American Express has been a significant supporter of small businesses for years, and its acquisition of Kabbage, a well-known online lender, has brought exciting changes to Kabbage business loans. In the Kabbage Business Loan review, we will explore what Kabbage business loans look like today, how AMEX has influenced Kabbage’s offerings, and whether these loans are a good choice for small business owners.

Table of Contents

ToggleWhat is Kabbage Funding?

Kabbage Funding, now operated by AMEX, provides small businesses with a line of credit ranging from $2,000 to $250,000. This line of credit offers flexibility, allowing businesses to draw funds as needed. Each time you make a draw, you create an individual installment loan, which you pay back on a 6, 12, or 18-month schedule. AMEX handles the application process, funding, and credit terms, all of which can be managed online.

Key Features of Kabbage Business Loans by AMEX

Here are the essential features and changes that business owners should know about:

Quick Approval and Access to Funds:

Applications can be completed online in minutes, with approval often happening the same day. Funds become accessible right away, allowing businesses to address urgent financial needs.

Flexible Loan Terms:

Businesses can choose to repay each draw on a 6, 12, or 18-month plan. This flexibility helps business owners manage cash flow better, which is especially useful for seasonal businesses or those with unpredictable income.

Fee-Based Repayment Structure:

Instead of a traditional interest rate, Kabbage Funding charges a monthly loan fee. This fee ranges based on creditworthiness and loan term:

- 6-month loans: 2-9% monthly fee

- 12-month loans: 4.5-18% monthly fee

- 18-month loans: 6.75-27% monthly fee

No Early Repayment Penalties:

One of the highlights of Kabbage loans is that there are no fees if you decide to pay off your loan early.

AMEX Membership Benefits:

AMEX cardholders may receive additional benefits, like customized financial insights and tools through AMEX’s Business Class program and support through small business grants.

How Kabbage Loans Have Changed After the AMEX Acquisition

Since AMEX’s acquisition, Kabbage loans have evolved to fit AMEX’s broader strategy. Here’s what’s new:

Improved Customer Support and Resources: AMEX has introduced more tools and resources for small businesses, including financial insights, access to the Business Class platform, and special offers.

Expanded Funding and Product Options: Alongside Kabbage Funding, AMEX now provides business checking, Kabbage Payments, and merchant financing options. These products help businesses handle transactions, manage cash flow, and access additional capital.

Shop Small and Small Business Saturday Initiatives: Through AMEX’s Shop Small campaign, Kabbage customers also gain visibility and support during major events like Small Business Saturday. This gives small businesses opportunities to attract local customers and boost their revenue.

Kabbage Business Loan Review after AMEX Acquisition

Suppose you are looking into reviews of any loan company, like Kabbage. In that case, it is helpful to check public reviews and trusted review sites like Trustpilot, Glassdoor, and the Better Business Bureau (BBB). Kabbage had solid reviews before its acquisition by American Express, with mostly positive feedback.

However, over time, some complaints began to surface, and the company ultimately shut down. American Express then acquired Kabbage,1 integrating it into its business loan offerings. Now, if you want to know about Kabbage business loans, you’ll need to look at reviews for American Express business loans, as these loans are managed under their brand.

1 – American Express has a strong reputation, and on Glassdoor, it has a high rating of 4.1 from over 19000 reviews, indicating employee satisfaction and good management.

