Cash App has become a popular choice for quick and convenient financial transactions, including borrowing money. But do you know how soon can you borrow from Cash App after payment? If not, then this guide is for you only. In this comprehensive guide, we’ll delve into the various aspects of Cash App‘s borrowing process and shed light on the timeframes involved.

The Cash App Borrow feature works like a Payday loan. If you are a verified user of Cash App then you can borrow money between $20 to $200. Which you have to repay in 4 weeks. This is a very good feature of Cash App and most people take advantage of this feature in their emergency times. Those who fully repay the amount borrowed from Cash App can borrow again from Cash App. Let us discuss in detail how much time has to be applied for re-borrowing.

Cash App Repayment Schedule.

Table of Contents

ToggleWhen you are taking a loan from Cash App, you’re presented with three repayment options. You can either opt to repay as you receive cash in your Cash App account (where 10% of each deposit is deducted), make weekly payments over 4 weeks, or settle the entire balance at once.

In cases where there isn’t a sufficient balance available in your Cash App account to fulfil your selected repayment plan, the amount due will be deducted directly from your linked debit card.

How Soon Can You Borrow from Cash App after Payment?

To borrow from Cash App after Payment, you must first make the final payment of your previous loan amount. Only after successfully repaying your previous loan can you apply for the next loan. Cash App does not allow simultaneous borrowing under the borrow feature.

Therefore, if you wish to borrow again, ensure that you deposit your previous borrowed amount in one go. Once your repayment is successful, you can then proceed to apply for the next loan.

How Long Does It Take for a Payment to Process on Cash App?

Payments on Cash App are typically processed automatically, and they are usually completed successfully within a few minutes. However, there are instances where users may encounter errors on the Cash App, such as “Failed for My Protection,” or other error codes like 503, 403, or 429. In such cases, connectivity problems may delay the processing of your payment.

If you experience any of these errors, it may take some time for your payment to process due to connectivity issues. However, if there are no connectivity-related problems on the Cash App, and your account is fully ready and verified, your payment will be processed within a few minutes.

If you have selected automatic repayment for your borrowed amount, it will be automatically debited. If you prefer to manually deposit this amount, it will be processed within a few minutes after making the deposit.

What Happens If You Don’t Repay Cash App?

If you fail to repay the borrowed amount on Cash App, the most significant consequence is that you won’t be able to borrow again from Cash App. This is because Cash App permits borrowing only a specific amount at a time.

Moreover, if you don’t repay the borrowed amount on Cash App, the good news is that it does not report to credit bureaus. Therefore, there won’t be any impact on your credit score.

So, it’s essential not to assume that since there’s no impact on the credit score, it’s acceptable not to repay the borrowed amount from Cash App. There are several other significant drawbacks associated with not repaying the borrowed amount. For instance, it may reflect your credit history, leading to difficulties in obtaining future loans. Additionally, if you have auto-debit enabled on Cash App, any amount deposited into your Cash App, Cash App Card or connected debit card will be automatically debited to repay the borrowed amount.

Hence, it’s crucial to repay the borrowed amount from Cash App on time to avoid potential complications.

Factors Influencing Loan Eligibility After Repayment.

After repaying loans on Cash App, several factors influence your loan eligibility:

- Regular Repayment: Enabling auto-debit and ensuring timely repayment of EMIs on Cash App enhances your loan eligibility post-repayment. Consistent repayment reflects positively on your borrowing behaviour.

- Timely Payments Across Loans: If you have loans from other sources, ensure timely payment of EMIs without any bounced payments. Maintaining a clean repayment record improves your chances of obtaining another loan on Cash App after repaying the current one.

- Manage Borrowing Across Multiple Sources: If you have multiple loans from different sources, prioritize repaying them to avoid crossing your borrowing limit. Managing and closing existing loans responsibly demonstrates financial discipline and enhances your credibility for future loans on Cash App.

