Tax season is upon us once again, and for many Americans, this means obtaining their W2 forms from their employers. The W2 is a document that reports an individual’s annual wages and the amount of taxes withheld from their paychecks. All employees should make sure that their tax liabilities are correctly entered on their W2 forms. Today, in this article, we will tell you how you can find tax liabilities on w2. So, friends, let’s start the article.

What is the W2 form?

The W2 form, or the Wage and Tax Statement, is a document employers must provide to their employees by January 31st of each year. It reports the employee’s total wages earned during the previous year, along with the amount of federal, state, and social security taxes withheld from their paychecks.

If an employee does not know their Employee Identification Number, then they can check it from the W2 form. Even if you do not have a W2 form, there are many methods by which you can check your Employee Identification Number without a W2 form.

Why Is It Important?

The W-2 helps you:

File your tax return correctly

See if you’ll get a refund or owe money

Prove your income if needed (for loans, renting, etc.)

How can I get a copy of my W2 online?

If you want to get a copy of your W2 form, then you have many options; some of the most commonly used options are given below.

Option 1: Ask Your Employer

The easiest way is to ask your employer or the HR department.

Many companies offer W2s through their online payroll system.

Just contact your company’s HR and ask if your W2 is available online.

Option 2: Use Payroll Services like ADP or Workday

If your company uses ADP, Paychex, Workday, or MyTaxForm.com, you can log in there and download your W2.

If you’re logging in for the first time, you might need a registration code from your employer.

Option 3: IRS Online Transcript

You can go to the IRS website and use their Get Transcript tool.

This gives you a Wage and Income Transcript, which includes data from your W2 form.

Visit: irs.gov/get-transcript

Note: It’s not the exact W2 form, but it shows all the info you need.

Option 4: Check Tax Software or Your Accountant

If you filed taxes with software like TurboTax or H&R Block, your W2 may still be saved there.

You can also ask your tax preparer if they still have a copy.

How to Get a Copy of an Old W2 Form

The process of getting a copy of the old W2 form is almost the same as getting a copy of the new W2 form. We have given some steps below, you can get a copy of your old W2 form by following those steps.

Method 1: Contact Your Former Employer

Employers are required to keep W2 records for at least 4 years.

Even if you don’t work there anymore, just call or email their HR and request a copy.

Method 2: IRS Transcript for Past Years

If your employer can’t help, go to irs.gov and request a Wage and Income Transcript.

This shows all W2 income reported to the IRS. It’s usually available for up to 10 years.

Method 3: File IRS Form 4506-T

If you need the actual W2 copy, not just the transcript, you’ll need to file Form 4506-T and check box 8.

It might take a few weeks, but the IRS will mail you a copy.

Method 4: Check with Your Tax Preparer

If a professional filed your taxes in the past, they might still have your W2s saved.

Give them a quick call.

How to find tax liabilities on your W2?

Your Form W-2 provides detailed information about your earnings and the taxes withheld by your employer during the year. However, it does not display your total tax liability—the total amount of tax you owe for the year. To determine your total tax liability, you’ll need to complete Form 1040, the U.S. Individual Income Tax Return.

Understanding Your W-2:

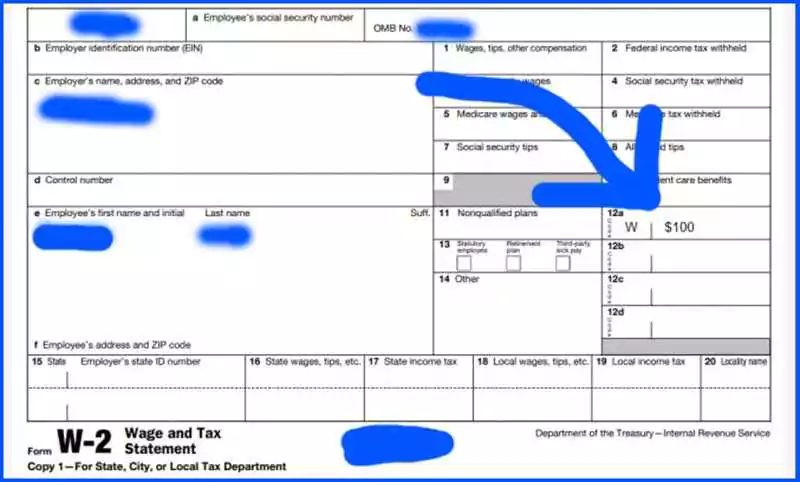

The W-2 form includes several boxes that detail your income and the taxes withheld:

- Box 1: Reports your total taxable wages, tips, and other compensation.

- Box 2: Shows the total federal income tax withheld by your employer.

- Box 4: Indicates the Social Security tax withheld.

