A voided check is essential for different money matters, like direct deposit. It shares details for electronic transactions, ensuring easy fund transfers. This article explains the full process to Get a voided check from Chase Bank online. Remember, you can’t fill, cash, or deposit a voided check. Despite this, it serves a specific purpose making it simpler to share your banking info with others.

What is a Voided Check for Direct Deposit?

A voided check for direct deposit is a physical check that has been marked as “void” by drawing diagonal lines across it. It is used as a secure and convenient way to share your bank account and routing information when setting up direct deposits for various financial transactions.

When you provide a voided check to your employer or a financial institution, they can obtain the necessary details from the check, such as the account number and routing number, which are required for electronic fund transfers.

When the check is voided, it cannot be used for actual payment or to withdraw funds. The purpose of providing a voided check is to ensure that your account information is accurately and securely used for direct deposit and other electronic payments, eliminating the need for paper checks and making the process more efficient.

(( Reference: the information I have gathered is based on data obtained from the website CIBC ))

What are voided checks used for?

Although voided checks are used for many purposes, we have written some of their common uses below.

| Purpose of Void Check | Description and Use |

|---|---|

| Setting Up Direct Deposit | Providing account and routing information for automatic deposits. |

| Electronic Fund Transfers | Verifying bank account information for automatic bill payments. |

| Account Verification | Confirming bank account details for loan applications or new accounts. |

| Supplier Payments and Reimbursements | Ensuring correct account information for paying suppliers or reimbursing employees. |

| Confirming Electronic Payment Authorization | Authorization for automatic electronic bill payments for various services. |

| Identity Verification | Using the voided check as a form of identity confirmation. |

Void checks serve as a secure way to share account information and streamline various financial processes.

Is it Possible to Get a Voided Check from Chase Bank Online?

Yes, Chase Bank offers a convenient online method to obtain a voided check. Instead of visiting a branch or requesting a physical check, you can access your Chase account online and generate a voided check form instantly.

(( the information I have gathered is based on data obtained from the official website of Chase Bank ))

How to Get a Voided Check from Chase Bank Online: Step-by-Step Guide

If you want to get a voided check from Chase Bank online, you don’t need to visit a branch. Here are two methods to do it: via online net banking and the Chase App. Below are the steps for both methods.

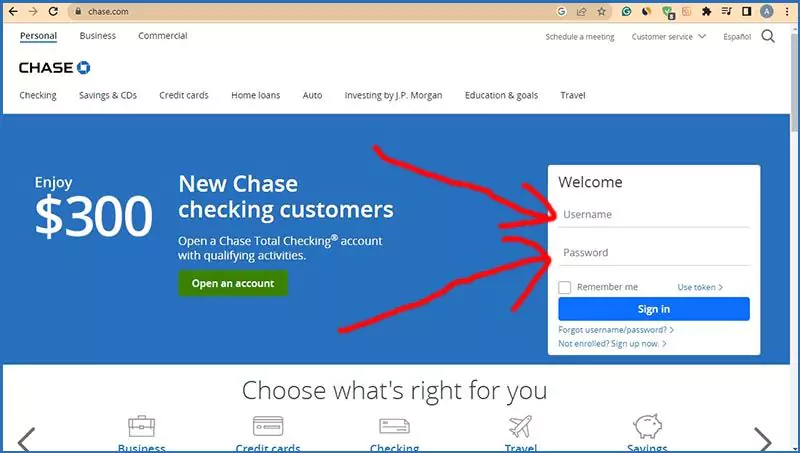

Method 1: Online Net Banking

Visit Chase Bank Website: Open Chase Bank’s official website on your PC or laptop and go to the net banking page. Enter your username and password to sign in, as shown in the image below.

