In today’s digital age, mobile payment apps have revolutionized the way we handle financial transactions. Among these, Cash App stands out as a popular choice for millions of users in the United States. In this comprehensive guide, we are going to tell you what is Cash App, how it functions, its features, safety measures, transaction limits, recent updates, customer service, and more.

Although there are many mobile banking apps used in the United States such as Google Pay, Zelle, Venmo, and Google Pay etc. But the popularity of Cash App is more than other apps. That is why today we have brought this article for you. In this article, we will tell you how Cash App is different from other apps and why it is popular. So let’s start the article.

What is Cash App?

Cash App is a mobile payment service that is currently quite popular in the United States and the United Kingdom. With Cash App, users can perform almost all types of online transactions. It allows users to link their bank accounts and also their Cash App cards. Through Cash App, users can receive amounts, and transfer funds, all of which are completely free.

However, Cash App applies various charges for certain services, known as convenience fees, such as Cash App Instant Transfer charges and Cash App Money Receiving charges. Additionally, Cash App is a highly secure mobile platform, with commendations for its triple-layer protection from major news websites like CNBC and Time Magazine.

How Does Cash App Work Exactly?

Cash App operates similarly to other money transfer apps, but it offers additional features that make it more popular. Cash App works by linking a user’s bank account or debit card to their Cash App account, allowing them to transfer funds to other users with just a few taps on their smartphone.

Users can also use the Cash App to buy and sell Bitcoin, invest in stocks, receive payments, transfer money, pay bills, borrow money, and more. One notable feature of Cash App is its three-layer protection system, ensuring the security of personal data for both the sender and receiver whenever a payment transfer occurs. The method of operation of Cash App is somewhat unique, which is why people trust it more.

Cash App Eligibility Requirements.

Cash App Eligibility Requirements 2024:

- Age Requirement: According to the Cash App website, to create an individual Cash App account, you must be at least 18 years old. If you’re under 18, you can be added to someone else’s Cash App family account, with a minimum age requirement of 13 to 18 years. Once you reach the age of 18, you can remove the Cash App family account.

- Residency: Cash App usage is limited to residents of the United States or the United Kingdom. If you’re not a resident of these countries, you need to have a valid passport and visa. Additionally, your bank account must be in the United States or the United Kingdom to use Cash App.

- Identification: Before using the Cash App, you need to possess a valid updated identification document such as a driver’s license or passport. If your identification document expires, your Cash App account may be closed. Therefore, keep your identification document up to date.

- Bank Account: You must have a valid bank account in the United States or the United Kingdom to use Cash App. Without a compatible bank account, you won’t be able to use Cash App.

- Compatible Device: Before using Cash App, ensure that you have a device that supports the Cash App application. Otherwise, you won’t be able to install and use Cash App on your device.

These are the five eligibility requirements that you need to fulfil before using Cash App and benefiting from its features.

Cash App Features and Functions.

There are many features in Cash App due to which Cash App is considered different from other mobile banking apps. We have given below some popular features of Cash App that most people use.

P2P Money Transfer:

- Cash App allows users to transfer money easily and quickly from one person to another using their mobile phones.

- Users can send money to friends, family, or anyone with a Cash App account using their phone number, email address, or $Cashtag (a unique identifier).

Deposit Cash:

- Cash App enables users to deposit physical cash into their Cash App account.

- There are many merchants located in the United States and the United Kingdom where you can deposit cash into Cash App account.

Bitcoins:

- Cash App provides a platform for buying, selling, and holding Bitcoins directly within the app.

Investing:

- Cash App offers investment options, allowing users to invest in stocks and Bitcoin.

- Users can start investing with as little as $1 and have access to fractional shares, making investing accessible to all.

Cash App Card:

- Cash App offers a debit card known as the Cash Card, which is linked to the user’s Cash App account.

- Users can use the Cash Card to make purchases online and in-store, withdraw cash from ATMs, Check balances without logging in and earn rewards on eligible purchases.

- You can also use the Cash App card on DraftKings and other similar platforms. Because normal ATM cards are rarely accepted on these platforms.

