The borrowing feature of Cash App has made Cash App more popular. Cash App’s borrowing feature has the option to borrow amounts ranging from $20 to $200. In the new Cash App account, this limit starts from $20 and reaches $200. Today in this article we will tell you how to borrow $200 from Cash App, what its eligibility is, and what is the repayment method. We will discuss this in detail. So let’s start the article.

To increase the borrowing limit of Cash App, you have to do regular transactions on Cash App and repay whatever you have borrowed from Cash App on time. This increases your Kesh App borrow limit. Apart from this, what other things should we keep in mind so that we can borrow $200 directly from Cash App?

Introduction to Cash App Borrowing:

Cash App Borrowing is a feature of the Cash App that provides emergency funds when needed. When you create a new account on Cash App and verify it, and as you start using Cash App regularly, the Borrow feature becomes enabled over time. If you see the Borrow feature in your Cash App, it means you are eligible for it.

When you click on the Cash App Borrow feature, you will see an amount displayed ranging from $20 to $200. Whatever amount is shown there, you are eligible to borrow. Once you get the loan from Cash App, it becomes due, and you are required to repay it every week.

This feature of the Cash App proves to be quite effective for individuals in need of quick funds during emergencies.

Benefits of Borrowing on Cash App:

While the borrowing feature on Cash App provides relatively small amounts, it offers several significant advantages:

- Accessibility: Cash App loans are sometimes available even for individuals with poor credit scores, offering financial assistance to a broader range of users. Cash App reports to credit bureaus, but very rarely

- Convenience: Borrowers can obtain loans from Cash App without the need to visit a physical location. Everything can be managed conveniently through the mobile app, eliminating the hassle of traditional loan applications.

- Competitive Interest Rates: Compared to other loan interest rates, Cash App offers competitive interest rates, making borrowing more affordable for users.

- Instant Access: Cash App provides instant loan approval, ensuring quick access to funds when needed.

- Minimal Documentation: Borrowers only require minimal documentation when applying for loans on Cash App, streamlining the borrowing process.

- No Credit Score Requirement: Unlike many traditional lenders, Cash App does not require a very good credit score to qualify for a loan, making it more accessible to a wider audience.

- Expedited Loan Approval: After repaying one loan on Cash App, users often qualify for subsequent loans more quickly, facilitating smoother borrowing experiences.

These benefits make borrowing on Cash App a convenient and accessible option for individuals seeking quick financial assistance.

Can you borrow $200 from Cash App?

Yes, Cash App allows users to borrow amounts ranging from $20 to $200, providing flexibility to meet various financial needs. But Cash App provides the amount of $200 only to its old customers. Apart from this, there are other eligibility criteria which we will discuss further.

Eligibility Criteria for Borrowing $200 on Cash App:

In states where the Cash App Borrow feature is enabled, Cash App has established specific eligibility criteria for users to apply for this service. The amount of loan a Cash App user can receive is determined based on their transactional history.

Here are some eligibility criteria:

- Age Requirement: Users must be at least 18 years old.

- Banking Account: Users should possess a valid checking account.

- Positive Banking History: A positive banking history is essential.

- Verified Cash App Account: Users must have a verified Cash App account.

- Connected Bank Account: The Cash App account should be connected to a bank account.

- Regular Deposits: Make regular cash deposits and withdrawals on Cash App. Regular deposits of approximately $1000 are preferred.

- State of Residence: Eligibility may also depend on the user’s state of residence.

- Cash Card: You must have an activated and unlocked Cash App Card.

- Past Borrowing Experience: Cash App typically favours old users who have previously borrowed and repaid loans on time. Such users have higher chances of receiving a $200 loan.

How to borrow $200 from Cash App?

Borrowing $200 from Cash App is a very straightforward process but before applying, you must first check whether you are eligible to borrow $200 from Cash App or not. After checking its eligibility criteria completely, if you want to borrow $200, you can borrow $200 from Cash App by following the steps below.

Steps to borrow $200 from Cash App.

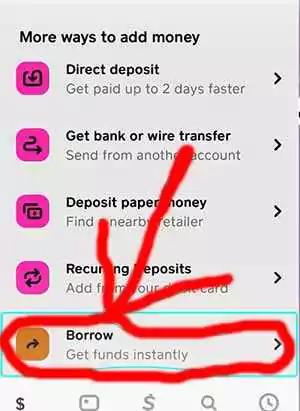

Step 1- In the first step, you have to open the Cash App on your mobile, click the “Profile Icon” button on the top right corner, and scroll down. As shown in the photo below.

Step 2- In the second step, as soon as you click on the “Profile icon” and scroll down, you will see a “borrow” option below. You will see the “borrow” option only if you are eligible to borrow $200 on Cash App. If you are not eligible, it will not appear. You have to click on this “borrow” button. As shown in the photo below.

Step 3- In the third step, as soon as you click on the “borrow” button, a new page will open in front of you on which it will be written “Borrow up to $200“. If you have to scroll down, you will see a “Get Started” button below which you have to click. As shown in the photo below.

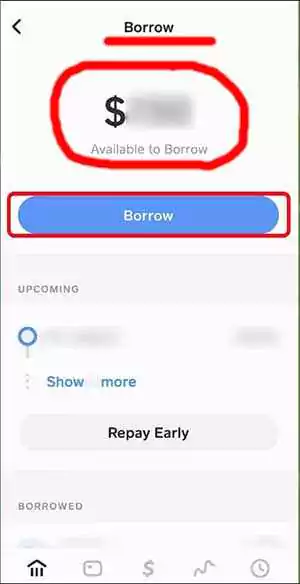

Step 4- As soon as you click on the “Get Started” button in the fourth step, a new page will open in front of you in which your cash app borrow limit will be visible and it will be written there “available to borrow”. If you are eligible to borrow $200, then here you will see the amount of $200.