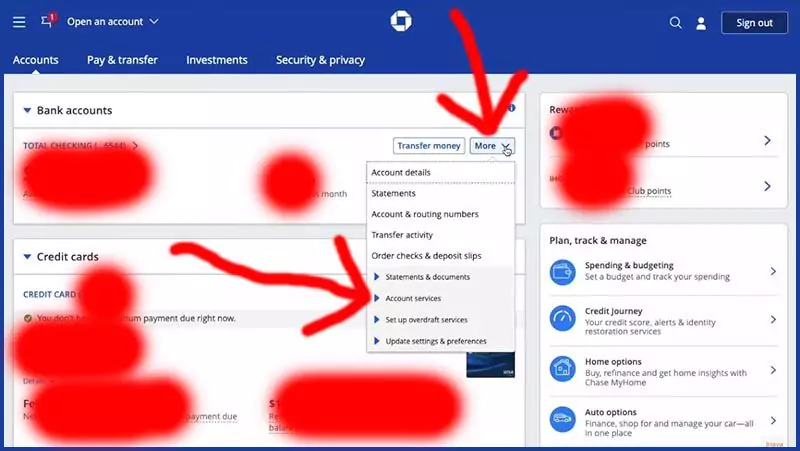

Navigate to Account Services: After logging in, you will see the net banking portal with various functions. Click on the “More” button and then select “Account Services” from the drop-down menu, as shown in the image below.

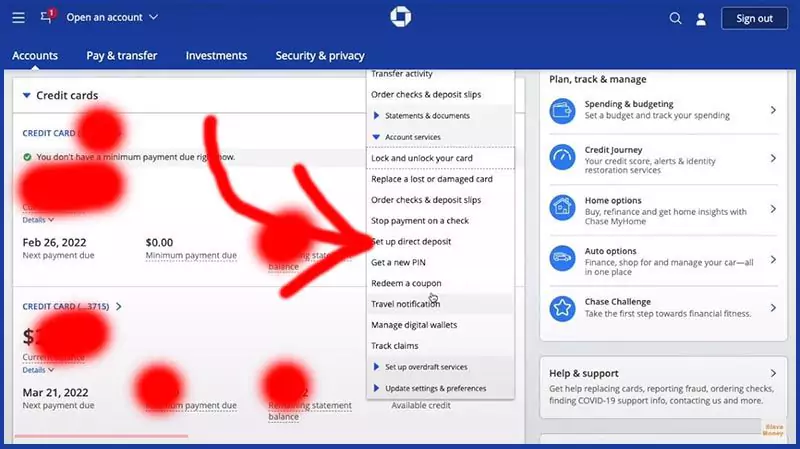

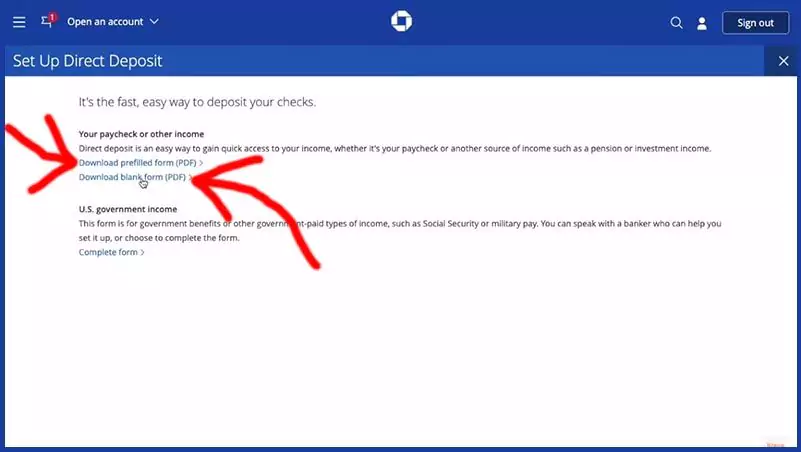

Set Up Direct Deposit: Scroll down and click on “Set up Direct Deposit”, as shown in the image below.

Download Prefilled Form: On the new page, choose “Download Prefilled Form”, as shown in the image below.

Your prefilled form, including the voided check, will appear using your existing net banking details, as shown in the image below.

If you face issues with the net banking method, you can use the second method.

Method 2: Using Chase App

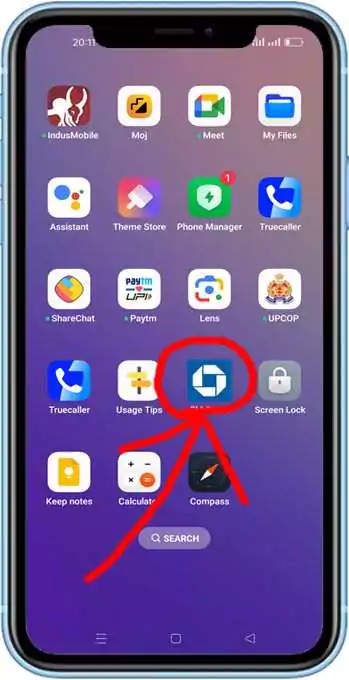

Install and Open Chase App: Download and open the Chase App on your mobile device, as shown in the image below.

