The Cash App Card is a convenient and versatile financial tool that offers users easy access to their Cash App balance. In this guide, we will explore what is a Cash App Card, its benefits, how to get one, and other important details you need to know.

However, there are several methods by which money can be transferred from Cash App to Apple Pay and other similar platforms without a Cash App card. But there is no charge for transferring money using the Cash App card and the money is transferred instantly. This is the reason why most Cash App users prefer to get a Cash App card and want complete information about it. Before getting a Cash App card, you must know what is a Cash App card and how it works.

What is a Cash App Card?

A Cash App Card is a customizable debit card linked directly to your Cash App balance. It allows you to spend your Cash App funds anywhere Visa is accepted, both online and in physical stores.

What Exactly is a Cash App Card?

A Cash App Card is a special card that lets you use the money in your Cash App account to buy things and take out cash. It works like a debit card and is connected directly to your Cash App balance. You can use the Cash App Card to make purchases in stores or online, just like a regular debit card. You can also use it to withdraw cash from ATMs.

One cool feature is that you can customize your Cash App Card with your own design or signature, making it unique to you. This card makes it easy to spend your Cash App money without needing a traditional bank account.

How does a Cash App card work?

A Cash App card works like a regular debit card and can be used in several ways:

In-Store Payments:

- Swipe or Tap: When you pay at a store, you swipe or tap your Cash App card.

- Authorization: The store’s payment system checks with Cash App to see if you have enough money.

- Approval: If you have enough money, the payment goes through, and the money is taken out of your Cash App balance.

- Receipt: You get a receipt, and the store gets paid.

Online Transactions:

- Enter Card Details: When you buy something online, you enter your Cash App card number, expiration date, and CVV code.

- Verification: The online store checks with Cash App to make sure you have enough money.

- Approval: If everything is okay, the payment is approved, and the money is taken out of your Cash App balance.

- Confirmation: You get a confirmation email or message, and the store gets paid.

ATM Withdrawals:

- Insert Card: At the ATM, insert your Cash App card.

- Enter PIN: Enter your Cash App card PIN.

- Select Amount: Choose how much money you want to withdraw.

- Withdraw Cash: The ATM gives you the cash, and the amount is taken out of your Cash App balance.

Balance Check:

- Open App: Open the Cash App on your phone.

- View Balance: Your balance is shown on the main screen.

- Use Card: You can use your Cash App card as long as there is enough money in your Cash App balance.

Adding Money:

- Open App: Open the Cash App on your phone.

- Add Funds: Tap on “Add Cash” and enter the amount.

- Confirm: Confirm the amount, and the money is added to your Cash App balance from your linked bank account.

Sending Money:

- Open App: Open the Cash App on your phone.

- Send Money: Tap on “Pay,” enter the amount, and choose the person to send money to.

- Confirm: Confirm the payment and the money is sent from your Cash App balance.

In all these processes, the Cash App card uses the money from your Cash App balance to complete transactions.

Is Cash App Card accepted everywhere?

No, the Cash App card is not accepted everywhere. Here’s where it works and where it might not:

Accepted:

- Stores and Restaurants: Most places that accept Visa debit cards will accept the Cash App card. You can swipe or tap your card at these locations.

- Online Shopping: You can use your Cash App card to make purchases on websites that accept Visa cards. Just enter your card details like any other debit card.

- ATMs: You can withdraw cash from ATMs that accept Visa cards. Note that some ATMs might charge a fee.

Not Accepted:

- International Locations: The Cash App card is generally for use within the United States. Some international locations might not accept it.

- Certain Merchants: Some businesses or online stores may not accept prepaid or debit cards like the Cash App card.

- Restricted Purchases: Certain types of transactions, such as those with age restrictions (like alcohol or gambling), might not accept the Cash App card.

Always check with the merchant or the website to see if they accept Visa debit cards before relying on your Cash App card for payment.

Is a Cash App Card a debit card?

Yes, the Cash App Card is a type of debit card that allows you to spend the funds in your Cash App account. It functions like a Visa debit card, meaning you can use it anywhere Visa is accepted, including online shopping, in-store purchases, and ATM withdrawals. The card is directly linked to your Cash App balance, enabling easy and convenient access to your funds.

Difference between a debit card and a Cash App card

The main difference between a debit card and a Cash App Card lies in their connection to funds and issuing authorities. A debit card is linked directly to a bank account, allowing transactions to withdraw funds from that account, and is issued by traditional banks or financial institutions.

In contrast, the Cash App Card is linked to the balance in your Cash App account and is issued by Cash App, a financial services platform. While both cards function similarly for transactions and can be used wherever Visa is accepted, the Cash App Card is funded by money in your Cash App account, which you need to transfer or receive into the app.

Is a Cash App Card considered prepaid?

No, the Cash App Card is not a prepaid card. It is a debit card that draws funds directly from your Cash App balance.

Is Cash App Card FDIC-insured?

