Cash App is a popular peer-to-peer payment app that allows users to send and receive money effortlessly. However, when it comes to withdrawing money from your Cash App account, understanding the available options and associated fees can help you make the best decisions. This article will guide you through the best methods to withdraw money from Cash App for free, helping you keep more of your money in your pocket.

There is no charge for standard money transfers through Cash App but there is a fee for instant transfers. Similarly, there are some options through which you can withdraw from Cash App without any fees. Today we will discuss all those options in detail one by one. We will also tell you which method will be right for you. So let’s start.

Cash App Withdrawal Fees:

Cash App provides various options for withdrawing funds, each with its own fee structure. Here’s a detailed breakdown of the fees associated with Cash App withdrawals:

- ATM Withdrawals fees:

- Standard ATM Withdrawals: When you use your Cash App Card at any ATM, there is a $2.50 fee per transaction. Additionally, the ATM operator may charge an out-of-network fee.

- Withdrawing Money to a Bank Account fees:

- Instant Withdrawal: If you need your money immediately, this option allows for instant transfers. However, it incurs a fee ranging from 0.5% to 1.75% of the transfer amount, with a minimum fee of $0.25.

(( Reference: This information was obtained from the official Cash App website. For further details, please visit the website. ))

Withdraw Money from Cash App for Free:

Yes, it is possible to withdraw money from Cash App for free under certain conditions. Here’s how you can do it:

Free ATM Withdrawals Using Cash App Card:

- Free In-Network Withdrawals: If you receive $300 or more in paychecks directly deposited into your Cash App account within a calendar month, you can get unlimited withdrawals for free from in-network ATMs.

- Out-Network Withdrawal: You also get one out-network ATM withdrawal reimbursed per 31 days. Each additional $300 direct deposit within the same month extends this benefit for another 31 days.

Free Transferring Money to a Bank Account:

- Standard Withdrawal: This option is always free. It typically takes 1-3 business days for the funds to be transferred to your linked bank account.

Get free cash from Friends or Family members:

- If any of your family members or friends need money online and have cash, you can transfer the amount to them via Cash App and receive cash from them in return. There will be no charge for it because in most cases, Cash App does not charge fees for receiving money. In this way, you can withdraw money from Cash App for free while staying at home.

Best Method to Withdraw Money from Cash App for Free

Among the various methods to withdraw money from Cash App for free, the best method is using the free in-network ATM withdrawal. Cash App provides unlimited free withdrawals from in-network ATMs every month. If you make a direct deposit of $300 or more each month into your Cash App,

Additionally, it offers one out-of-network ATM withdrawal per month. By adjusting your needs slightly, you can take full advantage of the free in-network ATM withdrawals. In our opinion, this is the best method for withdrawing money from

What ATMs are Free for Cash App?

In the United States, ATMs operate on various networks such as MoneyPass, AllPoint, and Flagstar. Cash App collaborates with different networks in different states, making it challenging to identify a specific ATM as in-network or out-of-network universally.

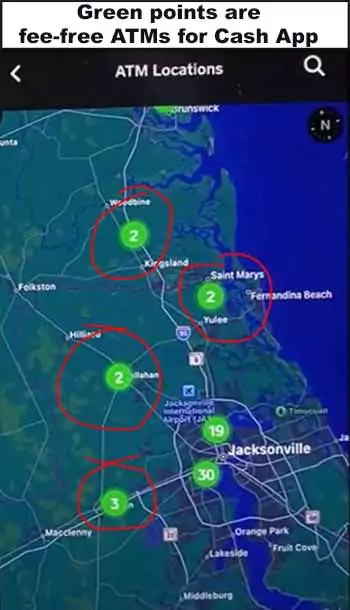

Generally, major banks like US Bank, Bank of America, and Wells Fargo have ATMs that are in-network for Cash App and these ATMs are free for Cash App. However, this can vary by state. To find free ATMs for Cash App, you should open the Cash App and use the ATM finder feature to locate in-network ATMs. These ATMs are part of networks that Cash App has partnered with, allowing free cash out with a Cash App card.

