Do you want to know if you can still apply for Kabbage loan, the answer is yes, but things have changed. Kabbage is now part of American Express, and its loans are called the American Express Business Line of Credit. Like before, you can still apply online, and the process is simple and fast. In this article, we’ll show you step-by-step how to apply for Kabbage loan online through American Express, what you’ll need, and how it can help your small business.

Table of Contents

ToggleWhat is Kabbage?

Kabbage is a financial service that used to provide small business loans and lines of credit. It helped business owners get funding quickly through an online application. After being acquired by American Express, Kabbage now offers business loans under the American Express brand, helping small businesses manage their cash flow, buy inventory, and cover other expenses when needed.

Kabbage made it easier for businesses to access funds without the long wait times of traditional banks.

How Kabbage Loans Worked Before?

Before Kabbage was bought by American Express, it gave small businesses easy access to loans. Business owners could apply online and get a line of credit from $2,000 to $250,000. Kabbage used a simple process that looked at the business’s financial data, like bank accounts and sales, to decide how much money to lend.

Business owners could use the money whenever they needed it to help with things like buying inventory or covering expenses. The loan application was quick, and businesses often got approved in just a few minutes.

What Changed After American Express Bought Kabbage?

When American Express bought Kabbage, some things changed, but now the process to get a loan is still simple and online.

New Name:

Now the loans are called AMEX Line of Credit, but they still work almost the same as Kabbage loans.

Eligibility Requirements:

Before: Kabbage had a simple application process that required minimal documentation. Most small businesses could apply easily, even those with newer credit histories.

After: American Express introduced stricter eligibility criteria. Now, applicants must have:

- A FICO score of at least 660.

- Minimum annual revenue of $3,000.

- Established businesses must be at least one year old.

- Additional documents like a Tax ID (EIN) and Social Security Number are required.

Application Process:

Before: The application was quick and straightforward. Users linked their bank accounts, and Kabbage used data from those accounts to assess creditworthiness instantly. The entire process often took just a few minutes.

After: The application process became more detailed:

- Documentation: You now need to provide detailed business information, including industry type and estimated annual revenue.

- Linking Accounts: While you still link business bank accounts, the assessment now requires more comprehensive reviews of financial health.

Monitoring and Support:

Before: Kabbage provided customer support but didn’t monitor accounts as closely.

After: American Express has a more structured support system with enhanced customer service. However, this also means more formal processes to navigate. The company monitors business accounts closely to ensure compliance with credit policies, which might make some businesses feel scrutinized.

Eligibility Criteria: Can You Get the Loan?

Age and Residency Requirements

- Applicants must be at least 18 years old.

- They must also be U.S. citizens or permanent residents of the United States or its territories.

Active American Express Card

- To qualify, you need to have an active American Express card with at least six months of account history. This means that your AMEX card must have been active for at least six months before applying for the business line of credit. (If you want soft credit pull)

Business Age

- Your business must have been operating for at least one year. Start-ups or businesses that have been in operation for less than 12 months may not qualify for this loan.

Minimum Monthly Revenue

- Your business must have an average monthly revenue of at least $3,000. This is an essential factor in demonstrating the financial stability and income-generating capacity of your business.

FICO

- You need a credit score (FICO) of at least 660.

These are the minimum requirements, but American Express might also look at other things, like your business performance and your relationship with them.1

Required Documents for Kabbage Loan: (Now AMEX Business Line of Credit)

To apply for Kabbage loan, now under American Express as the Business Line of Credit, you’ll need to prepare several documents. Here’s a list of the required documents:

Required Documents for Kabbage Loan

Business Tax ID (EIN) Number: This is your Employer Identification Number, which you get from the IRS for tax purposes. It identifies your business entity.

Social Security Number: If you’re a sole proprietor or a single-member LLC, you may need to provide your personal Social Security Number.

Average Monthly Revenue: You’ll need to provide documentation showing your business’s average monthly revenue, which should be at least $3,000.