Yes, the Cash App Card is FDIC-insured. The funds in your Cash App account are protected through Cash App’s partner banks, Wells Fargo Bank, N.A., and Sutton Bank, which are both members of the FDIC. This insurance coverage ensures that your funds are protected up to $250,000 per person.

It’s important to note that Sutton Bank issues the prepaid debit cards associated with Cash App. Therefore, your money is safe and insured, providing an extra layer of security for your Cash App funds.1

Benefits of using Cash App Card

- Convenience: Easy access to your funds without needing a bank account.

- Security: Built-in security features like instant card lock and transaction notifications.

- Customizable: You can design your own card.

- Rewards: Cash App offers occasional rewards and discounts for using the card.

- Instant payments: instant payments to other Cash App users.

- ATM withdrawals: You can withdraw amounts from ATMs.

The New Cash App Glitter Card.

The New Cash App Glitter Card is a customized version of the Cash App debit card, designed to stand out with a sparkling, glittery finish. Just like the regular Cash App card, it is linked to your Cash App account and can be used for purchases wherever Visa is accepted.

The glitter design adds a fun, personalized touch to the card while offering the same features, such as instant discounts with Boosts, ATM withdrawals, and the ability to spend your Cash App balance directly.

How to Get a Cash App Card?

If you have a verified Cash App account and want to get a Cash App card, follow these simple steps:

Step 1: First, open the Cash App on your mobile phone. This process is the same whether you use an Android or Apple phone. After opening Cash App, you will see a Cash App card icon at the bottom of the screen. Click on that icon, as shown in the photo below.

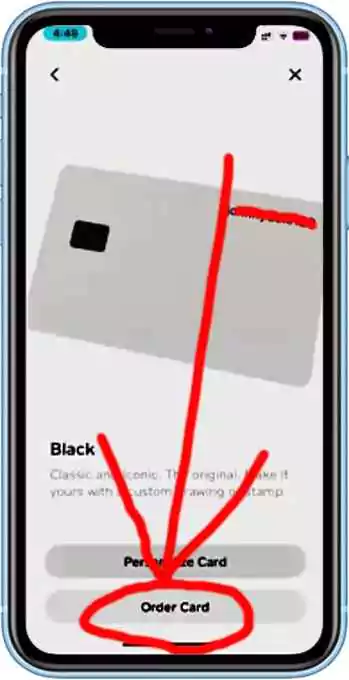

Step 2: When you click on the Cash App card icon, a new page will open. You will see a button to order a Cash App card. If you already have a Cash App card, it will show your existing card here. If you do not have a card yet, you will see an option to order a card. Click on the “Order Card” option, as shown in the photo below.

Step 3: After clicking on “Order Card,” you will see different styles of Cash App cards. You can choose the design you like. A simple Cash App card is free, but other designs might have different charges. Select the design you want and click on it, as shown in the photo below.

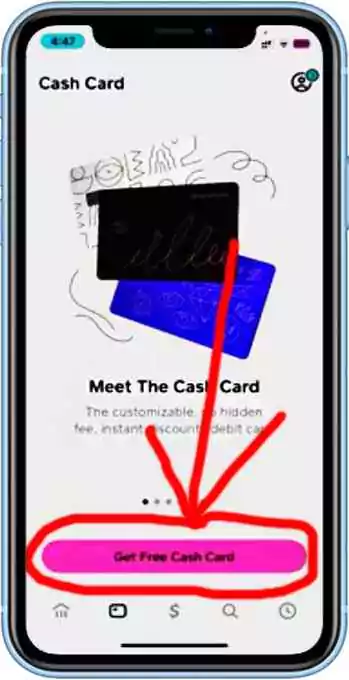

Step 4: Once you select your design, a new page will open with the “Get Free Cash Card” option. Check everything carefully and click on “Get Free Cash Card.” Your Cash App card will be ordered. You will receive your card in a few days. As shown in the photo below.

So in this way, you can get a Cash App card by following four simple steps. As soon as you order successfully, by post the Cash App card arrives at your home within a few days. The Cash App card is also received in the mail within a few days before it is delivered to your home.

How to order a new Cash App Card before it expires?

To order a new Cash App card before it expires, open your Cash App, navigate to the “Cash Card” tab, and select the option to order a replacement card. Cash App generally notifies you when your card is nearing expiration, but you can proactively request a new one if you notice the expiration date is approaching.

After confirming your details, Cash App will issue the replacement card and mail it to the address on file. Replacement requests often involve a small fee, so check for any charges before finalizing your order.

Limits of a Cash App Card:

The Cash App card has several limits for different types of transactions. Here’s a detailed breakdown of the limits:

Transaction Limits

- Per Transaction: The maximum you can spend per transaction is $7,000.

- Daily Limit: You can spend up to $7,000 per day.

- Weekly Limit: The weekly spending limit is $10,000.

- Monthly Limit: You can spend up to $15,000 per month.

These limits reset at 6 p.m. CST daily, weekly on Saturdays, and monthly on the last day of the month.