It’s important to note that to use these in-network ATMs for free, your Cash App account must receive at least $300 in direct deposits per month. Without meeting this condition, Cash App will charge a fee for each ATM withdrawal, regardless of whether the ATM is in-network or out-of-network.

(( Reference: For precise and up-to-date information, you can visit the official Cash App website or use the app to find in-network ATMs in your area. ))

Specific Banks or ATMs that Allow Free Cash App Withdrawals

In the United States, Cash App users can withdraw money for free from ATMs associated with specific networks and banks. Here are the key points to know about which ATMs might allow free withdrawals for Cash App users:

Networks and Banks:

- MoneyPass: ATMs in the MoneyPass network are often in-network for Cash App. ( vary by area)

- AllPoint: Many ATMs in the AllPoint network also support free withdrawals. ( vary by area)

- Major Banks: ATMs from major banks such as US Bank, Bank of America, and Wells Fargo are frequently in-network, though this can vary by state.

Using Cash App to Locate Free ATMs:

- ATM Finder: To find free ATMs, open the Cash App and use the ATM finder feature. This tool will help you locate in-network ATMs based on your location.

- App Updates: The Cash App regularly updates its network collaborations, so using the app’s ATM finder ensures you have the most current information.

Conditions for Free Withdrawals:

- Direct Deposit Requirement: To qualify for free ATM withdrawals, your Cash App account must receive at least $300 in direct deposits each month. If this condition is not met, Cash App will charge a fee for ATM withdrawals, regardless of whether the ATM is in-network or out-of-network.

Regional Variations:

- State Differences: The availability of free ATMs can vary by state due to different network collaborations. Always check within the Cash App for the most accurate information for your specific location.

Tips to Minimize Withdrawal Fees

Plan Withdrawals in Advance: Use the standard withdrawal option to avoid instant withdrawal fees.

Direct Deposits: Set up your paycheck or other direct deposits to go directly into your Cash App account. This can qualify you for free ATM withdrawals.

Cash App Card Usage: Use your Cash Card for purchases directly instead of withdrawing cash. This helps you avoid ATM fees altogether.

Limited use of Cash App out-network ATMs. : Those with $300 or more in direct deposits each month to their Cash App account get one free out-network withdrawal each month, which they should use promptly

Use mostly in-network ATMs: When withdrawing money from Cash App, we should always use Cash App in-network ATMs because if we have a direct deposit of $300 or more per month, then withdrawal from our Cash App card is free. You can find Cash App in-network ATMs from Cash App

Conclusion:

Withdrawing money from Cash App can be done without incurring fees if you use the right methods. By setting up direct deposits of $300 or more each month, you can take advantage of free in-network ATM withdrawals and even get one out-of-network withdrawal reimbursed.

Using standard bank transfers, which are always free, is another great option. For the best experience, plan your withdrawals in advance and use the ATM finder feature in the Cash App to locate free ATMs. Following these strategies will help you keep more of your money and avoid unnecessary fees.

FAQs:

Can I withdraw money from the Cash App without any fees?

Yes, using standard withdrawals or ensuring you have $300 in monthly direct deposits to qualify for ATM fee reimbursements.

Where can I withdraw money from the Cash App for free?

Use standard bank transfers or ATMs with your Cash Card if you meet the direct deposit requirement.

Can I use the Cash App card to withdraw money for free?

Yes, ATM fees will be reimbursed if you have $300 or more in direct deposits to your Cash App account each month.

How to withdraw money from Cash App for free?

Use standard bank transfers, qualify for ATM fee reimbursements with $300 in direct deposits, or transfer money to friends or family in-app.

Free places to withdraw money from Cash App?

Any ATM can be free if you meet the direct deposit requirement. Otherwise, use standard bank transfers for fee-free withdrawals.

Thanks for your visit.

(Withdraw money from Cash App for free: Best methods)

Disclaimer: The information provided in this article is for general informational purposes only. While we strive to keep the content accurate and up-to-date, it may not reflect the most current information on Cash App policies and fees. Please refer to the official Cash App website for the latest updates. The article does not constitute financial advice. Use Cash App services at your own risk.