- Frequent Transactions on Cash App: Conducting a higher volume of transactions on Cash App helps maintain a healthy transaction history. A regular pattern of transactions showcases your active usage and financial stability, making it easier to qualify for another loan when needed.

- Reduced Debt-to-Income Ratio: Aim to lower your debt-to-income ratio by reducing outstanding debts relative to your income. A lower ratio signifies better financial health and increases your eligibility for loans on Cash App.

- Verified Identity and Information: Ensure that your identity and personal information on the Cash App are verified and up to date. Accurate and complete information enhances trust and credibility with lenders, facilitating smoother loan approval processes.

Tips to Increase Cash App Borrow Limit.

Cash App’s borrowing limit cannot increase by more than $200. $200 is the maximum amount you can borrow on Cash App. But if your Cash App Borrow Limit is less than $200 then we have mentioned some methods below by following which you can increase your Cash App Borrow Limit.

- Verify Your Account: Start by verifying your Cash App account. Provide your full name, date of birth, and the last four digits of your Social Security number. This verification process helps increase your borrowing limits.

- Link a Bank Account (If not linked): Connect a bank account to your Cash App profile. This action not only adds convenience but also contributes to increasing your borrowing limits. Note that while you can create a Cash App account without an SSN, it may come with limitations. And if SSN is already set in Cash App then it should not be removed.

- Avoid Overdrafts and Negative Balances: Keep a positive balance in your Cash App account to avoid overdrafts or negative balances. Maintaining financial stability reflects positively on your borrowing capabilities.

- Regular Money Transfers: Engage in regular money transfers with others through your Cash App account. Deposit amounts on Cash App, and transfer to relatives

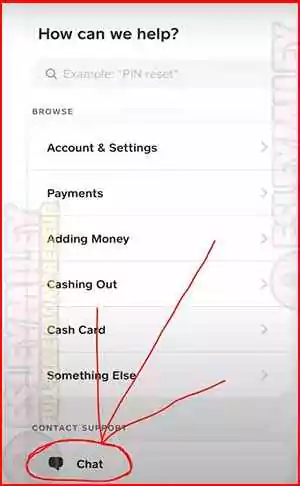

- Direct Communication with Cash App Customer Support: If necessary, directly communicate with Cash App customer support to discuss increasing your Cash App borrow limit. Open your Cash App, click on the profile icon at the top right corner, scroll down, and select the “Cash App Support” option. Initiate a conversation with customer support representatives and request an increase in your borrowing limits. As shown in the image below

Conclusion.

Borrowing from Cash App can be a convenient option for quick financial assistance, but it’s essential to understand the repayment process and consequences of non-repayment. By adhering to the repayment schedule and maintaining good financial standing, borrowers can utilize Cash App’s borrowing feature effectively.

Additionally, following the tips provided can help increase borrowing limits and ensure a smoother borrowing experience on Cash App.

FAQs.

If you repay Cash App, can you borrow again?

Yes, once you repay a Cash App loan, you can borrow again based on your eligibility and borrowing limits.

How long after repayment can you borrow from Cash App?

The timeframe for borrowing again after repayment varies and depends on factors such as your repayment history and Cash App's policies.

How soon can you borrow from Cash App after payment on iPhone?

The process for borrowing from Cash App after making a payment is the same on iPhone as it is on other devices. The timing may vary based on factors such as payment processing and account activity.

Can you borrow money from Cash App if you have an outstanding loan?

No, Cash App typically requires you to repay your existing loan before you can borrow again.

What is the maximum amount you can borrow from Cash App?

The maximum amount you can borrow from Cash App is $200. Cash App may periodically adjust your borrowing limit based on your credit history.

Can you repay a Cash App loan early?

Yes, you can repay a Cash App loan before the scheduled repayment date if you wish to do so.

Thanks for your visit.

(How soon can you borrow from Cash App after payment?)

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Readers are advised to consult with a financial professional before making any financial decisions.