Autopay on Klarna?

If you have turned off Klarna autopay and have not made manual payment, your EMI will not be paid on time, which may lead to you being declared a default and you may face problems in using the Klarna app in future. Apart from this, you can also deposit the remaining amount with the next EMI, but for this, you will have to pay some extra fee.

Does turning off autopay affect my Klarna account?

Turning off autopay does not negatively affect your Klarna account, but it does mean you need to be more careful to make your payments on time. If you miss a payment, it could limit your ability to use Klarna in the future.

Can I use a different payment method after turning off autopay on Klarna?

Yes, after turning off autopay, you can select a different payment method for your Klarna payments. You can update this in the payment options for your order.

Thanks for your visit.

(How to turn off autopay on Klarna?)

Disclaimer: The information provided in this article is for informational purposes only and is based on general knowledge at the time of writing. Klarna’s policies and procedures may vary by country and change over time. We recommend contacting Klarna directly or consulting their official resources to ensure the accuracy and applicability of the methods described. We are not responsible for any actions taken based on the information provided in this article.