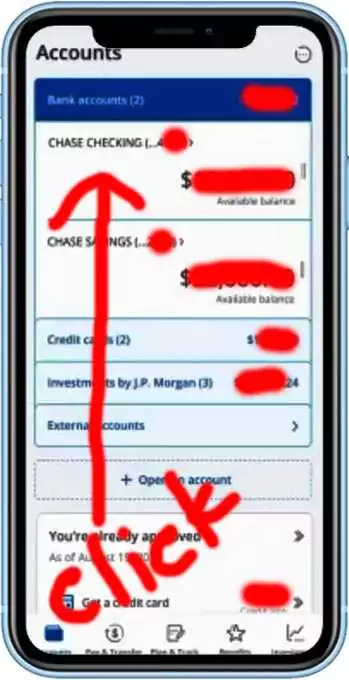

Login: Login to the Chase App and view your checking and savings balance. Select the account you want to get the voided check from, as shown in the image below.

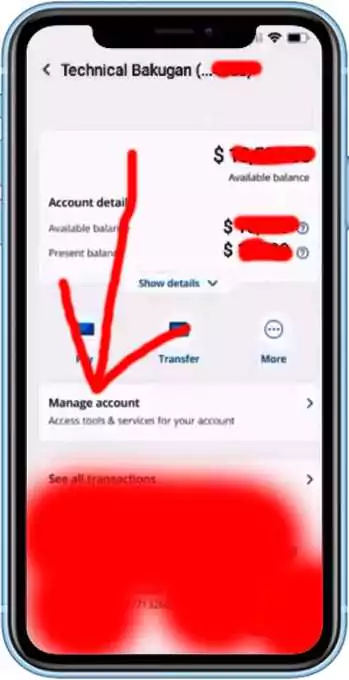

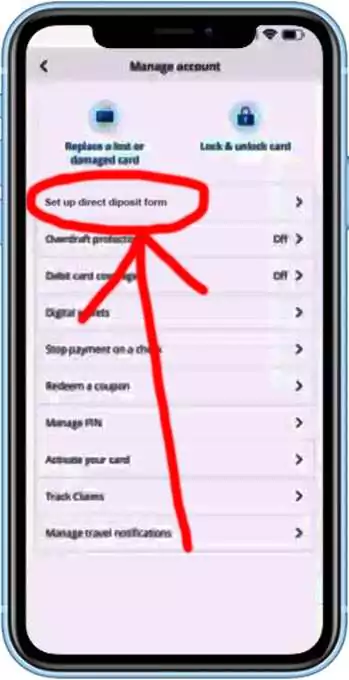

Manage Account: Click on “Manage Account”, as shown in the image below.

Setup Direct Deposit Form: Click on “Setup Direct Deposit Form”. This form, when generated, will include a voided check, as shown in the image below.

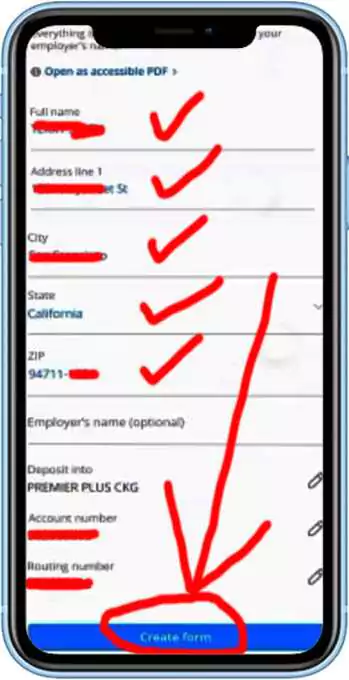

Create Form: Enter your full name, address, city, state, and zip code, and click on “Create Form”, as shown in the image below.