Bank Statements: Linking your business bank account allows Kabbage to review your transaction history to assess your revenue and spending patterns.

Estimated Annual Gross Revenue: Provide an estimate of how much your business earns each year.

Business Structure Documentation: Depending on your business structure (LLC, corporation, sole proprietorship, etc.), you may need to submit additional documents, such as:

- Articles of Incorporation

- Operating Agreement (for LLCs)

- Business licenses or permits

Identification: A government-issued ID (like a driver’s license or passport) may be required to verify your identity.

How to Apply for Kabbage Loan Online (Now American Express Business Line of Credit)

Here’s how you can apply for Kabbage loan, now called American Express Business Line of Credit.

Gather Your Documents:

Before you start, get these things ready:

- Your Business Tax ID (EIN).

- Your Social Security Number.

- The name of your business and what it does (industry).

- An estimate of how much money your business makes in a year.

Step-by-Step Process:

Here is a simple step-by-step guide on how to apply for Kabbage loan online, which is now called the American Express Business Line of Credit:

Step 1 – Visit the American Express Website

Open the official American Express website. At the top of the page, you’ll see a “Business” button. Please hover your mouse over it, and a drop-down menu will appear. Look for the “Funding Products” section, then click “Business Line of Credit.”

As shown in the image below.

Step 1 – Click on ‘Apply Now’

Once you click on “Business Line of Credit,” a new page will open. On this page, you’ll see an “Apply Now” button. Click on it to start your application process.

As shown in the image below.