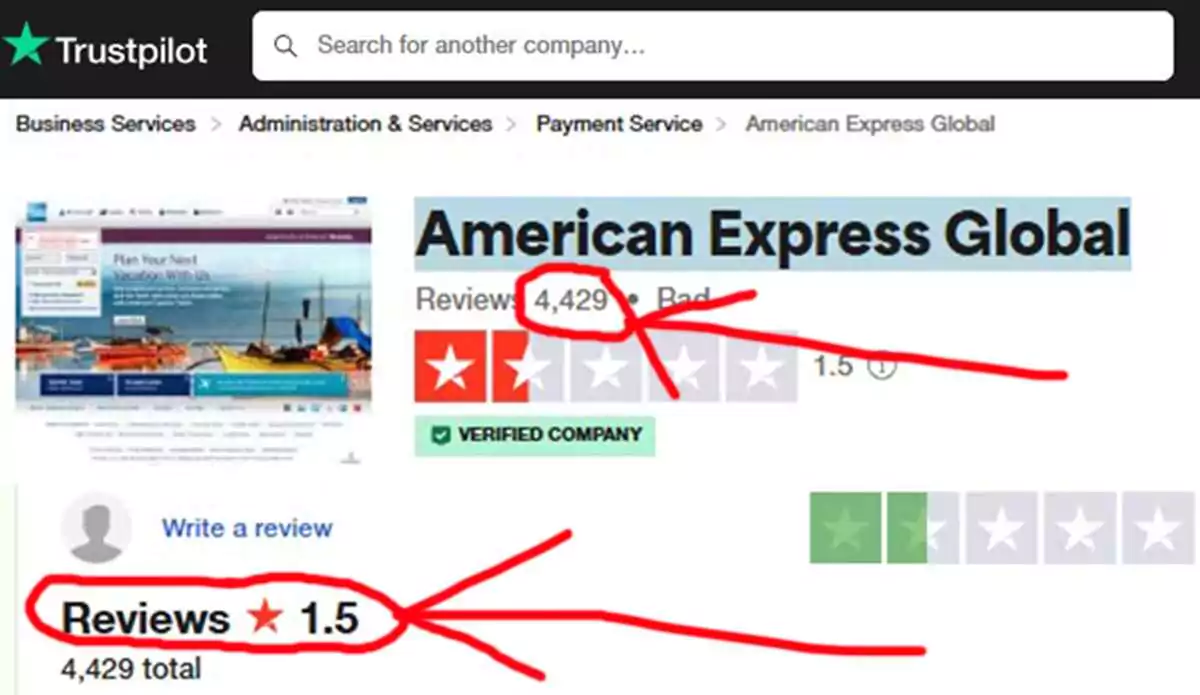

2 – On Trustpilot, its rating is much lower at 1.5 from over 4400 reviews, which is not considered favorable.