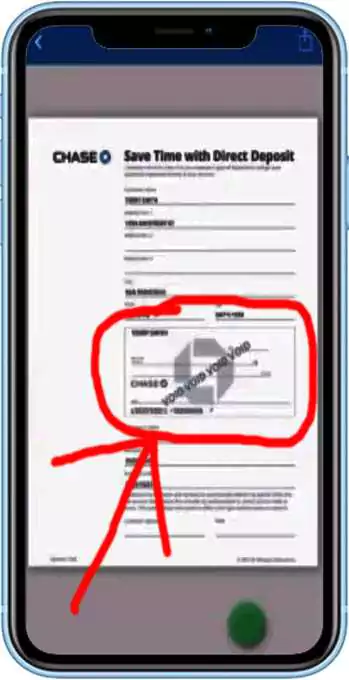

Download Voided Check: The form will be generated and will include the voided check in the middle, as shown in the image below.

By following these simple steps, you can easily obtain a voided check from Chase Bank either through online net banking or the Chase App.

How Long Does It Take to Get a Voided Check?

Getting a voided check from Chase Bank online is a quick process. Once you generate the voided check form, you can download it instantly and use it for your financial needs.

Voided Check Example for Direct Deposit:

Below is an example of a voided check that can be used for direct deposit:

Is It Safe to Email a Voided Check?

While it’s generally safe to email a voided check to trusted recipients, it’s essential to exercise caution when sharing sensitive financial information online. Ensure that you’re using a secure email service and only sending the voided check to authorized individuals or reputable institutions.

Is a Blank Check the Same as a Voided Check?

No, a blank check and a voided check are different. A blank check is entirely unfilled, with no information written on it, while a voided check has been marked as “void” and contains the account and routing information necessary for electronic transactions.

Is a Void Check the Same as a Direct Deposit Form?

No, a voided check is not the same as a direct deposit form. A voided check provides the account and routing information needed for direct deposit, while a direct deposit form is a separate document that may require additional details and authorization for setting up direct deposit.

Is a Void Check the Same as a Cancelled Check?

No, a void check is not the same as a cancelled check, though they both serve different purposes in banking and financial transactions.

Void Check: A void check is a regular check on which the word “VOID” is written across the front in large letters. When a check is voided, it becomes invalid and cannot be used for payment. Voided checks are often used to provide the necessary bank account and routing information for processes like setting up direct deposit, electronic fund transfers, or verifying account details.

They are a secure way to share account information without the risk of the check being cashed.

Cancelled Check: A cancelled check, on the other hand, is a check that has been processed and cleared by the bank. After the recipient (payee) has deposited or cashed the check, the bank processes it, deducts the amount from the payer’s account, and marks the check as “cancelled”.

Cancelled checks are usually returned to the payer as part of the monthly bank statement or as images in online banking platforms. They serve as a record of payment and proof that the transaction has been completed.

Can I use a voided check twice?

Usually, you should not use a voided check more than once. A voided check is mostly used to set up direct deposit or automatic payments. When you give your voided check to a financial institution, they keep it in their records. That means you can’t get it back or use it again. It’s a one-time use in this case.

But there’s an exception.

If you give a voided check to a person (not a company) just to show your bank account number, routing number, or other account details, then you can take the check back after they note down the info. In that case, you can use the same voided check again later.

Still, it’s a good habit to void a new check every time to keep things clear and safe—especially when sharing with different people or businesses.

Conclusion:

Obtaining a voided check from Chase Bank online is a straightforward process that can be completed using either the bank’s online net banking system or the Chase mobile app. Voided checks play a crucial role in various financial transactions by securely sharing account and routing information for direct deposits, electronic fund transfers, and other purposes.

While voided checks cannot be used for payments, they ensure the accurate and secure transfer of banking details, simplifying the setup of many financial services.

Faq’s

Time Required to Obtain a Voided Check:

Chase Bank's online process allows for the instant generation and download of the voided check form.

Understanding Voided Check vs. Cancelled Check:

A voided check and a cancelled check are synonymous and both indicate that the check is not valid for payment.

Thanks for your visit.

(How to Get a voided check from Chase Bank online?)

Disclaimer: The information provided in this article is for educational purposes only and is based on data from Chase Bank’s official resources. Please consult Chase Bank directly for the most current and personalized advice. And if any account number or check number is visible in this article, then it is a fake number created by us, it does not expose anyone’s privacy.