- Box 6: Displays the Medicare tax withheld.

Your W-2 does not directly show your final tax liability, but it provides information on how much tax has already been paid. To determine your total tax liability, compare these numbers with your tax return calculations.

To find your total tax liability, you’ll need to complete Form 1040, which will guide you through reporting all income, applying for deductions and credits, and calculating the total tax you owe for the year.

For more detailed information on Form 1040 and instructions on how to complete it, you can visit the IRS website:

Tips for reducing your tax liabilities.

An effective way to reduce your tax liabilities is to grow your tax deductions. You can do this by contributing to your employer-sponsored retirement plan, such as a 401(k) or IRA. These contributions are tax-deductible and can minimize your taxable income, ultimately lowering your tax liabilities.

Some effective ways to reduce your tax liabilities.

- You can contribute to retirement accounts to reduce your taxable income.

- Taking advantage of short-term rental tax loopholes may reduce your tax liability.

- Another way to lower your taxable income is to pay into a Health Savings Account.

- Donating to charity can also result in a deduction from your taxes.

- Investing in working interests in oil and gas can also provide tax benefits.

Along with keeping all these things in mind, we should also keep in mind that we do not get tax refund fraud. Therefore, we should not share our confidential information with anyone.

What are state tax liabilities on W2 forms?

State tax liabilities on the W2 form are the amount of state income tax withheld from your paychecks throughout the current year. The amount of state income tax withheld will depend on your state of residence and its tax rate.

How to find IRA contributions on W2 forms?

If you made your own Traditional IRA or Roth IRA contributions (like from your bank account), you will not see them on your W-2 form. The W-2 only shows the money your employer paid you or took out of your paycheck. So, if you made IRA contributions by yourself, you will not find them on the W-2. Instead, your bank or IRA provider will send you Form 5498 in May. That form shows how much you put into your IRA.

But if your job offers a retirement plan like a SIMPLE IRA, and you add money through your paycheck, you can find it on your W-2 in Box 12 with Code S. This shows the amount you saved from your salary into that plan. If it’s a SEP IRA, it usually doesn’t show on the W-2 either — your employer handles that on their tax forms.

How to find HSA contributions on W2 forms?

You can find your HSA (Health Savings Account) contributions on your W-2 form in Box 12, next to the code “W”. This box shows the total amount your employer contributed to your HSA during the year. It also includes any money you choose to put into your HSA through a payroll deduction plan, like a cafeteria plan.

These contributions are not included in your taxable income, so they’re reported separately. If you’re checking how much was added to your HSA for tax purposes, Box 12 with code “W” is where to look.

Where is the adjusted gross income (AGI) on a W2 form?

Adjusted Gross Income or AGI is not reported on a W2 form. So it is wrong to ask where is the adjusted gross income on the w2 form. To calculate your AGI you will need to add up all your taxable income and subtract any adjustments to income, such as contributions to a traditional IRA or student loan interest.

How to calculate AGI from W2 forms?

To find your AGI (Adjusted Gross Income) using just one W-2 form, follow these steps:

Look at Box 1 on your W-2.

This shows your total taxable income from that job. That number is your starting point.

Check if you have any adjustments.

These are things like:

Student loan interest

Traditional IRA contributions

HSA (Health Savings Account) contributions

Subtract those adjustments (if any) from your Box 1 amount.

The result is your AGI.

Example:

Your W-2 shows $42,000 in Box 1.

You also paid $2,000 in student loan interest.

AGI = $42,000 – $2,000 = $40,000

If you don’t have any adjustments, then your AGI is just $42,000.

Once you have your yearly AGI, you can find your monthly AGI by dividing it by 12.

For example, if your AGI is $40,000 per year, then:

$40,000 ÷ 12 = $3,333 per month

This is your estimated monthly AGI.

What does total state mean on W2 forms?

Total state on W2 forms refers to the total amount of state income tax withheld from your paychecks throughout the year. This amount is reported in box 17.

Where is the EIN on a W2 form?

The Employer Identification Number or EIN is a unique nine-digit number assigned by IRS to businesses for tax purposes. You can find your EIN on your W2 form in box B. This number is essential when filing your taxes, as it helps the IRS match your tax return with the correct employer or company.

What is NY PFL on W2 form?

NYPFL stands for New York Paid Family Leave. It’s a program for people who work in New York State. It gives workers paid time off if:

- You have a new baby (by birth, adoption, or foster care)

- You need to care for a seriously ill family member

- Or your family member is called to active military duty

It is a great benefit — it helps people take care of their families without losing their jobs or paychecks.

Why is NYPFL on My W2?

When you see NYPFL in Box 14, it just shows how much money was taken out of your paycheck to pay for this benefit. This is not money you received. It’s a deduction that you paid during the year.