If you see an amount of less than $200 here, then you should understand that you are not yet eligible to borrow $200. If you see an amount of $200 here then you have to click on the “borrow” button. As shown in the photo below.

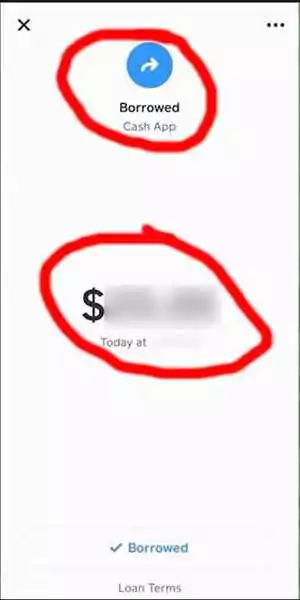

Step 5- As soon as you click on the “Borrow” button, after the processing goes on for some time, whatever amount is approved by Cash App will be instantly transferred to your Cash App account and a new page will open in front of you on which it will be written “borrowed” and whatever amount has been borrowed will be written below. As shown in the photo below.

So in this way, your amount of $200 can be borrowed very easily. But while following all the steps, you have to remember that you have to borrow the amount only after reading all the details thoroughly and understanding the terms and conditions.

How to borrow $200 from Cash App on iPhone?

To borrow $200 from Cash App on an iPhone, you’ll need to follow the same steps as you would on a normal Android device or any other device. This is because the interface of the Cash App remains consistent across all devices, and the steps you follow on Android must also be followed on an iPhone. The eligibility criteria for borrowing $200 on Cash App, which apply to normal Android users, also apply to iPhone users.

If you face any problem in borrowing cash from your iPhone, then delete the Cash App cache from the iPhone and then try again.

How much interest does Cash App charge for $200?

To borrow the amount from Cash App, you have to pay a flat 5% interest rate. It is a good thing that a flat interest rate is charged on this and not the reducible interest rate. Because at flat interest rates, all the extra amount you have to pay gets revealed in one go. Apart from this, if you are not able to repay the amount borrowed from Cash App on time, then a weekly late fee of 1.25% will be charged. This may cause a loss to you, so pay your EMI on time.

(( Reference: Information sourced from the official Cash App website. For more details, visit the website directly. ))

How to borrow from Cash App without direct deposit?

You can borrow money from Cash App without using direct deposit, but it’s not guaranteed. Cash App looks at how you use your account to decide if you qualify for the Borrow feature. Things like your account activity, spending habits, and how often you add money to your Cash App can help.

If you don’t have direct deposit, try these tips to improve your chances:

Add money to your Cash App regularly

Use Cash App often to send and receive payments

Keep your account active and in good standing

While direct deposit helps, it’s not the only way to qualify. Stay active on the app, and you might still get access to Borrow even without direct deposit.

Repayment Options:

When you borrow money from Cash App, you have several repayment options available. You can manually pay back the loan through the Cash App’s interface. Alternatively, you can enable auto-debit, allowing automatic deductions from your account.

Why Can’t We Borrow $200 from Cash App Sometimes?

When you borrow money from Cash App and you do not receive the amount of $200, there can be many reasons why this is happening. Below we have given a proper table in which you will find reasons why can’t we borrow $200 from Cash App sometimes.

Reasons why you may not be able to borrow $200 from Cash App:

| Reason | Description |

|---|---|

| Sufficient Transaction History | If you lack sufficient transaction history, Cash App may not allow you to borrow $200. |

| Poor Credit Score | A poor credit score can result in the denial of a $200 loan from Cash App. |

| Verified Cash App Account | If your Cash App account is not verified, you won’t qualify for a $200 loan. |

| Age Requirement | Individuals under 18 years of age cannot withdraw $200 from Cash App. |

| Connected Bank Account | If your bank account is not linked to your Cash App account, you cannot borrow $200. |

| State of Residence | Cash App Borrow may not be available in your state, preventing you from accessing $200. |

| Poor Borrowing History | Previous late repayments or defaults on Cash App loans may disqualify you from borrowing $200. |

Each of these factors plays a role in determining your eligibility for borrowing $200 from Cash App.

Conclusion:

In conclusion, Borrowing $200 from Cash App can be a convenient solution during emergencies, offering quick access to funds with minimal requirements. By understanding the eligibility criteria and repayment options, users can make informed decisions about their financial needs. However, it’s essential to note that borrowing should be done responsibly, considering factors such as interest rates and repayment terms to avoid any financial strain in the future.

FAQs:

What happens if I miss a repayment on Cash App?

Missing a repayment on Cash App may result in additional fees or penalties, and could potentially impact your ability to borrow in the future.

Is there a credit check required for borrowing on Cash App?

Cash App may conduct a soft credit check as part of the borrowing process, but it does not impact your credit score.

Can I repay my Cash App loan early?

Yes, Cash App allows users to repay their loans early without any prepayment penalties.

Thanks for your visit.

(How to borrow $200 from Cash App?)

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Users are encouraged to consult with a financial advisor or conduct their research before making any financial decisions.