Tax-related Work:

- Cash App provides features to manage tax-related activities or documentation.

- Users can access transaction history, pay taxes, and export history of tax deductions

NFC Tag Option:

- Cash App supports NFC (Near Field Communication) payments through NFC tags.

- Users can tap their phone against an NFC tag to initiate transactions conveniently.

- You can turn on or turn off the Cash App NFC tag as per your wish.

Borrowing Money:

- Cash App offers borrowing options through its Cash App Borrow feature.

- Users can borrow money instantly, with repayment options and fees outlined transparently within the app.

- Almost everyone can borrow money on Cash App. If someone is not able to borrow money on Cash App, then there must be some reasons behind it.

- To increase the Cash App borrow limit, you will have to increase your transactions and keep repaying all the existing loans on time.

Bill Payments:

- Cash App allows users to pay bills directly through the app.

- Users can set up bill payments for utilities, subscriptions, rent, and more, streamlining the payment process.

Cash App Pay:

- Cash App Pay enables users to make payments at various merchants or online platforms using Cash App funds.

- It provides a convenient and secure payment method without the need for physical cash or cards.

Compatibility with Apple Pay:

- Cash App seamlessly integrates with Apple Pay, allowing users to use Cash App for transactions wherever Apple Pay is accepted.

- Users can link their Cash App account to Apple Pay to easily transfer from Cash App to Apple Pay.

Credit Card Support:

- Cash App supports linking and using credit cards for transactions.

- Users can add a credit card to Cash App account and use it for purchases, transfers, or withdrawals.

Use on Amazon:

- You can use the Cash App on Amazon.

- Users can link their Cash App account as a payment method on Amazon and use it to shop for a wide range of products.

Support for Disputes and Errors:

- Cash App provides support for resolving Cash App disputes or Cash App errors encountered during transactions.

- Users can contact Cash App support to report unauthorized transactions, errors, or other issues for resolution.

Using Gift Cards:

- Cash App allows users to redeem and utilize gift cards for purchases or transfers.

- Users can redeem gift cards within the app and use the funds for various transactions or send them to others as gifts.

- You can transfer money from gift cards such as Vanilla to Cash App.

How to Use Cash App?

If you fulfil the Cash App eligibility criteria mentioned by us, then you can easily use Cash App.

Here’s a step-by-step guide:

Step 1 – Download and install the Cash App from the App Store or Google Play Store.

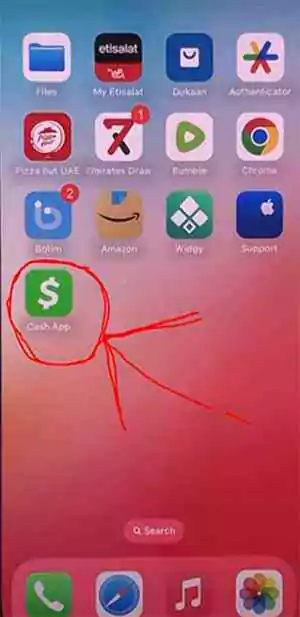

Step 2 – Tap the Cash App icon on your device. As shown in the image below.

Step 3 – Sign up for an account and link your bank account or debit card.

Step 4 – Verify your identity by providing your full name, date of birth, and Social Security number. Although you can create a Cash App account even without an SSN, its use will be limited.

Step 5 – Start sending and receiving money instantly using the Cash App.

Safety and Security in Cash App.

Cash App prioritizes the safety and security of its users’ funds and personal information. It employs encryption and other security measures to protect user data and transactions. During the transaction, Cash App stores the information of both the amount transferer and the amount receiver in an encrypted version. Which no one can crack. This is why big news channels praise its privacy.

Additionally, Cash App offers fraud protection and 24/7 customer support to assist users in case of any issues.

Transaction Limits and Fees in Cash App.

Your Cash App account imposes limits on both incoming and outgoing transactions, which can be expanded by verifying your identity.