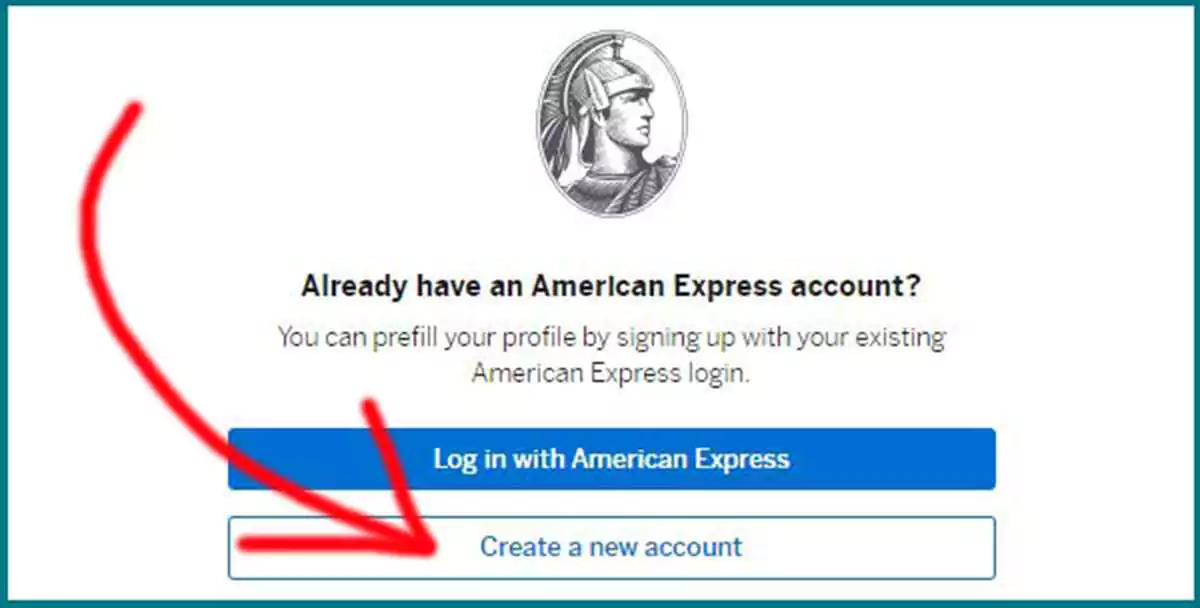

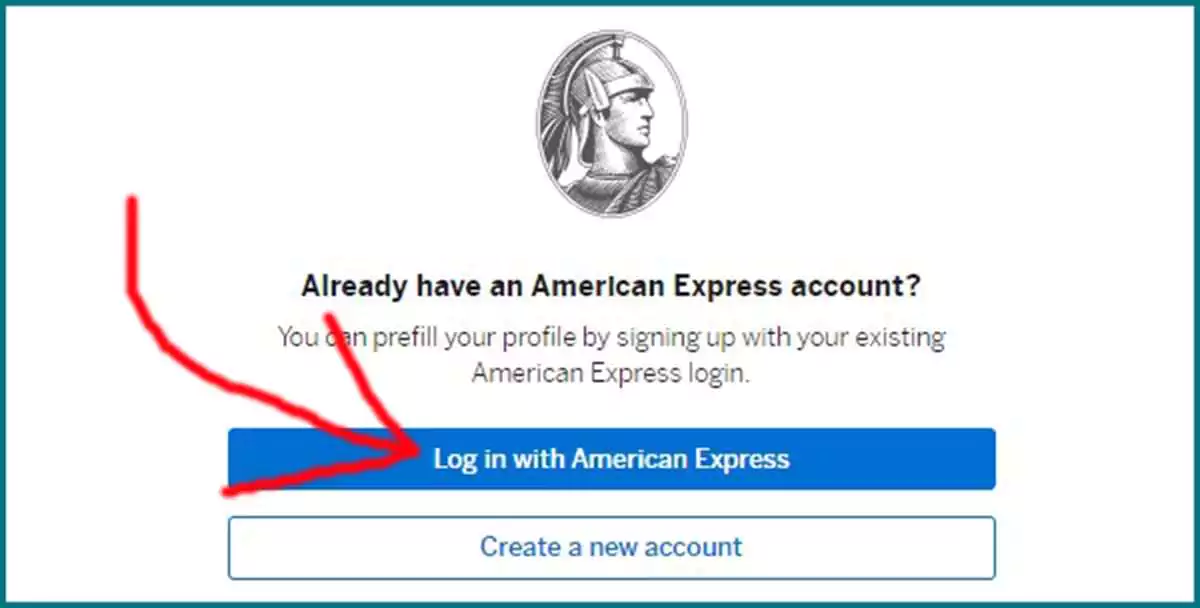

Step 1 – Log In or Create an Account

If you are already an American Express customer, click “Login.” If you’re applying for the first time, click on “Create a New Account.”

As shown in the image below.

