In today’s digital era, people look for easy ways to transfer money between various platforms. Many users are interested in connecting BankMobile with Cash App for this purpose. This guide will provide a detailed explanation of how to transfer money from BankMobile to Cash App. We’ll cover the steps, any charges involved, and how well these two financial platforms work together.

BankMobile Transfer Capacity to Other Platforms:

Table of Contents

ToggleBankMobile is a banking service that helps students and professionals with digital transactions. When it comes to its transfer capacity, BankMobile allows payments on nearly all types of platforms.

Transactions like Google Pay, Cash App, IMPS, and direct bank account deposits can be made using BankMobile. There are no limitations on these transactions. However, not everyone knows how to use BankMobile for these transactions. In this guide, we’ll explain this question in detail.

Does Cash App Work with BankMobile?

Yes, Cash App does work with BankMobile. If you want to transfer an amount from your Cash App to BankMobile or from BankMobile to Cash App, it can be done easily. You just need to follow a separate process for it. So, if you use both Cash App and BankMobile, they can work together seamlessly.

Can You Transfer Money from BankMobile to Cash App?

Yes, you can transfer money from BankMobile Vibe to Cash App. To do this, you need to link your BankMobile account to the Cash App. Since Cash App allows us to link any bank account, you can simply input the details of your BankMobile account instead of a traditional bank account to link it with Cash App.

After linking, you can click on the “Add Amount” option, select your BankMobile account, and easily transfer the available amount from BankMobile to the Cash App.

How to Transfer Money from BankMobile to Cash App: Complete Guide

BankMobile does not provide a direct option to transfer money to Cash App. If you wish to transfer an amount from your BankMobile Vibe to Cash App, you need to link your BankMobile Vibe account to Cash App. Below is a step-by-step guide on how to transfer money from BankMobile to Cash App:

Link BankMobile Vibe to Cash App.

To transfer money from BankMobile to Cash App, you first need to link your BankMobile account to Cash App. Here are the steps:

Step 1: Open the Cash App on your mobile device.

Step 2: Click on the profile button in the top right corner. As shown in the image below.

Step 3: Select “Add Linked Banks” from the options. As shown in the image below.

Step 4: Choose “Link Debit Card” and click on “Next.” As shown in the image below.

Step 5: Click on “No Card” and select “Continue.” As shown in the image below.

Step 6: Scroll down to find “BankMobile Vibe” and select it. As shown in the image below.

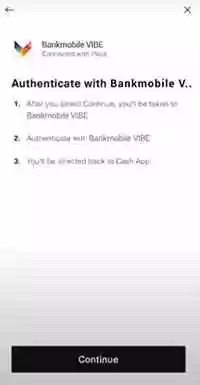

Step 7: Click on it, and you will be redirected to the BankMobile Vibe website.

Step 8: Log in with your BankMobile Vibe account details.

Step 9: After authentication, your BankMobile Vibe account will be linked to the Cash App. As shown in the image below.

Transfer BankMobile Vibe Amount to Cash App.

Once your BankMobile Vibe account is successfully linked to the Cash App, follow these steps to transfer the amount:

Step 1: Open the Cash App. As shown in the image below.

Step 2: Enter the amount you want to transfer from BankMobile Vibe to Cash App. and click on “Add“. As shown in the image below.

Step 3: Choose the linked BankMobile Vibe account from all linked bank accounts or cards.

Step 4: Select the BankMobile Vibe account and click on “Next.”

Following these two steps will seamlessly transfer your BankMobile Vibe amount to the Cash App.

(( The information provided is sourced from the video tutorial available at https://www.youtube.com/watch?v=tVS7loZOls0. ))

Charges for BankMobile to Cash App Transactions:

When you make transactions from BankMobile Vibe to Cash App, there are generally no charges involved. It is entirely free of cost. However, it’s essential to be aware that Cash App may have its standard charges, depending on different conditions.

Cash App provides two types of deposits: Standard Deposits to your bank account and Instant Deposits to your linked debit card.

- Standard Deposits: Standard deposits come with no charges and usually take 1-3 business days to arrive in your bank account.

- Instant Deposits: Instant Deposits, on the other hand, come with a fee ranging from 0.5% to 1.75%, with a minimum fee of $0.25. Despite the fee, the advantage is that these deposits arrive instantly on your linked debit card.

(( The information provided regarding Cash App transaction charges has been sourced from Cash App’s official support page on cash-out speed options. ))

Can You Connect BankMobile to Cash App?

Yes, you can easily connect your BankMobile Vibe account to Cash App. It’s a simple process, similar to linking any other bank account to Cash App. Just follow the same steps you would use to link another bank account, and you can connect your BankMobile Vibe account without any hassle.

How to Link BankMobile to Cash App:

Linking your BankMobile Vibe account to the Cash App is as easy as linking other bank accounts or debit cards.

Follow these steps to seamlessly link your BankMobile Vibe account to Cash App:

- Open the Cash App on your mobile device.

- Click on the “Linked Accounts” option.

- Select “Add New Bank Account.”

- Enter the details of your BankMobile Vibe account and submit.

- After submitting, your BankMobile Vibe account will be linked to the Cash App.

The process is similar to how we link other bank accounts or debit cards to Cash App. It involves providing the necessary details, submitting them, and completing the authentication process. Once authenticated, your BankMobile Vibe account is successfully linked to the Cash App.

BankMobile Vibe Customer Support:

If you encounter any issues while transferring money or have any other concerns with your BankMobile Vibe account, you can easily get assistance from BankMobile Vibe Customer Support. Here are two simple ways to connect with a live person at BankMobile Vibe Customer Service:

1. Customer Care by Email:

If you prefer written communication, you can email your questions to the Customer Care team by following these steps:

- Log in to your BankMobile Vibe account.

- Click on the FAQ button.

- Select “Email Support Team” and complete the provided form.

- Your message will be securely sent to the Customer Care team for assistance.

2. Customer Care by Phone:

For a more direct and immediate interaction, you can reach BankMobile Vibe Customer Support by phone. Simply dial:

- Customer Care Phone Number: 877 327 9515

Hours of Operation:

8 am to 11 pm ET, 7 days a week

Feel free to call during the specified hours to speak with a live person and get prompt assistance with your BankMobile Vibe-related queries.

(( The information provided has been sourced from BankMobile Vibe, offering a comprehensive platform for financial services. ))

Conclusion:

Transferring money from BankMobile to Cash App is a simple process once you understand the steps. By linking your accounts and using Cash App’s features effectively, you can manage transactions seamlessly. BankMobile and Cash App complement each other, offering flexibility for users. If you encounter any issues, BankMobile’s reliable customer support is always available to help.

FAQs:

Is there a limit on the amount I can transfer from BankMobile to Cash App?

Yes, there might be transfer limits, and they can vary based on your BankMobile and Cash App account status. Check with both platforms for specific details.

How long does it take for a BankMobile to Cash App transfer to complete?

Transfer times can vary. In many cases, transactions are processed within a few minutes, but factors like weekends or holidays may affect processing times.

Is it safe to transfer money between BankMobile and Cash App?

Both BankMobile and Cash App employ security measures to protect transactions. Ensure you follow recommended security practices, like using secure networks and keeping your login credentials confidential.

Thanks for your visit.

(How to Transfer Money from Bankmobile to Cash App?)

Disclaimer: The information in this article is for educational purposes only. Readers are encouraged to verify all details from official sources before making financial transactions.