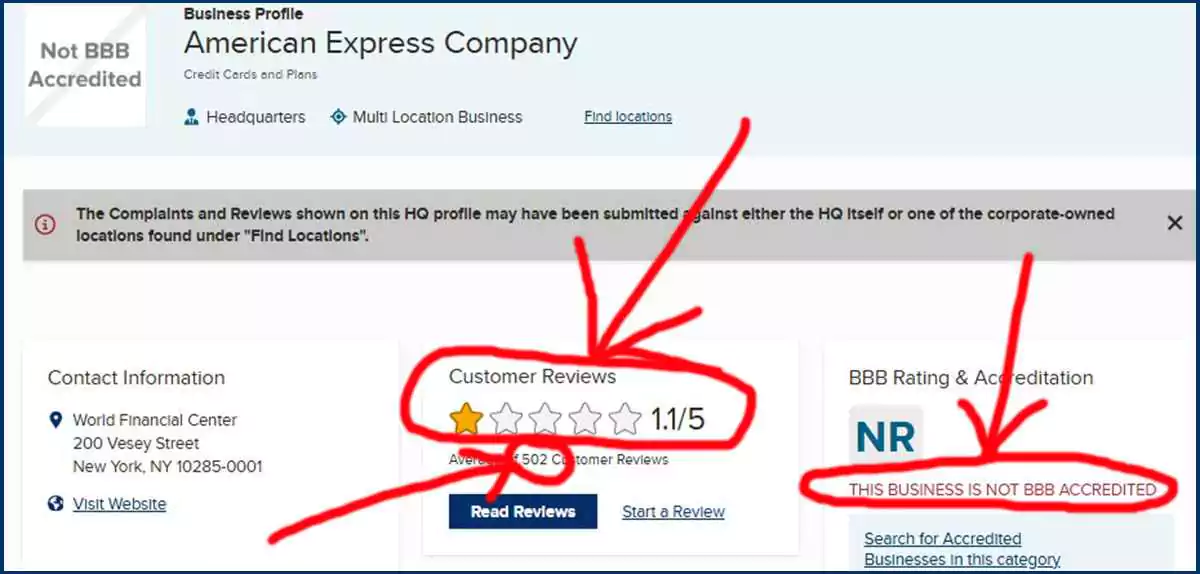

3 – On the BBB website, American Express holds a rating of 1.1 from over 500 reviews and is also not BBB accredited. That shows significant customer complaints there.

For a fuller picture, you can also seek opinions from local business owners who have used American Express business loans. Overall, American Express is reputable, and reviews suggest that its business loan service (formerly Kabbage) is positively received, despite the mixed ratings across review platforms.

Pros and Cons of Kabbage Business Loans by AMEX

Pros:

- Fast access to funds with a straightforward application process.

- Flexible repayment terms make cash flow management easier.

- No prepayment penalty gives businesses the freedom to repay early.

- Access to AMEX resources and potential offers for members.

Cons:

- Higher fees compared to traditional bank loans, especially for longer-term loans.

- A personal guarantee is required which could be risky if the business faces financial trouble.

- Limited to certain industries, so not all businesses are eligible.

Who is Kabbage Funding Best For?

Kabbage Funding is ideal for small to medium businesses that need quick and flexible funding but might not meet traditional bank lending requirements. It’s particularly suited for:

- Seasonal businesses with varying cash flow.

- Businesses that need quick funds for urgent expenses.

- AMEX members looking to maximize AMEX’s added benefits.

Alternatives to Kabbage Loans by AMEX

If you’re considering other loan options, here are some alternatives:

- SBA Loans: Government-backed loans with lower interest rates, but they require extensive paperwork and take longer to process.

- Online Lenders: Companies like OnDeck and Sigma Solutions offer similar lines of credit with varying terms and fees.

- AMEX Business Credit Cards: For smaller, everyday expenses, AMEX business credit cards can be a good choice, offering rewards, cashback, and manageable repayment options.

Conclusion

The Kabbage business loan, under American Express, provides small businesses with flexible and fast-access funding. With AMEX’s support, borrowers now benefit from enhanced resources, like financial insights, flexible repayment plans, and the option to draw only what’s needed. However, higher fees and a required personal guarantee may be a drawback for some.

FAQ’s

How quickly can I get approved for a Kabbage loan?

Approval can be as fast as the same day you apply, but it depends on your business information and eligibility.

What fees do I have to pay on a Kabbage loan?

Instead of interest, Kabbage charges a monthly loan fee, which can range from 2% to 27%, depending on the loan term and your credit profile.

What fees do I have to pay on a Kabbage loan?

Instead of interest, Kabbage charges a monthly loan fee, which can range from 2% to 27%, depending on the loan term and your credit profile.

Can I pay off my Kabbage loan early?

Yes, you can repay early without any penalties, which can save you on fees.

Do I need to be an American Express cardholder to get a Kabbage loan?

No, you don’t need to have an AMEX card to apply, but AMEX members may get additional benefits.

Is there a risk if I personally guarantee the loan?

Yes, if you default, AMEX can use your personal assets to cover the loan, so it’s important to consider this risk.

Thanks for your visit.

(Kabbage Business Loan Review)

Disclaimer: This article is for informational purposes only and does not constitute legal advice. The information provided is based on publicly available sources and may change over time. Neither the author nor the website is responsible for any decisions made based on this content. We have no affiliation with Kabbage, Inc. or American Express. We are a separate financial consulting company.