ATM Withdrawal Limits

- Per Transaction: You can withdraw up to $310 per transaction.

- Daily Limit: The maximum you can withdraw in a day is $1,000.

- Weekly Limit: The weekly withdrawal limit is $1,000.

These limits include all ATM withdrawals and cash-back transactions.

Sending and Receiving Money

- Unverified Accounts: Unverified users can send up to $250 within a seven-day period and receive up to $1,000 within a 30-day period.

- Verified Accounts: After verifying your identity, you can send up to $7,500 per week and receive unlimited funds.

(( Reference: Cash App Help ))

Fees of a Cash App Card:

The Cash App Card, like many financial products, has various fees associated with its use. Here is a breakdown of these fees:

Instant Transfer Fee

- Standard Transfers: Free, typically taking 1-3 business days to transfer funds from your Cash App balance to your bank account.

- Instant Transfers: 1.5% of the transfer amount, with a minimum fee of $0.25. This allows for immediate transfer of funds to your linked debit card.

ATM Withdrawal Fee

- ATM Withdrawals: $2 fee per withdrawal.

- Fee Reimbursement: If you receive $300 or more per month in direct deposits, Cash App will reimburse ATM fees for up to three withdrawals every 31 days.

Other Fees

- Ordering the Card: Free. There are no costs associated with ordering or maintaining the Cash App card itself.

- Inactivity Fees: None. There are no fees for inactivity.

- Design Fees: There are many designs of Cash App cards available, each design has different charges

- Temporary Authorization Hold: When using the Cash App card at gas stations, there may be a temporary hold of up to $100. This hold is refunded once the actual amount of the purchase is processed. To avoid this, it’s recommended to pay inside the register.

For more detailed information, you can visit the official Cash App support page. ((Reference: Cash App – Support Page ))

Security Features

Data Encryption

Cash App uses advanced encryption to protect users’ data. This includes encryption of both the data in transit and the data stored on their servers, ensuring that sensitive information is secure from unauthorized access.

Security Locks

Users can enable security locks on their Cash App accounts. These locks can include PIN codes, Touch ID, or Face ID, providing an additional layer of security. This ensures that even if someone gains physical access to your device, they cannot access your Cash App account without the security code.

Notifications and Alerts

Cash App provides real-time notifications and alerts for every transaction. This helps users monitor their account activity closely and detect any unauthorized transactions immediately. Users can customize these notifications to receive alerts via email or SMS.

Fraud Protection

Cash App has built-in fraud protection measures to identify and prevent suspicious activities. If any unusual activity is detected, Cash App may temporarily disable the account and contact the user to verify the transactions. This proactive approach helps mitigate the risk of fraud.

Customer Support

Cash App offers customer support to address security concerns and assist users with any security-related issues. Users can contact support through the app or via phone for help with securing their accounts or reporting suspicious activities. (( Reference: Cash App – Website))

Integration with Other Services

The Cash App Card can be used with services like Apple Pay, DraftKings, and Google Pay, providing more flexibility in how you use your funds.

Common Issues and Solutions

- Card Not Working: Ensure your Cash App balance is sufficient and the card is activated.

- Declined Transactions: Verify card details and ensure the merchant accepts Visa.

- Lost/Stolen Card: Lock the card immediately from the app and order a replacement.

- Other Cash App errors: Cash App Errors 503, 403, 429 etc. You can solve these errors by using a Simple Method.

- Not Connected with Other Platforms: If your Cash App Card is Not Adding to Apple Pay, you can solve this problem by using a few simple steps.

- Cash App Card Locked: If your Cash App card unfortunately gets locked, there are several ways to unlock it. You can unlock your Cash App card using whichever method you prefer.

Conclusion:

The Cash App Card is a highly convenient and secure way to manage and access your Cash App funds, functioning similarly to a traditional debit card but with unique features such as customization and seamless integration with other payment platforms. Understanding its operation, benefits, and limitations can help you make the most of this financial tool, whether you’re making purchases, withdrawing cash, or sending money.

FAQs.

Is Cash App Card a Visa?

Yes, the Cash App Card is a Visa card.

Is Cash App Card free?

Yes, the Cash App Card is free to order and use.

Is Cash App Card a Mastercard?

No, the Cash App Card is a Visa card, not a Mastercard.

Is Cash App Card a prepaid card?

No, the Cash App Card is not a prepaid card, it is a debit card linked to your Cash App balance.

How long does it take to receive my Cash App Card?

It usually takes 7-10 business days to receive your Cash App Card after you order it.

Can I use my Cash App Card at an ATM?

Yes, you can use your Cash App Card at any ATM, but fees may apply unless you have direct deposit set up with Cash App.

Thanks for your visit.

(What is a Cash App Card?)

Disclaimer: The information provided in this article is for educational purposes only and should not be considered legal advice. The details mentioned are based on the latest information available and may change over time. For the most accurate and up-to-date information, please refer to the official Cash App website.

- Reference: Cash App Official Website [↩]