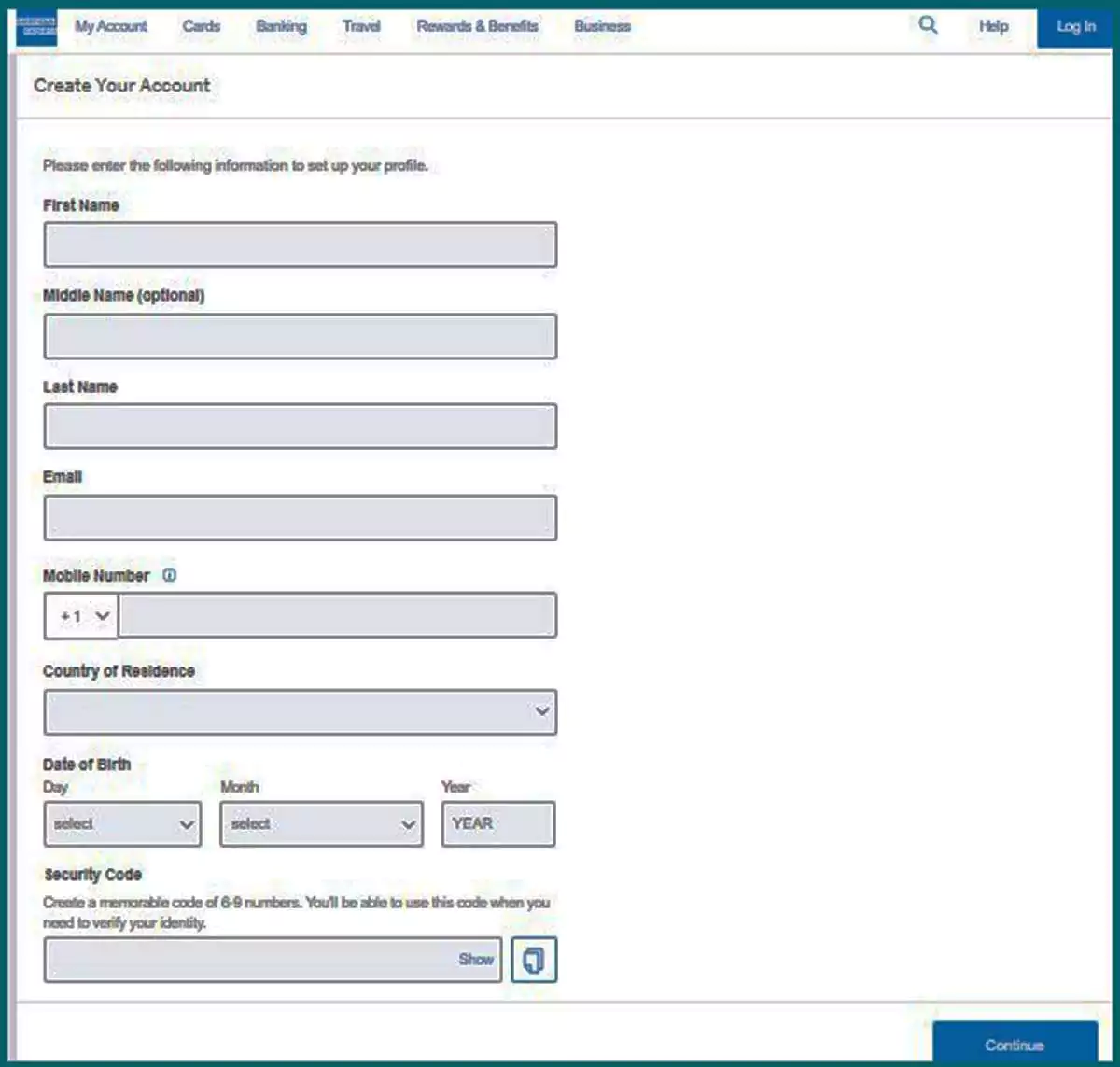

Step 1 – Create a New Account (If You Don’t Have One)

If you don’t have an account yet, click “Create Account.” You will be asked to provide some important information, like your name, email, and business details. Fill in the information and click “Continue.”

As shown in the image below.

Step 1 – Complete the Registration

After filling in all the necessary information and submitting it, your registration will be completed. Now, go back to the “Business Line of Credit” page, click on “Apply Now,” and this time select “Login with American Express.”

As shown in the image below.