Sending and Receiving Limits:

- Before identity verification, you can send and receive up to $1,000 within a rolling 30-day period, with a total account limit of $1,500.

- If you believe you haven’t reached these limits but are encountering restrictions, consider consolidating multiple accounts.

Balance Limits:

- If your identity is unverified, your Cash App balance is limited to $1,000.

- Upon identity verification, you’ll enjoy an unrestricted cash balance.

Deposits:

- Cash App offers two types of deposits: standard and Instant Deposits.

- Standard deposits are free and typically arrive within 1-3 business days.

- Instant Deposits incur a fee ranging from 0.5% to 1.75%, with a minimum fee of $0.25, and are credited instantly to your linked debit card.

Fees for Sending and Receiving Money:

- Cash App does not charge fees for sending or receiving money. Transfers are free, and most payments are directly deposited into your bank account within minutes.

- International transactions are also fee-free. Payments to the UK or EU are converted at the mid-market exchange rate at the time of the transaction, and recipients receive funds in their local currency without additional charges.

Latest Updates and Trends in 2024.

Cash App recently announced two exciting updates on their official Twitter account:

- On March 7, 2024, Cash App introduced the Glitter Card, a dazzling addition to their lineup of Cash App Cards. The tweet encourages users to embrace the sparkle and order the Glitter Card through the app, adding a touch of shimmer to their wallets. This update offers users the option to personalize their Cash App experience with a stylish and eye-catching card. (Note: Prepaid debit cards issued by Sutton Bank.)

- On March 20, 2024, the Cash App unveiled another feature that allows users to deposit cash directly into their Cash balance at any Kroger Family of Store location. This update provides added convenience for users who prefer to deposit physical cash into their Cash App account. To locate a participating store, users can open the Cash App, navigate to the Money tab, and tap Deposit Paper Money to access a map showing the nearest retailers.

Cash App Customer Service.

If you need assistance with Cash App, there are various ways to contact Cash Support:

Through the App:

- Tap the profile icon on your Cash App home screen.

- Select Support.

- Choose Start a Chat to send a message or navigate to the issue and tap Contact Support.

By Phone:

- Call Cash Support at 1 (800) 969-1940. Representatives are available to assist you every day from 9 AM to 7 PM ET.

Via Social Media:

- You can also reach Cash Support through their official social media accounts:

- Instagram: @CashApp

- Twitter: @CashApp @CashSupport

- TikTok: @CashApp

- Twitch: twitch.tv/CashApp

- Reddit: u/CashAppAndi

- Facebook: SquareCash

- You can also reach Cash Support through their official social media accounts:

By Mail:

- If you prefer traditional mail, you can write to Cash App at the following address: Cash App 1955 Broadway, Suite 600 Oakland, CA 94612

Important Note for Security:

- Cash App representatives will never ask for sensitive information like your password, PIN, social security number, or full card number.

- They will never request you to conduct a “test” transaction over the phone, social media, or through any other means.

- If you have push notifications enabled, Cash App may send you updates directly from the app.

Conclusion.

Cash App offers a convenient and secure way for users to handle financial transactions, from sending money to investing in stocks and Bitcoin. With its user-friendly interface, robust security measures, and diverse features, Cash App has become a preferred choice for millions in the US and UK. Whether you’re transferring funds, paying bills, or investing, Cash App provides a seamless experience backed by reliable customer support.

FAQs.

Are there any fees associated with using Cash App?

Cash App may charge fees for certain transactions, such as instant transfers charges or using the Cash Card.

What are the transaction limits on Cash App?

Transaction limits vary based on the user's account history and verification status.

How can I contact Cash App customer service?

Cash App offers customer support through email, phone, and in-app chat for assistance with any issues or inquiries.

Can I use Cash App internationally?

Cash App is currently available only in the United States and the United Kingdom.

Thanks for your visit.

(What is Cash App and How does it work?)

Disclaimer: Please note that the information provided in this article is for informational purposes only and should not be construed as financial advice. Users are encouraged to conduct their own research and consult with a financial advisor before using Cash App or any other financial service.