Think of it like this:

Just like Social Security and Medicare taxes are taken from your pay, the same way, New York takes out a small amount for Paid Family Leave. Your employer is required by law to show that on your W2. So you can see how much you contributed.

Do I Need to Do Anything With Box 14?

Most of the time, your tax software or tax preparer will ignore Box 14 or just keep it for records. But it’s always a good idea to double-check your W-2 and keep it safe in case the IRS needs it.

Where is the import code on a W2 form?

Import code is a code that is printed on a W2 form and is a unique code that allows tax software to automatically import data from your W2 into your tax return. You can find the import code on your W2 form in box D.

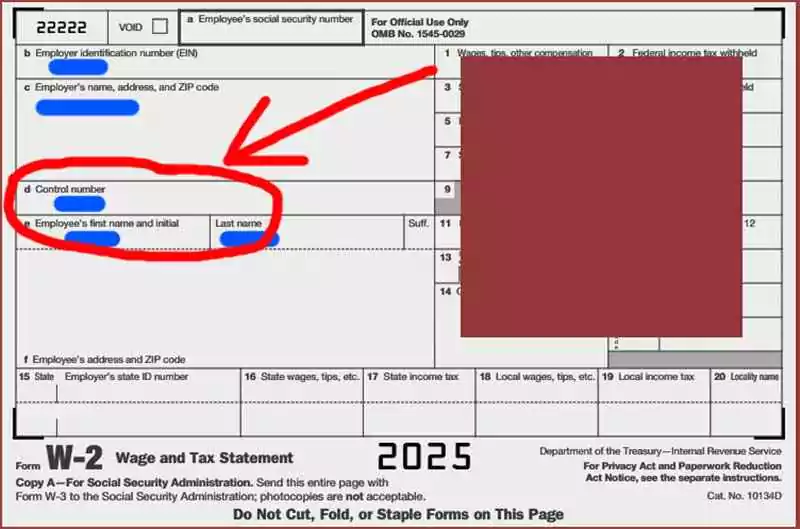

What is control number on a W2 form?

A W-2 Control Number is a unique code that your employer may assign to your W-2 form. It’s typically found in Box D of the form. This number is used internally by employers to organize and track W-2 forms, especially when managing a large number of employees. It’s important to note that the Control Number is optional and not required by the IRS for tax filing purposes.

- Purpose: Helps employers manage and track individual W-2 forms within their payroll systems.

- Location: Usually located in Box D of the W-2 form.

- Optional: Not all W-2 forms will have a Control Number; it’s not mandatory.

- Tax Filing: You can file your taxes without a Control Number. If your tax software requests it and your W-2 doesn’t have one, you can typically leave the field blank or enter a placeholder number.

- Security: While not a security feature, the Control Number can aid in reducing errors and ensuring that each W-2 form is unique within an employer’s system.

Where is the taxable income on a W2 form?

Taxable income is not reported on a W2 form. To calculate your taxable income, you will need to subtract any deductions or exemptions from your AGI or adjusted gross income.

Where is the FICA located on a W2 form?

FICA, which stands for Federal Insurance Contributions Act, refers to taxes withheld for Social Security and Medicare. You can find the FICA amount withheld on your W2 form in boxes 4 and 6.

Conclusion.

Understanding how to decipher your W2 form is crucial for accurate tax filing and minimizing tax liabilities. By utilizing the tips and guidance outlined in this article, you can confidently manage your tax obligations and ensure compliance with tax laws.

Faq’s

Can I reduce my tax liabilities on my W2?

Yes, you can reduce your tax liabilities on your W2 by taking advantage of deductions and credits that you are eligible for. In the above paragraph, we have given complete information about it and have told you step by step. What are the processes you have to apply and are there any steps that you can take to reduce your tax liability on your w2.

What happens if I don’t pay my tax liabilities on my W2?

If you don't pay your tax liabilities on your W2, the IRS may take collection action on you, including garnishing wages, seizing your assets, or filing a tax lien against you. And it can prove very wrong for your future.

How do tax liabilities on W2 forms affect my tax refund?

Your tax refund is determined by the amount of tax you owe minus the amount of tax you have already paid. If your tax liabilities on your W2 are higher than the amount you have paid, you will owe additional taxes. If your tax liabilities are lower than the amount you have paid, you will receive a refund.

Do self-employed individuals have tax liabilities on W2 forms?

No, self-employed individuals do not have tax liabilities on W2 forms. Their tax liabilities are calculated on an estimated basis and they do not have tax liabilities on their w2 forms.

Thanks for your visit.

(How to Find Tax Liabilities on w2)

Disclaimer: The information provided in the article is for general informational purposes only. It is not intended as legal advice. Readers are advised to consult with a qualified professional for advice specific to their circumstances.