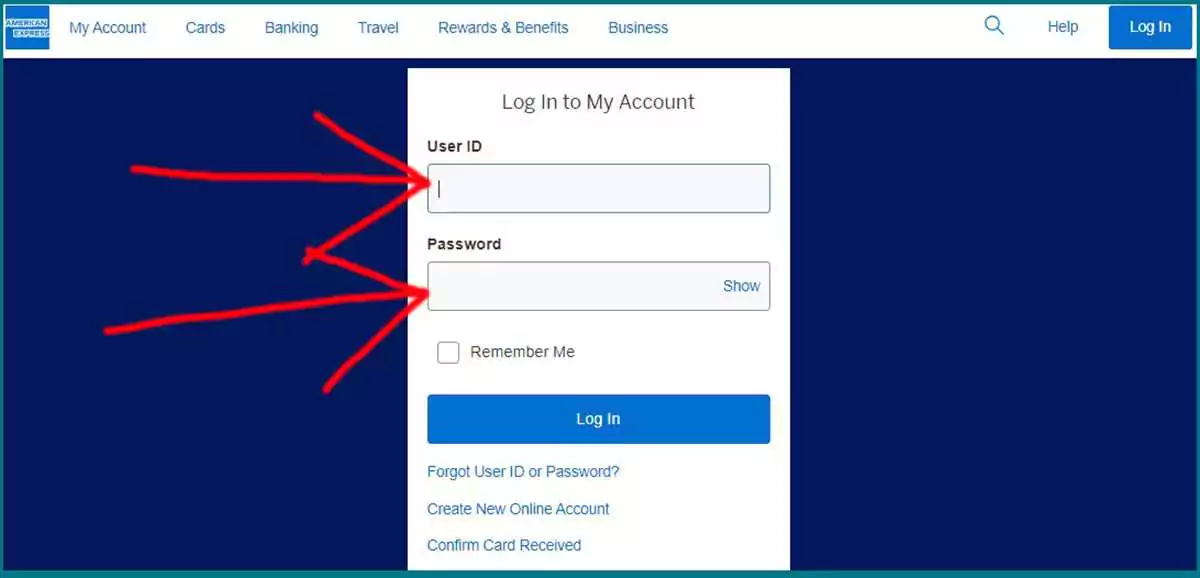

Step 1 – Log In Using Your Credentials

When you click “Log in with American Express,” a new page will appear asking for your User ID and Password. If you create a new account, you will have received these credentials. If you’re an existing customer, use your User ID and Password. Enter the details and click “Login.”

As shown in the image below.

Step 1 – Fill in the Required Information

After logging in, you will be directed to a page with more steps to complete. Fill in all the required information about your business and finances, then click “Submit.”

That’s it! Once you submit all the required information, your application for the American Express Business Line of Credit is complete.

Is it hard to get an American Express business line of credit?

What Can You Use the Loan For?

Once you get approved, you can use the money for different things in your business:

- Buying inventory (products you need to sell).

- Managing cash flow (having enough money to run the business).

- Expanding your business (like opening a new store or adding new products).

- Buying equipment (like computers or machines).

Benefits of American Express Business Line of Credit (Previously Kabbage Loan)

Here are some reasons why this loan is helpful for small business owners:

1. Flexibility

You can borrow as much as you need, from $2,000 to $250,000.

2. Fast Approval

The process is quick, and you might get approved in minutes if everything looks good.

3. No Hidden Fees

There are no surprises when it comes to fees. The fee structure is clear and simple.

4. Support from American Express

American Express offers a lot of help to small business owners. If you need support, they are there to assist you.

Alternatives to a Kabbage loan for small business financing.

There are many alternatives to a Kabbage loan for small business financing, including:

Conclusion

Applying for a Kabbage loan, now known as the American Express Business Line of Credit, remains a convenient option for small businesses looking for quick and flexible funding. While the process has become a bit more detailed since American Express took over, it’s still a great option for businesses that meet the eligibility criteria.

With its straightforward application process and clear fee structure, this line of credit can help business owners manage their cash flow, purchase inventory, or expand operations efficiently.

Faq’s

Is Kabbage Still Offering Loans?

Kabbage is now part of American Express, but loans are still available under the name American Express Business Line of Credit.

Can Self-Employed People Apply?

If you meet the eligibility requirements, self-employed people can apply for the loan.

How Do I Track My Loan Application?

You can track your loan status by logging into your American Express account.

Are There Any Fees to Apply?

There are no fees to apply, but there are fees when you borrow money. The fees depend on how long you take to pay back the loan.

Thanks for your visit.

(How to Easily Apply for Kabbage Loan Online?)

Disclaimer: This article is for informational purposes only and does not constitute legal advice. We are not affiliated with Kabbage Inc., Kservicing Wind Down Corp., or American Express in any way. Please consult with a lender before applying for any loan, as terms, conditions, and eligibility criteria may vary. American Express and Kabbage reserve the right to modify their loan policies at any time. We have no affiliation with Kabbage, Inc. or American Express. We are a separate financial consulting company.